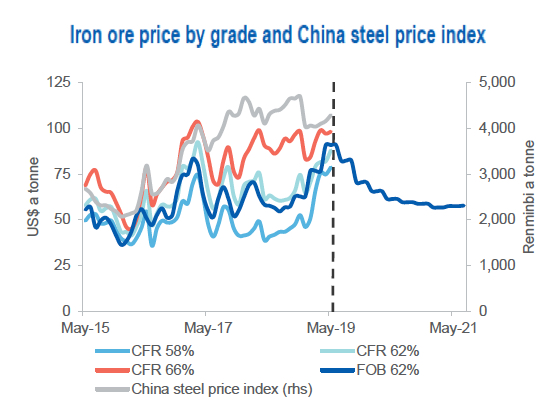

The Chinese import price of 62% Fe content ore jumped to $125.77 per dry metric tonne on Tuesday, according to data supplied by Fastmarkets MB.

The price of the steelmaking raw material is up a stunning 73% year-to-date and is now trading at its highest since January 2014.

Iron ore’s rally is primarily supply driven. Vale has suspended 93m tonnes of production following the deadly dam collapse while Western Australian output was hampered by storms.

However the supply crunch is beginning to ease. Rio de Janeiro-based Vale recently received permission to bring back into full production its 30m tonnes a year Brucutu operation.

Source: Bloomberg (2019) Metal Bulletin; Department of Industry, Innovation and Science (2019) Source: Resources and Energy report June 2019, Australia’s Department of Industry, Innovation and Science.

According to cargo tracking data supplied by Refinitiv Brazilian exports in June was roughly 500,000 tonnes more than in January this year, the last monthly data not impacted by the Brumadinho disaster.

At the same time Australian exports are hitting records with shipments leaving the busiest iron ore terminal in the world – Port Hedland in Western Australia – up more than 20% year on year at the end of June.

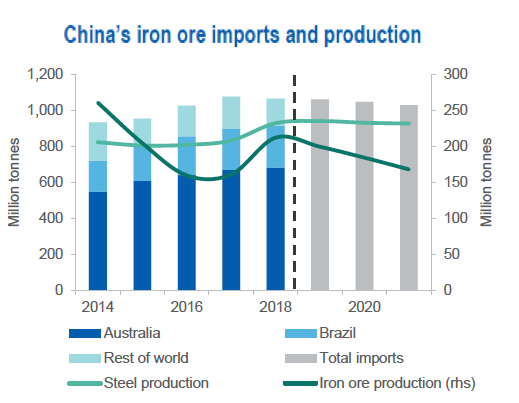

China imports around 70% of the world’s seaborne iron ore which is estimated at more than 1.5 billion annually and Beijing’s economic stimulus has also buoyed the market. Chinese steel output is up by more than 10% so far this year and is now running at an annualized rate of over 1bn tonnes and port stocks are 17% below levels seen this time last year.

But here the outlook is also becoming murkier and in its latest quarterly report, the Australia’s Department of Industry predicts Chinese steel output – which represents half global production – has reached its high water mark.

The official forecaster of the world’s top exporting country sees Chinese steel production peaking at 940m tonnes this year before going into a steady decline dragging down imports in the process.

This coupled with supply returning to normal levels will see the price fall to half today’s levels in 2021. The Australia government’s office of the Chief Economist estimates iron ore prices would average $80 a tonne this year before falling to an average of just $57 a tonne in 2021 as the seaborne market returns to surplus.

The price used by the Dept. is free-on-board Australia so for comparison with the benchmark add between $6 – $10 for cost and freight.