Source: Maurice Jackson for Streetwise Reports 07/09/2019

In this interview with Maurice Jackson of Proven and Probable, the president and CEO of this company describes the most recent developments at its Montana prospect.

Maurice Jackson: Joining us today is Michael Rowley, president and CEO of Group Ten Metals Inc. (PGE:TSX.V; PGEZF:OTCQB; 5D32:FSE), which is known for platinum, palladium, nickel, copper and cobalt in the Stillwater district in Montana.

Glad to have you back, sir. Michael, I can only imagine the excitement that your team and mostly prudent shareholders must be feeling as the press releases continue to show hit after hit of high-grade mineralization on your flagship Stillwater West Project. Today’s interview will be no different as we have more exciting results to provide shareholders. But before we begin, Mr. Rowley, please introduce us to Group Ten Metals and the opportunity the company presents to the market.

Michael Rowley: Thank you, Maurice; glad to be back. We are indeed looking forward to starting our work on the ground this year, which we expect will be a break out year for Group Ten with our first drill program following a year of compilation and targeting work.

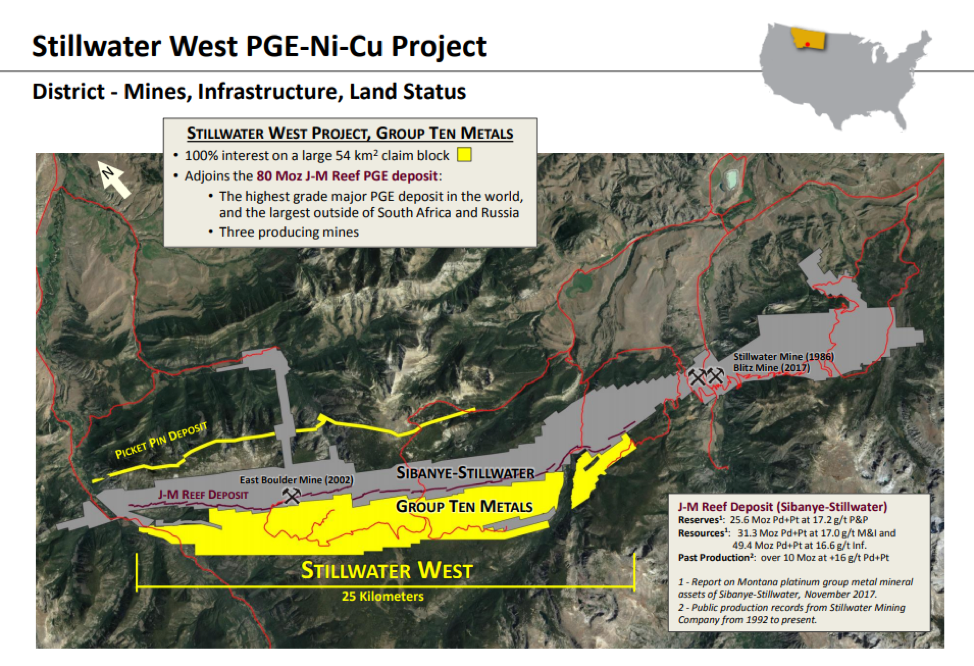

Group Ten is one of two companies active in the Stillwater District in Montana, which is world-renowned for its mineral wealth. The Stillwater Complex is a layered magmatic intrusion that was formed about 2.7 billion years ago when successive pulses of metal-rich magma laid down multiple layers, then cooled and crystalized to become a package of rocks about 8 kilometers thick. Those layers have been tipped up by the mountains to the south and they now sit at an angle of about 60 degrees, which is very amenable to mining, and it means that mineralization we see at surface may continue for many kilometers down along the magmatic layers.

The other company active in the Stillwater complex is Sibanye-Stillwater Gold Ltd. (SBGL:NYSE), a company that was created when South African gold miner Sibanye bought Stillwater Mining in 2017 for $2.2 billion. They operate three mines on one deposit—called the Johns-Manville or J-M Reef deposit—which is the highest-grade platinum group elements (PGE) deposit in the world, and one of the largest, hosting 80 million ounces (80 Moz) of platinum and palladium at over 16 grams per tonne (16 g/t) grade. To put in perspective, we get excited when gold deposits have 10 million ounces at a couple of grams per tonne gold. The J-M Reef deposit is eight times that size and also eight times that grade. And it is open for expansion. It is a truly fantastic deposit, and it speaks to the amount of metal that is in the system at Stillwater.

Group Ten has a very large land position that adjoins Sibanye-Stillwater across about 25 kilometers and covers the lower portion of the Stillwater Complex. We also have claims above Sibanye in the layered geology.

We made our first acquisition there in 2017 and quickly expanded our holdings as we got into the data and saw the potential. As of today we have more than doubled that initial land position, compiled a terrific database that includes data from over 200 drill holes plus physical core, and geochemical and geophysical surveys. We are the first to bring the land position together with the database and that has attracted a world-class team that is familiar with new geologic models developed in a similar layered magmatic system at the Platreef in South Africa.

Maurice Jackson: Mr. Rowley, before we delve into the press release, can you provide a concise summary of the series of technical news releases Group Ten Metals has delivered starting in December 2018?

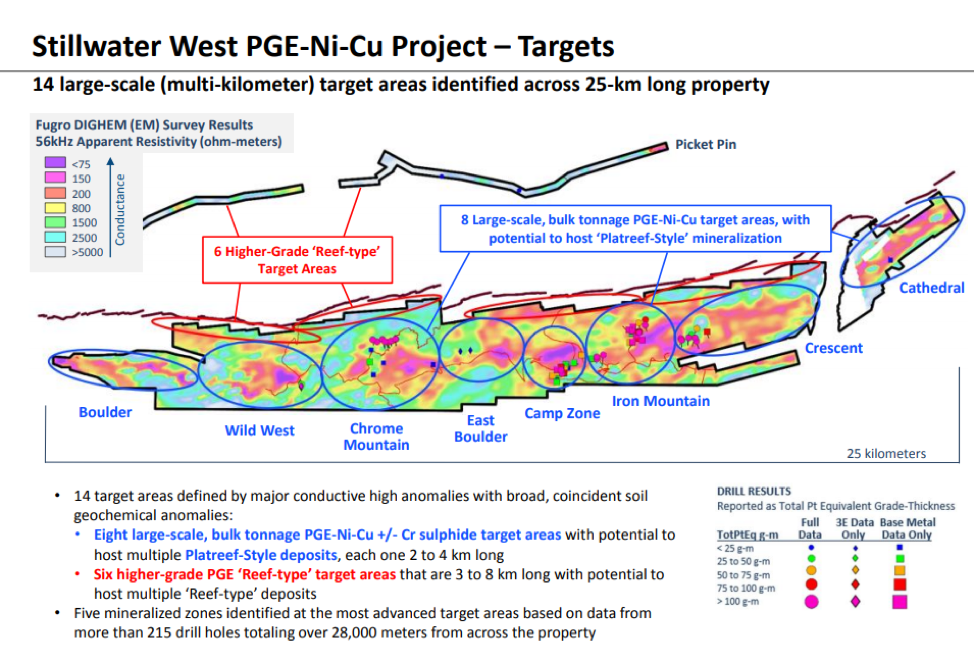

Michael Rowley: This is a big project and we have compiled a substantial database. Our early work defined 14 target areas, so we basically have gone west-to-east with a series of news releases detailing the eight bulk tonnage “Platreef-style” target areas shown in blue ellipses in our materials. These have attracted the attention of every major you can name based on their size and potential. We also have six higher-grade “reef-type” target areas, higher up the layered stratigraphy, shown in red.

Geologists get excited when the “three Gs”—geophysics, geochemistry and geology—correlate, and that is basically how we developed those eight target areas. In each target we see kilometer-scale geophysical anomalies (i.e., areas of highly conductive rocks) that correlate with large areas of high levels of metals in soils. And, where we have data, we see rock and drill data confirming that the conductive anomalies are indeed targeting copper and nickel sulfide mineralization.

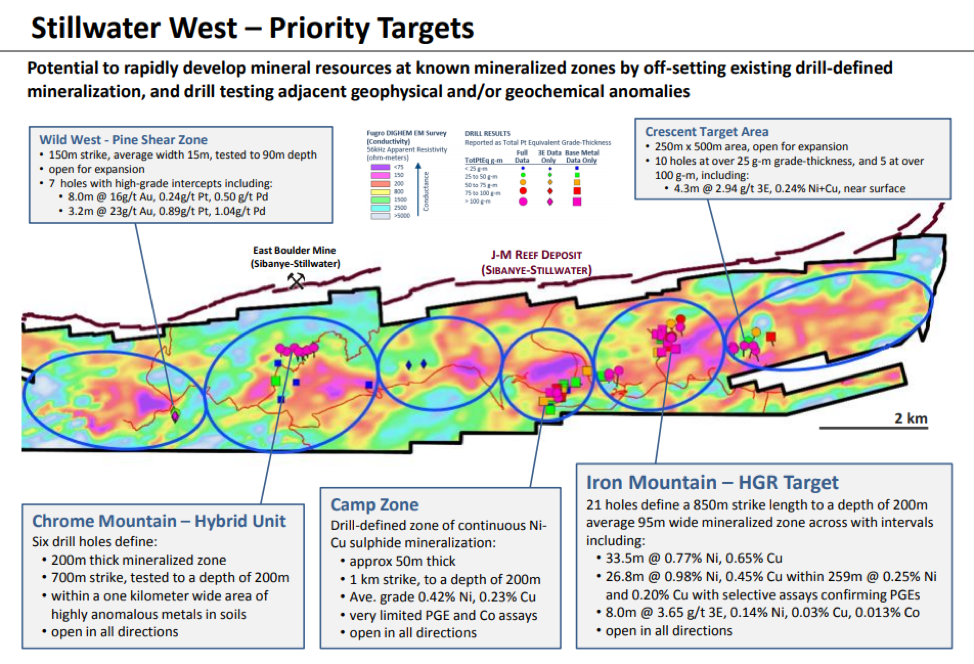

Five of the eight target areas have a substantial amount of past drilling that defines known mineralized zones that are open for expansion in terms of both grade and size based on our data compilation and targeting work. The three most advanced of those areas—the Chrome Mountain, Camp Zone and Iron Mountain target areas—will be our focus for drilling in 2019 as we see the potential to quickly advance known mineralization in these areas to our first formal mineral resources at Stillwater West.

Maurice Jackson: Looking forward, the company issued a press release on the plans for 2019. What are goals for 2019?

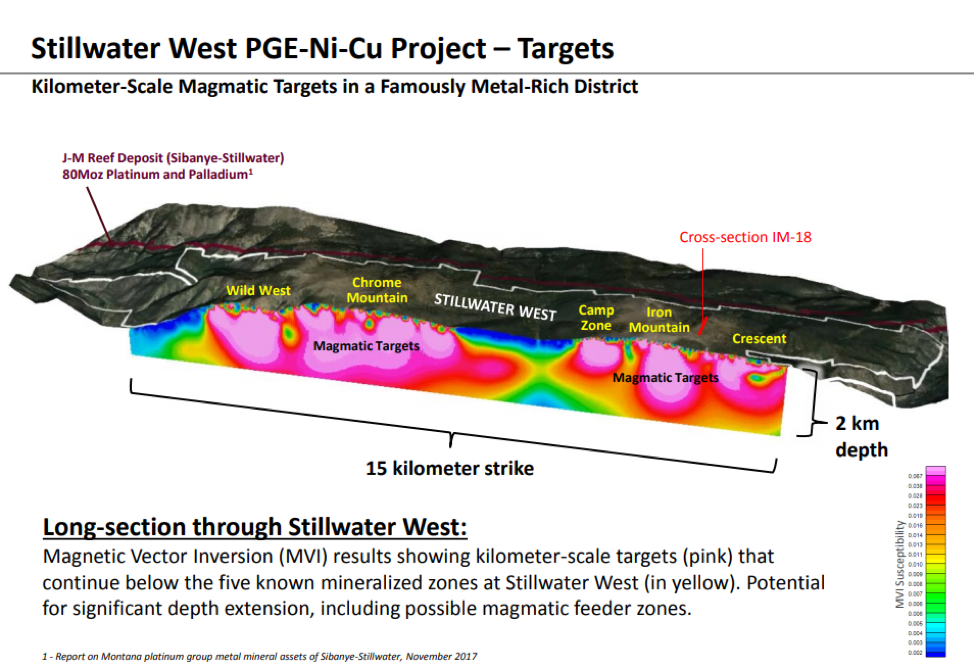

Michael Rowley: Our news on June 4 sets the stage for our first drill programs in 2019, where we will focus on expanding known mineralization in priority target areas, and advancing those areas to formal mineral resources. We also, for the first time, will look deep into the Stillwater Complex with results of some 3D geophysical modelling work that shows continuity of those same mineralized zones to over several kilometers depth in some areas, which adds massive size potential to our targets.

Everything we have done to date confirms the potential for multiple large and very large polymetallic platinum, palladium, nickel, copper and cobalt deposits at Stillwater. We are calling these “Platreef-style” deposits based on the similarities we see with the Platreef district in South Africa, which has become a world leader in the supply of low-cost platinum, palladium, nickel and copper since the 1990s, with the development of Anglo American Platinum Ltd.’s (AMS:JSE) Mogalakwena Mine, and Ivanhoe Mines Ltd.’s (IVN:TSX; IVPAF:OTCQX) Platreef mine, which is now under construction. These are truly massive deposits—collectively over 400 Moz of PGEs plus tens of billions of pounds of nickel and copper—and they occur in the lower part of the Bushveld layered magmatic system.

That same portion of the Stillwater Complex has never been systematically tested for deposits of this type, even though the geological parallels are well known, the setting is correct, and every indication is there in the database, including drill results. That exploration process was basically interrupted at Stillwater.

We took a big step forward in 2018 when Dr. David Broughton, a key member of the discovery team at Ivanhoe’s Platreef project, joined our team and confirmed that potential at Stillwater West.

Maurice Jackson: Michael, take us now to the targets and exploration plans news release, which included some very exciting 3D modelling results.

Michael Rowley: We applied a technique called MVI, or magnetic vector inversion modelling, to our geophysical data. This is a cutting edge technique that has been very successful in recent years, especially at Platreef where it was instrumental in identifying an extension of Ivanhoe’s Platreef Mine, and also at a number of other projects including some porphyry systems.

The results show enormous size potential at Stillwater West. The magmatic layers that we see at surface, and that host those five drill-defined mineralized zones, appear to be continuous, and kilometers thick. At the east side, under the Cathedral and Crescent target areas, the magmatic layers may be one or two kilometers thick. As we move west it thickens to over three kilometers under Iron Mountain, which includes the HGR target, where we have our highest grades to date. And then at Chrome Mountain, farther to the west, we see over six kilometers deep in some areas, which gets very interesting as this may represent a possible feeder zone to the Stillwater complex. These become very compelling targets for drill testing when you consider the quantity of platinum, palladium, nickel, copper and cobalt seen elsewhere in the Stillwater Complex—both on our ground in our target areas, and also some hundreds of meters north in the J-M Reef deposit, where Sibanye-Stillwater is now mining at depths of up to about two kilometers.

In addition to reporting the potential for size going down along the magmatic layers of the system, the June 4 news release also summarizes the five known mineralized zones as defined by drilling to date, and shows the potential to expand these areas laterally. The key point here is that there has been no systematic drill test of the geophysical highs adjacent to these areas of known mineralization, which is to say that we see the potential to expand the mineralized bodies in these areas in terms of both size and grade by testing areas of highly conductive rock based on the relationship we see with conductivity and metal sulfide content.

We are now finalizing our drill plans for 2019, which will target those conductive high anomalies while also offsetting past holes to quickly advance known mineralized zones to our first formal resources in the three most advanced target areas. These are massive systems, and even a modest drill program can quickly add ounces of precious metals and pounds of base metals by tying together existing drill-defined mineralization and bringing the whole zone into a NI 43-101 qualified inferred resource. Those initial resources will then provide Group Ten an important base valuation to build on as we expand and build out those initial resources in future programs.

Maurice Jackson: Sir, what is the next unanswered question for Group Ten Metals? When should we expect results, and what determines success?

Michael Rowley: Our most recent news discussed our targets and permit status, so the next release is expected to be the start of work. We are currently in discussion with our major shareholders, who hold over $2.4M of in-the-money warrants, with an eye to funding this years’work. This is a very supportive group that we have a good rapport with and I look forward to reporting on the results of those conversations in the coming weeks as we ramp up to the start of field work. These are massive targets, and we have a terrific base to build upon. I think it will be an exciting year.

Maurice Jackson: Last question, sir. What did I forget to ask?

Michael Rowley: Perhaps we could touch on the markets, and the value proposition presented by Group Ten, which like a number of junior exploration stocks is really undervalued relative to our target commodities and a number of other metrics. Group Ten’s market cap is about $9 million at present, and yet we have great assets in three truly world-class districts. At Stillwater we share very rare geology and a famously metal-rich district with an asset that is valued at nearly $3 billion.

Another important consideration is the fact that Group Ten is focused on an American asset at a time when the U.S. is recognizing a need to secure supplies of strategic and critical metals within its borders. We saw this recently regarding nickel and cobalt and in the past year with a broader list of commodities that included PGEs. The Stillwater district has some of the absolute best geology in the world for a number of the commodities listed—including nickel, cobalt, platinum and palladium—and we are right there beside three active mines.

Maurice Jackson: For someone listening that wants to get more information on Group Ten Metals the website address is www.grouptenmetals.com. And as a reminder Group Ten Metals trades on the TSX-V: PGE and on the OTCQB: PGEZF. For direct inquiries please contact Chris Ackerman at (604) 357-4790 ext. 1, and he may also be reached at info@grouptenmetals.com.

Group Ten Metals is a sponsor and we are proud shareholders for the virtues conveyed in this interview. As a reminder, I’m a licensed representative for Miles Franklin Precious Metals Investments, where we provide a number of options to expand your precious metals portfolio from physical delivery, offshore depositories, precious metal IRAs and private blockchain distributed ledger technology. Call me directly at (855) 505-1900, or you may e-mail maurice@milesfranklin.com.

Finally, please visit provenandprobable.com for Mining Insights and Bullion Sales.

Michael Rowley of Group Ten Metals, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Group Ten. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Group Ten. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Group Ten Metals is a sponsor of Proven and Probable. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Group Ten Metals. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Group Ten Metals, companies mentioned in this article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.

( Companies Mentioned: PGE:TSX.V; PGEZF:OTCQB; 5D32:FSE,

)