As many of you know, I serve as interim CEO and chairman of HIVE Blockchain Technologies, the first publicly traded company involved in the mining of cryptocurrencies. We maintain facilities in Iceland, Sweden and Norway, all of which have optimally cool climates and cheap renewable energy.

The week before last, HIVE business took me to just within the frigid Arctic Circle. This was followed by stops in Zurich, Geneva and Milan, where temperatures soared in a record-setting heat wave. Keep in mind that many European hotels still do not have air conditioning.

The constant flying and wildly fluctuating temperatures were well worth it, though. I’m very pleased to say that a satisfactory agreement was reached between HIVE and its strategic partner, Genesis Mining. All claims arising from the master service agreements, as well as legal proceedings, have been withdrawn and discontinued. You can read the full press release here.

Above all else, I’m thrilled that HIVE can return to creating value for its shareholders, to whom I extend my gratitude.

Cryptocurrencies Challenging Traditional Monetary Policy

The agreement couldn’t have come at a better or more interesting time. Economic conditions have improved in the cryptocurrency ecosystem, with bitcoin surging as high as $13,764 late last month. Meanwhile, Facebook’s upcoming Libra coin is drawing fresh attention to digital currencies as a concept.

That includes attention from Congress. In a July 2 letter, lawmakers on the House Committee on Financial Services requested that Facebook and its partners halt development of Libra, as they fear the coin could lead “to an entirely new global financial system that is based out of Switzerland and intended to rival U.S. monetary policy and the dollar.”

Agustín Carstens, head of the Bank of International Settlements (BIS), also weighed in on Facebook’s announcement, telling the Financial Times that “many central banks” were working on developing their own cryptocurrencies.

“It might be that it is sooner than we think that there is a market, and we need to be able to provide central bank digital currencies,” commented Carstens, a harsh critic of cryptocurrencies.

This is quite an admission. But if you recall, it wasn’t so long ago that JPMorgan CEO Jamie Dimon was calling people who buy bitcoin “stupid.” Today, his bank is starting client trials of its very own digital currency, the JPM Coin.

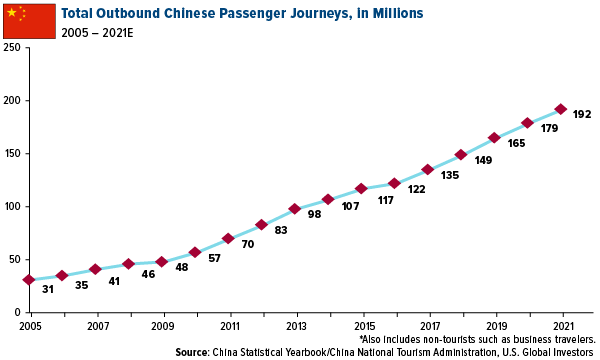

The times are definitely changing, and that includes international tourism. When I was in Europe, I saw busloads full of Chinese tourists, who are the biggest spenders of any other nationality. This is very constructive for airlines and the travel industry as a whole. Many of the tourists gobbled up all of the three and four-star hotels, leaving only the five-star hotels, which naturally raised their rates—often to outrageous levels.

On an unrelated note, I want to congratulate my good friend Frank Giustra for being awarded the Order of Canada for “his impactful contributions to business and to international humanitarian initiatives addressing global crises and development.” This is a huge honor, equivalent to knighthood in the U.K., and I can’t think of too many people who are as deserving of it as Frank is.

Finally, I don’t normally recommend movies, but I saw Pavarotti recently and can’t stop thinking about it. The Ron Howard-directed documentary of the great Italian tenor Luciano Pavarotti is a marvel, both inspirational and moving. You need not be an opera fan to enjoy the film or appreciate Pavarotti’s contribution to world music of the past half century. It’s for anyone who’s interested in the lives of high achievers, of which Pavarotti was decidedly one, having sold more than 100 million records.

Farewell to an American Legend

Photo by: The World of Mustang, Lee laccoca 2009 Mustang serial #001 | Attribution-ShareAlike 2.0 Generic (CC BY-SA 2.0)

“The Depression turned me into a materialist. Years later, when I graduated from college, my attitude was: ‘Don’t bother me with philosophy. I want to make ten thousand a year by the time I’m twenty-five, and then I want to be a millionaire.’ I wasn’t interested in a snob degree; I was after the bucks.”

That’s from the first chapter of Lee Iacocca’s best-selling autobiography, published in 1984. The larger-than-life auto executive, who gave the world the iconic Ford Mustang and later saved Chrysler from bankruptcy, died last week at the age of 94.

It’s appropriate that his passing should coincide with our celebration of America’s independence. Iacocca embodies the American spirit of innovation and “can-do-it-ness” as few people have in the 243 years since the birth of the country that helped make his infinite success possible.

Born to Italian immigrants, Iacocca worked his way up the ranks at Ford, eventually finding national renown in 1964 with the launch of the Mustang, which he conceived as “a sports car but more than a sports car.” Retailing for less than $2,400—or about $20,000 in today’s dollars—it was a runaway hit, generating $1.1 billion in profits over the next two years.

But Iacocca is perhaps best known for reviving the struggling Chrysler, which he led after being fired from Ford by Henry Ford II. In 1980, Chrysler was looking at a loss of $1.7 billion. This was turned into a $2.4 billion profit by 1984. Investors were handsomely rewarded. A New York Times article in January 1983 named Chrysler “the surprise stock” of the past year, beginning at just above $3 a share and ending at $18—an incredible increase of around 500 percent.

So great was Iacocca’s superstar celebrity that he was rumored to be a presidential contender in 1988. And yes, he became a millionaire, many times over. I have no doubts that his legacy will continue to strengthen in the years to come, as his remarkable story is uniquely American. Although he’s gone, we’ll see him again—or, at least, an actor’s portrayal of him—as soon as this November, when the 1960s period film Ford v Ferrari hits theaters.

After 25 Years, Has Amazon Become Too Large?

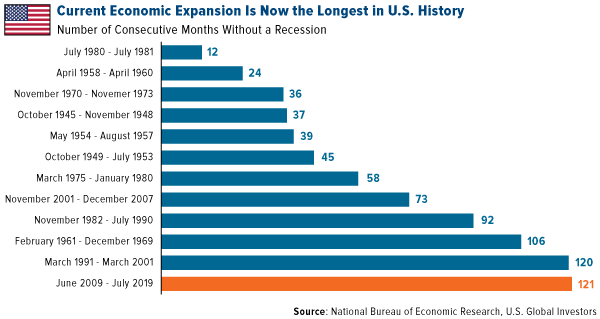

Other notable milestones took place last week. For one, the current economic expansion reached a record 121 months. This is enough to beat the previous record-holder, the period between March 1991 and March 2001. As I’ve said before, business cycles die not of old age but by the Federal Reserve. We’ll see if the Fed chooses to lower rates next week, though the better-than-expected June jobs report makes that look less likely.

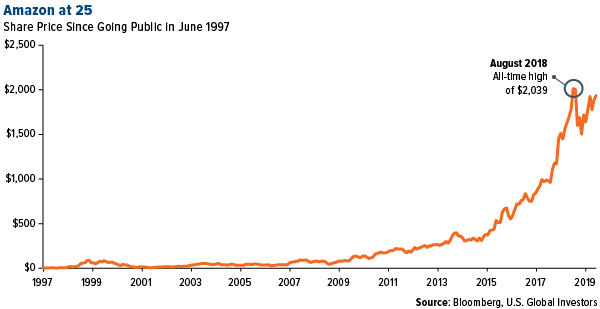

Also of note is that Amazon, another American success story, turned 25 years old. Jeff Bezos founded the book seller—now the world’s largest retailer, having surpassed Walmart—amazingly at a time when very few people even had access to the internet. Less than half a percent of the world’s population was online in 1994, according to the World Bank.

A lot has changed since then, as you well know. Bezos’ nearly $1 trillion empire has completely redefined how we shop and consume media. It’s given us the Kindle, Prime, Alexa and much more. Today it’s the eighth largest grocer in the U.S., having bought Whole Foods in August 2017. It’s even started selling tiny modular homes, some of which go for as little as $5,000.

For many investors, Amazon has been life-changing. A $100 investment in the company’s IPO in 1997 would have been worth a whopping $120,762 in August 2018, when its stock hit an all-time high of $2,039.

But can the momentum continue? Like its digital peers Google and Facebook, Amazon’s tremendous success may also be its greatest obstacle going forward. Calls to break up the online retailer are intensifying, with some antitrust authorities citing previous cases such as Standard Oil and AT&T. Last month, it was announced that the Federal Trade Commission (FTC) agreed to scrutinize Amazon and Facebook for antitrust violations, while the Department of Justice (DOJ) took on Google and Apple.

“I think it is inevitable that they’ll get broken up,” Stacy Mitchell, co-director of the advocacy group Institute for Local Self-Reliance (ILSR), told CNET. “You can’t mask the kind of structural power that these companies have and maintain that power in a democracy.”

The company’s antitrust troubles aren’t confined to the U.S. last Friday, the United Kingdom’s Competition and Markets Authority ordered Amazon to halt its acquisition of food delivery service Deliveroo.

Looking to make sense of the markets? Subscribe to my award-winning Frank Talk CEO blog! Click here to sign up!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Frank Holmes has been appointed non-executive chairman of the Board of Directors of HIVE Blockchain Technologies. Both Mr. Holmes and U.S. Global Investors own shares of HIVE. Effective 8/31/2018, Frank Holmes serves as the interim executive chairman of HIVE.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 3/31/2019.