Benchmark iron ore prices fell on Friday after the country’s influential Iron & Steel Association urged the Chinese government to maintain order in the global market for the steelmaking raw materials amid a surge in prices this year.

The Chinese import price of 62% Fe content ore fell by 5.9% on Friday to $114.81 per dry metric tonne according to Fastmarkets MB, after peaking earlier this week just shy of $126 a tonne, the highest since January 2014.

Vice chairperson of the industry body, Qu Xiuli, at a conference in Shanghai on Friday flagged “relevant problems in the industry to government ministries and regulators, urging a stronger investigation and supervision to maintain normal iron ore market order.”

The group wants to see prices back at “reasonable levels,” she said, according to Bloomberg.

Shares of the world’s diversified iron ore majors declined sharply on Friday. The world no 2 producer, Rio Tinto, lost 5.4% of its value, BHP Group gave up 4.2% and shares of Brazil’s Vale trading in New York fell back over 2%.

Units of iron ore focused Fortescue Metals trading over the counter (OTC) in New York sank 7.9% , but losses for North America-based miner Cleveland Cliffs were more modest at just over 1%.

The price of iron ore is still up a stunning 58% year-to-date following a dam burst at Vale’s Brumadinho operations that killed more 300 people. In response, the Rio de Janeiro-based company suspended 93m tonnes of production.

Supply worries ease

Vale recently received permission to bring its 30m tonnes a year Brucutu operation back into full production.

According to cargo tracking data supplied by Refinitiv, Brazilian exports in June were roughly 500,000 tonnes more than in January this year, with the last monthly data not impacted by the Brumadinho disaster.

Source: Bloomberg (2019) Metal Bulletin; Department of Industry, Innovation and Science (2019) Source: Resources and Energy report June 2019, Australia’s Department of Industry, Innovation and Science.

At the same time, Australian exports are hitting records with shipments leaving the busiest iron ore terminal in the world – Port Hedland in Western Australia – up more than 20% year on year at the end of June.

“Prices are disconnected from fundamentals at the moment,” CRU Group Senior Analyst Erik Hedborg said in an interview with Bloomberg on Thursday:

“We are rather bearish on Chinese steel demand for the second half.”

Australia sees further falls

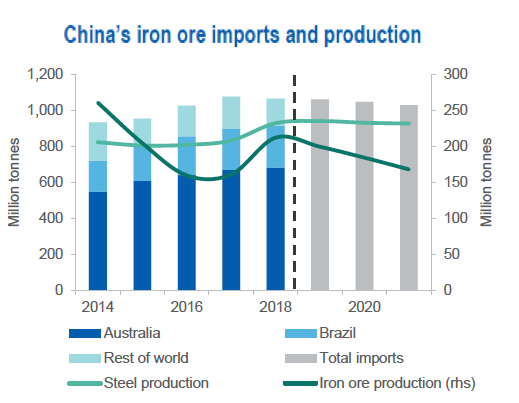

In its latest quarterly report, Australia’s Department of Industry predicts Chinese steel output – which represents half of global production – has reached its high water mark.

The official forecaster of the world’s top exporting country sees Chinese steel production peaking at 940 million tonnes this year before going into a steady decline, dragging down imports in the process.

This, coupled with supply returning to normal levels, will see the price fall to half today’s levels in 2021. Australia government’s office of the Chief Economist estimates iron ore prices would average $80 a tonne this year before falling to an average of just $57 a tonne in 2021 as the seaborne market returns to surplus.

The price used by the Dept. is free-on-board Australia, so for comparison with the benchmark, add between $6 – $10 for cost and freight.