Source: Michael Ballanger for Streetwise Reports 07/09/2019

Sector expert Michael Ballanger explores the analogies between fishing and investing.

As many of you know, I love to spend the summers exploring the thousands upon thousands of bays and inlets and coves that represent the Georgian Bay landscape. With the exception of a few boyhood jaunts around the Parry Sound area, I was not able to fully appreciate the grandeur of the Canadian Shield as it escapes its marine blanket while leaving behind thousand of large and small islands in its wake. Sightseers like the famous Group of Seven, whose artwork is almost exclusively the Georgian Bay vistas, would refer to them as islands or fresh water atolls but boaters young and old refer to them simply as “rocks,” and they are both feared and revered by anyone that has run aground, as propeller shafts and stern drives do not get mangled by islands or fresh water atolls.

Part of the majesty of the region lies in the perpetual presence of danger whenever one departs the well-marked channels and heads out into “the big water.” Summer weather on the Great Lakes and particularly northern Georgian Bay is fickle and it is immediate, in that a bright blue sky with calm seas during breakfast hours can become a roaring tempest by early afternoon, with winds that seem to know instinctively in which direction to blow your vessel. . .and know this: It is never away from rocks.

However, most seasoned mariners are well aware of weather conditions and are usually happily ensconced in a cove or bay, carefully free of any real or imagined threats from Mother Nature by the time storms arrive, not unlike seasoned portfolio managers, who are ever aware of changing economic or financial conditions that may produce a hurricane force impact upon their holdings.

Now, an integral part of the Georgian Bay boating experience lies in the remoteness of the anchorages to human interference and the uncanny ability of Mother Nature to ignore human expectation. One boater we know was in a tidy little cove hundreds of miles from the nearest highway. When they returning from a dinghy ride, they found a black bear rummaging the cockpit fridge (incensed that all he could find was beer). After they had shoo-ed the bear away and were exiting the cove, they noticed another boat attempting to take their spot. They quickly warned the others of the impending dangers via VHF radio, but just as boaters discount weather info at their own peril, this couple suffered the same fate as the former couple, and Yogi wound up with a double, taking much more than beer as its reward.

What makes northern Georgian Bay incomparable for me, though, is the fishing. In case you didn’t know, fishing is the #1 global recreational past-time, outranking international football (soccer), American football (football), golf, tennis, baseball and hockey. The reason is that the most populated country on the planet has a gene in the DNA of their citizens that forces them to drop a fishing line into any pond or lake or pool that exceeds one foot in depth. China has exported natural-born gamblers to Macau and Vegas (and to their central bank to manage exchange rates) but they have exported fifty times as many citizens to North America, whose major obsession is fishing. They line the busiest bridges and the most treacherous roads, crammed together elbow to elbow with lunch boxes at their feet, desperately trying to outcast and outmaneuver their counterparts so they can reel in a four-inch sunfish or a ten-pound carp.

However, before landing on the Chinese immigrants for their obvious love a sport, let it be known that I share their passion for angling. It is sport I have enjoyed, with my greatest conquest to date being in Lake Ontario (a 36.7 lb. chinook salmon in 1987), where the fish landed eleventh in the annual Lake Ontario Fishing Derby. (The tenth-place fish won its acquirer a $20,000 fishing boat, motor and trailer; my eleventh-place sammy got me a year’s supply of “Worm-Up,” worth $500.)

Fishing is a sport that attracts all types of people spanning all demographic and econographic strata. You find billionaires hunting tuna off the Great Barrier Reef, maniacally driven by the same endorphin that sent Huck Finn to the fishin’ hole instead of the schoolhouse. The thrill of catching a fish is on a par with hitting blackjack at the card table or having the winning card at your mother’s Wednesday night Bingo game. Fishing carries the same narcotic as horse racing, lotteries, Bingo, and, of course and without further adieu, investing.

As an example, my partner and I were circumnavigating Bone Island on the weekend, trolling the shoals and islets for bass, pike or, if very fortunate, pickerel (known as walleye to our American friends), and given that early afternoon in high heat and blazing sun is not always the most ideal angling time, we were proceeding with limited expectations, such that even a strike would be a success, let alone a landed fish. As we circled a small rock protruding from the water like an indignant waiter, I felt a tremor in the 10-pound test I was using and sure enough, it was “fish on.” The adrenalin surge of engagement had my mate feverishly reeling in her line as I battled was surely an eight-pound largemouth.

It is not unlike the rush of anticipatory excitement one feels when a junior mining stock, of which you are holding far too much, announces a 27-meter interval of economic-grade “anything,” after which you presume that it is surely the arrival of the next Voisey’s Bay or Olympic Dam or Hemlo. As tends to occur in the landing of a fish or the establishment of an economic ore body, the fish that had determined to chomp down on the flashy $20 Mepps was, alas, not the eight-pound leviathan for which I prayed, but rather a (perhaps) one-pound smallmouth with eyes obviously much larger than its stomach.

Furthermore, in the same manner than a PEA (preliminary economic assessment) can disappoint investors with an unexpected outcome, as my brave little fish approached the net of doom, it suddenly breached the surface and as if making a statement, spat the lure directly into the boat and disappeared beneath the waves—but not before flipping me the middle fin in a gesture of “nice try, moron.” Four times that day we hooked a fish and four times they decided to elude the net and the boat, the result of which was an 0-4 record for the day.

We had all of the right tools and made all of the moves that, in the past, had worked, but at the end of the afternoon, we were frustrated, frazzled and fishless. Exactly as happens in the investment world, you can experience all of the excitement and satisfaction of proper research, funding and execution, but if the investment community decides to spit out the hook or break the line, you are doomed. The charm of fishing is like the charm of investing; you are in pursuit of what is elusive but attainable, a perpetual series of occasions for hope.

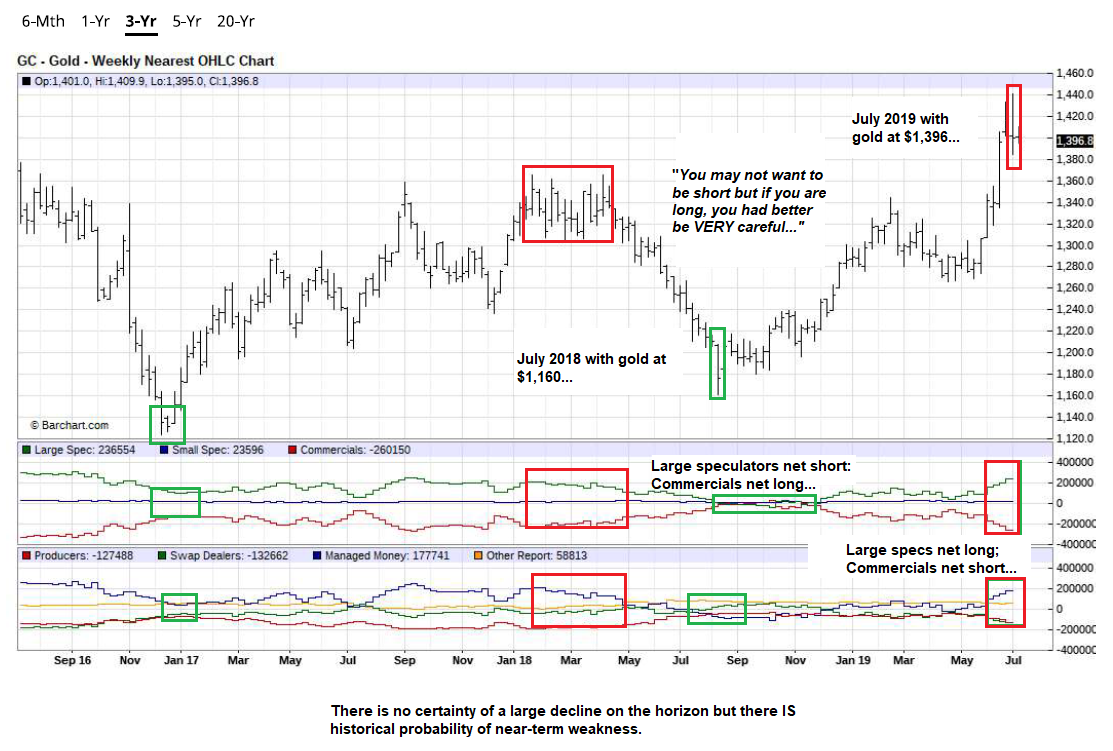

I post for comparison purposes two charts of gold futures continuous contract; the first was put up a week ago and the second is as of the close of business on Monday, July 8. You will note that the RSI (relative strength index), which traded up to nearly 90 in late June as gold touched $1,442, has now exited the overbought plus-70 zone from which every tradable correction since 2016 has occurred ( with the operative adjective being “tradable”).

While it is subject to conflicting interpretations from technicians far wiser than I, RSI in full retracement mode compels me to the sidelines, having jettisoned all leveraged ETFs and call options and 50% of the formerly untouchable GDX and GDXJ holdings. I was painfully early in the exit of the leveraged ETFs and call options, but near perfect in the sale of GDX and GDXJ and now enjoy the enviable task of buying them all back at lower levels.

It is only a week between the two charts but also notice that in addition to the continued drop in RSI from 68.48 to 61.27, the negative (bearish) MACD (moving average convergence-divergence) crossover is now complete, while volumes have become less robust than in the period immediately following the “breakout.”

Also, notice the red band at $1,350-1,375, which was three-year resistance and which is now the “absolutely critical band of support,” a close below which lies the dreaded “failed breakout.” These events, mastered beautifully in both planning and execution, are exceeded only by the illegality of their implementation. For years upon years, I have whined, screamed, pleaded and beseeched readers to avoid drinking the Kool-Aid of gold and silver market technical “breakouts,”and that only in the precious metals (PMs) do you sell breakouts and buy breakdowns. . .all for one simple reason: Both markets are rigged.

Further adding to the parade of red flags is, of course, the COT structure, where Commercials added yet another 26,616 net shorts, representing 2,616,000 ounces of undeliverable, phony, paper gold. This results in an aggregate short position of 286,822 contracts representing 28,682,200 ounces of that same fictitious metal, never the focus of a margin call and never, ever to be found in any vault or warehouse anywhere.

Now, the COT has rarely, if ever, been a useful timing tool but it has been an important barometer of trend changes looming on the horizon. The record net short was around 322,000 contracts, so that we are heading in that direction is concerning. Without the worry of capital constraints, the bullion banks are free to continue to pile on their aggregate short pile until demand by Large and Small Speculators (also referred to as “prey” by the Commercial trading desks) is exhausted. This creates a bid-stack vacuum into which the cretins simply nudge price for the express purpose of sending prices lower, which they cover and then make obscene profits with nary the report of as much as one trading day of losses in the past ten years.

The next chart carries the graphic images of how bottoms occur when the Large Spec positions converge with those of the Commercials, and vice-versa at tops. Those alligator jaws, so wide open as of Monday’s COT report, are destined to snap shut, but only after serious price declines. Now, there is the possibility of the signal failure in which the Commercials are forced to cover into rising prices, but my interpretation is that since we saw little if any capitulation from the shorts into the gap to $1,442, I see little evidence of a squeeze near term with prices now back below $1,400.

I would urge you all to view these charts and graphs in the context of assessing not just direction but, more importantly, probability of same. This is all in the interest of avoiding those $50-100/ounce drawdowns, the recovery of which are nigh on impossible in the course of a trading year. The data that currently presents itself demands caution—not panic nor abandonment nor mass liquidation, but simple prudence in terms of position sizes and risk.

Just as in the world of successful investing, it is the charm of successful fishing that has kept me in the hunt for a return to free markets and fiscal sanity, both of which are absent from the 2019 landscape. Not that every time one has a fish on the line it should automatically result in a family of four being fed, but the fight should be a fair one. It is difficult enough to navigate free markets, but it is virtually impossible to survive the interference and interventions of, shall we say, “managed” markets, where all departments of government are openly hostile to gold and silver ownership and sponsorship.

Imagine battling an especially large fish in an epic angling affair lasting forty-five minutes, wherein the beast is inches from the net only to have an unknown entity suddenly emerge from the depths, severing your line. This is exactly what happens when the Commercials fill Large Spec demand with those phony, “paper” contracts, created magically out of thin air for the sole purpose of managing price. Buyers of the “paper” contracts have intent to acquire the physical by taking delivery which is a far cry apart from the intent of the bullion banks. They never deliver any physical metal and they almost always cover. They leap up and cut the lines of the Large and Small Specs with nary a tear being shed.

In the end, the rules of engagement in trading all markets should be the same irrespective of asset class; favoritism across asset classes destroys markets and creates unimaginable moral hazard. The last point of correlation I make is this: The singular most important attribute carried by the successful angler is patience. The ability to believe in your preparation and execution in both fishing and investing is matched only by your ability to wait diligently for the moment of opportunity. That requires patience, sometimes little, often much more, but never, ever without.

It is also a virtue the likes of which may be particularly valuable in the coming weeks and months; I pray it is not needed but fear that it may.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.