Source: Bill Powers for Streetwise Reports 06/28/2019

U.S. Gold Corp.’s President and CEO Edward Karr, in this interview with Bill Powers of Mining Stock Education, provides an overview of the company and explains why geologist Dave Mathewson has called the Keystone project “the best exploration project he has seen in his career.”

In this interview, U.S. Gold Corp.’s (USAU:NASDAQ) President and CEO Edward Karr provides an overview of the company and explains why the upcoming drill program at its Keystone project in Nevada is so prospective. Dave Mathewson, who is Nevada’s most-successful gold exploration geologist and current Vice President of Exploration for U.S. Gold Corp, has called the Keystone project “the best exploration project he has seen in his career.”

In this interview, U.S. Gold Corp.’s (USAU:NASDAQ) President and CEO Edward Karr provides an overview of the company and explains why the upcoming drill program at its Keystone project in Nevada is so prospective. Dave Mathewson, who is Nevada’s most-successful gold exploration geologist and current Vice President of Exploration for U.S. Gold Corp, has called the Keystone project “the best exploration project he has seen in his career.”

Bill Powers: How and why was U.S. Gold Corp. formed?

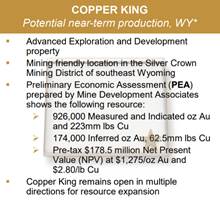

Edward Karr: We formed U.S. Gold Corp. as a private company back in 2014. The reason we founded U.S. Gold Corp. really was to acquire our flagship property called Copper King. Copper King is located in the state of Wyoming about 20 miles outside of Cheyenne. It has a very robust resource. It is an open pit gold, copper, silver, zinc, polymetallic porphyry deposit, and comes right up to surface. We bought Copper King off another publicly traded company called Energy Fuels Corporation. Energy Fuels is a uranium company based out of Denver. They had acquired Copper King when they took over Strathmore Minerals Corporation, and it was a non-core asset for them being a gold/copper deposit. That’s how we originally set up and formed U.S. Gold Corp.

Edward Karr: We formed U.S. Gold Corp. as a private company back in 2014. The reason we founded U.S. Gold Corp. really was to acquire our flagship property called Copper King. Copper King is located in the state of Wyoming about 20 miles outside of Cheyenne. It has a very robust resource. It is an open pit gold, copper, silver, zinc, polymetallic porphyry deposit, and comes right up to surface. We bought Copper King off another publicly traded company called Energy Fuels Corporation. Energy Fuels is a uranium company based out of Denver. They had acquired Copper King when they took over Strathmore Minerals Corporation, and it was a non-core asset for them being a gold/copper deposit. That’s how we originally set up and formed U.S. Gold Corp.

Bill Powers: Your other flagship project is the Keystone project in Nevada. How did that come under the control of U.S. Gold Corp.?

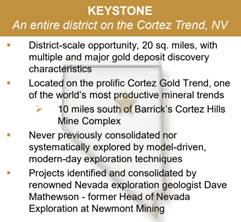

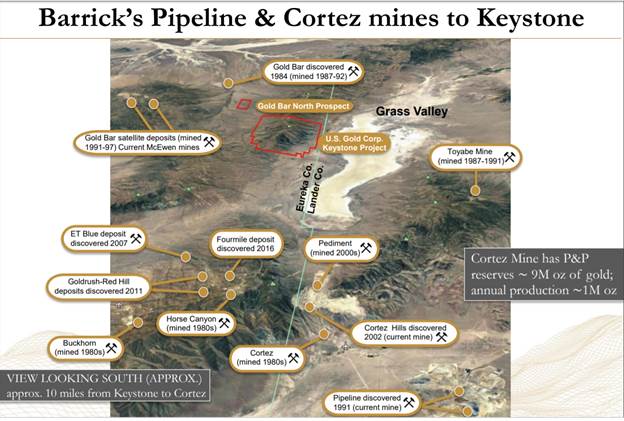

Edward Karr: We had an opportunity come along while were still private and only had our flagship project Copper King. In 2016, I received a telephone call from Dave Mathewson, the well-known Nevada exploration geologist, and he had a new exploration project called Keystone. Dave told me that he believes Keystone is the best exploration project he has seen in his career. It has an incredible address being located in Nevada on the Cortez Gold Trend. It’s about 12 miles south of Barrick Gold’s Cortez Hills complex, which includes the Cortez Hills Mine, the new discoveries, Gold Rush, ET Blue and Fourmile. We are right below that and it looks very prospective. When Dave told me about it, I just knew we had to do a deal, so we acquired Keystone into U.S. Gold Corp.

Edward Karr: We had an opportunity come along while were still private and only had our flagship project Copper King. In 2016, I received a telephone call from Dave Mathewson, the well-known Nevada exploration geologist, and he had a new exploration project called Keystone. Dave told me that he believes Keystone is the best exploration project he has seen in his career. It has an incredible address being located in Nevada on the Cortez Gold Trend. It’s about 12 miles south of Barrick Gold’s Cortez Hills complex, which includes the Cortez Hills Mine, the new discoveries, Gold Rush, ET Blue and Fourmile. We are right below that and it looks very prospective. When Dave told me about it, I just knew we had to do a deal, so we acquired Keystone into U.S. Gold Corp.

Bill Powers: What are your plans for Keystone this year?

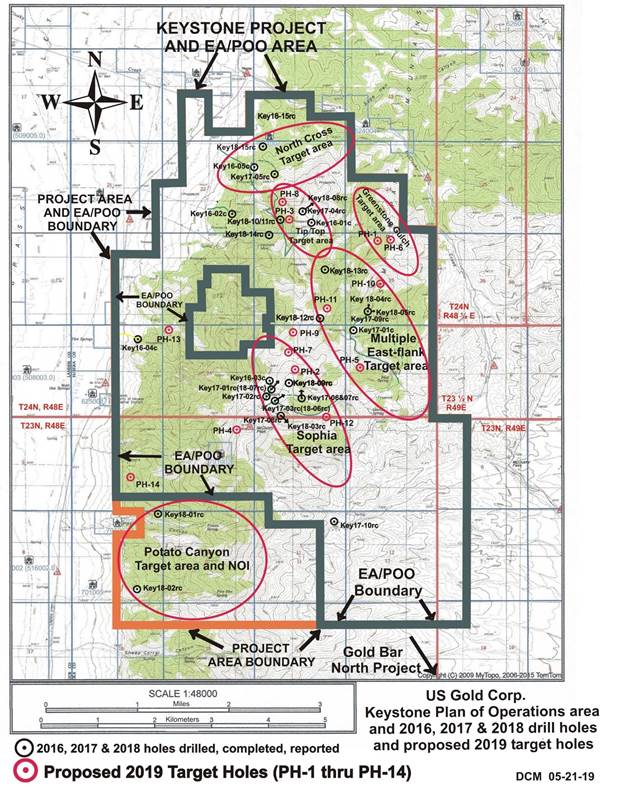

Edward Karr: That was 2016. In the last three years, we have been hard at work at Keystone. We have done a tremendous amount of advancement of the project. We’ve increased our land position. We’ve run a bunch of geophysical surveys over the project, gravity surveys, geochemistry, district-wide mapping. We’ve done a bunch of scout hole drilling. The host rocks and the geology look amazing. Now, we’re really to the point that we are targeting in on what we hope are future potential discoveries.

Last year in October, we received the approval of our environmental assessment and our plan of operations. That was a major, major factor for us. We now have no limitations as to where we can go in the district. We can basically explore and drill anywhere. We put out a press release recently outlining our 2019 planned Keystone summer exploration programs. We’d like to go out and drill potentially 14 to 15 holes this summer. These are fairly deep holes. They’re down to about 2,000 feet, and we put out a map on that press release that shows where we would like to go and some of the geological reasons why we would like to go there.

This will most likely be a two-phased program, like we did last year. It’s been a very, very wet winter, lot of snow, lot of precipitation out in Nevada, and a wet spring. Right now as of the third week of June, the property is just finally drying out. I think we can get a drill rig out on property by second half of July, so we will start drilling then. Drill July, August, probably into September, maybe an initial 10 holes for our first phase. From mid-September to, let’s say, through the end of October, we will send all of those chips and core to the laboratory for assays. Hopefully, we have some assay results back by the end of October this year. Then depending on those results, that will really guide our thinking for our second phase in the fall of 2019.

Bill Powers: If you’re successful at Keystone, what gold discovery analog might we compare this project to?

Edward Karr: There are a bunch. Really, I think one of the best comparisons just looking at where we are geographically is our northern neighbors. You look at Cortez Hills, that’s basically a big high-grade breccia of pipe deposit across the valley pipeline, a little lower grade big 25 million ounce deposit. You look south of Cortez Hills, one of Barrick’s big discoveries that is now going into production will be an underground mine called Goldrush. Goldrush is about 10 million ounces, a nice high-grade deposit, definitely an underground mine. A lot of the drill holes that we’re seeing with the geological conditions, the geochemistry, it really looks very similar to a Goldrush type of environment. I give you an example.

Last fall down in our Sophia target area, one of our drill holes, which was drill hole 18-09, you can go out and look at some of our prior press releases on this, that was an extremely exciting drill hole for us. We had great brecciation and alteration. It shows us that the rock is really beat up, and at the bottom of the drill hole, we lost the hole. We literally drilled into a void. Well, a void is a cave, and a cave can be a very positive thing. The Goldrush deposit north of us is littered with caves. You have these caves and then right below the bottom of those caves, that’s the big mother lode of the Goldrush deposit.

When the drill drills into one of these caves, it cavitates in that open space, because the drill is meant to be drilling through difficult rock. Open air just cavitates and then ultimately you lose it. But, for about 100 feet before we hit that void, we had some of the best geochemistry indications we have seen of any hole. All of the indicators literally spiked off the charts. This is the model. It is a Cortez-Carlin style deposit; collapsed breccia, geochemistry is there. We do not have a high-grade gold intercept yet, but a focus of our summer 2019 exploration plans is going to be following up on that hole. We believe if we can step out a little ways and get through that void, there could be something very, very exciting right below that. That’s certainly something all of your readers should be paying attention to.

Bill Powers: Your company is very unique in that you are listed on the NASDAQ Exchange as a junior gold explorer. Can you comment on your share structure and who owns the shares?

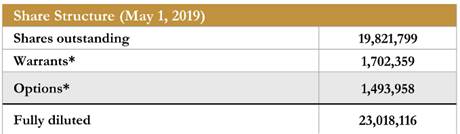

Edward Karr: We have today as of the end of June 2019, just around 20 million shares issued and outstanding of common stock. We have recently closed a $2.5 million financing, that was a non-brokered financing predominantly done by existing supporting shareholders of the company. That was structured as a series F preferred. It was an at market deal, so the preferred converts into common stock at $1.14 per share. The only reason we did it as a preferred is one of the investors wanted a beneficial owner limitation on it.

Our stock today is about 20 million shares. Management, insiders and a couple close shareholders own almost 30% of the company. The other 70% is owned by thousands and thousands of retail shareholders. Our public listing has a long history because we merged into a publicly traded technology company that had been trading since 1971. We have a very, very large shareholder base. We do not have a lot of marquee institutions in our company. We really don’t have any. That’s just because it’s been a very challenging, very difficult market for the junior exploration sector, and our market cap is only today around $20–21 million. It’s really, really, really, really cheap. Most of these institutions want to see a $50-plus million market cap, and we’re very hopeful as we advance our projects that we can get some big named institutions into our shareholder registry in the future.

Bill Powers: As we conclude, what would be three things that most likely could go wrong with U.S. Gold Corp.’s plans for the next year?

Edward Karr: Well, number one I would think is if the price of gold were to collapse. Today as of this interview we’re about $1,410/oz. Looks like a pretty good break out and a lot of us believe it’s the beginning of a new bull market. But, if that turns out to be wrong and this is just a head fake and the world moves into a deflationary collapse and gold goes back to $1,100 an ounce, I think it’s going to be very challenging.

Number two, a real challenge in the junior exploration sector has been access to capital. Getting good money from good investors on good terms. Because, this industry, it really is difficult because we’re constantly burning money. We don’t have any revenues, very similar to biotechnology, and we’re trying to get to discovery success. We constantly have to raise money and that’s been challenging. Hopefully if the gold market continues, it’ll be easier.

I’d say the third thing is always business challenges. We are very, very prudent, we believe, with our treasury. We don’t just go out and drill the Keystone project to Swiss cheese. Every one of these drill holes is expensive, they cost money, and we have to be very precise. This is trying to hit the bulls eye of a target 1,000 yards down range. You got to have a good gun, you got to have a really good scope, you got to have a good spotter, and all the conditions need to be right to come up with that discovery.

We believe we are very, very, very close at Keystone to discovery success. Everything is looking really good. But ultimately, what we can’t predict in any way, is that going to be five drill holes, 15 drill holes, or 25 more drill holes? It’s this challenge of raising enough capital on the best terms to be able to fund the company and those exploration budgets without diluting all the shareholders too much. Those are probably the three biggest challenges we have in the near future.

Bill Powers: To learn more about U.S. Gold Corp you can go to www.usgoldcorp.gold. Ed, thank you for providing an overview of your company.

Edward Karr: Thanks so much Bill. I appreciate the interest.

Bill Powers is the host of the Mining Stock Education podcast that interviews many of the top names in the natural resource sector and profiles quality mining investment opportunities. Powers is an avid resource investor with an entrepreneurial background in sales, management and small business development. His latest interviews can be found at MiningStockEducation.com.

Disclosure:

1) Bill Powers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: U.S. Gold Corp. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: U.S. Gold Corp. My company has a financial relationship with the following companies mentioned in this article: U.S. Gold Corp. Additional disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Energy Fuels. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of U.S. Gold Corp., a company mentioned in this article.

The content produced by Bill Powers and Mining Stock Education LLC is for informational purposes only and is not to be considered personal, legal or investment advice or a recommendation to buy or sell securities or any other product. It is based on opinions, public filings, current events, press releases and interviews but is not infallible. It may contain errors and we offer no inferred or explicit warranty as to the accuracy of the information presented. If personal advice is needed, consult a qualified legal, tax or investment professional. Do not base any investment decision on the information contained on MiningStockEducation.com, our podcast or our videos. We usually hold equity positions in and are compensated by the companies we feature and are therefore biased and hold an obvious conflict of interest. MiningStockEducation.com may provide website addresses or links to websites and we disclaim any responsibility for the content of any such other websites. The information you find on MiningStockEducation.com is to be used at your own risk. By reading MiningStockEducation.com, you agree to hold MiningStockEducation.com, its owner, associates, sponsors, affiliates, and partners harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries (financial or otherwise) that may be incurred.

Graphics provided by the author.

( Companies Mentioned: USAU:NASDAQ,

)