Source: Maurice Jackson for Streetwise Reports 06/28/2019

Dr. John-Mark Staude, CEO of Riverside Resources, speaks with Maurice Jackson of Proven and Probable about his company’s recent agreement to acquire a portfolio of properties in Sonora.

Maurice Jackson: Joining us for a conversation live from Mexico is Dr. John-Mark Staude, the president and CEO of Riverside Resources Inc. (RRI:TSX.V; RVSDF:OTCQB), where Knowledge is Golden.

Glad to have you back on the program to discuss Riverside Resources’ latest press release regarding the strategic acquisitions for the Riverside Property bank, but before you share the exciting details, Dr. Staude, introduce us to Riverside Resources and the opportunity you present to the market.

John-Mark Staude: Riverside is a prospect generator with projects in Canada, United States and particularly in Mexico. We have joint venture programs and major projects with major companies like BHP and smaller companies and we provide multiple different commodity exposure of gold, silver, copper. We’ve been able to operate for 13 years, have no debt and have a very strong balance sheet. We’re a wonderfully driven prospect generator company.

Maurice Jackson: Let’s go to Sonora, Mexico, where you are right now, and where Riverside Resources just entered into a binding letter of agreement with the proud sponsor of Proven And Probable and that will be Millrock Resources Inc. (MRO:TSX.V; MLRKF:OTCQX). John-Mark, Riverside is acquiring five projects with no reversionary interest from Millrock Resources. Why these projects and why now?

John-Mark Staude: Why now? Because the market has been low and Riverside’s been working on this for a while, and we’ve been successful in acquiring some key projects that fit for us. I think for Millrock it works for them as they’re working more in Canada and particularly in Alaska. For us, we know these projects well. They have been on our radar for a number of years. We tried to get a larger position in Millrock’s in Mexico, but Millrock beat us in that when they acquired Paget Minerals. What Riverside sees is specific opportunities on these projects and a number of them that fit within the BHP strategic area, where we’re working with BHP and thus we can see that there’s a possibility of bringing these projects with BHP forward as porphyry coppers as well.

Maurice Jackson: On behalf of the Riverside shareholders, provide us with project descriptions for each project, please.

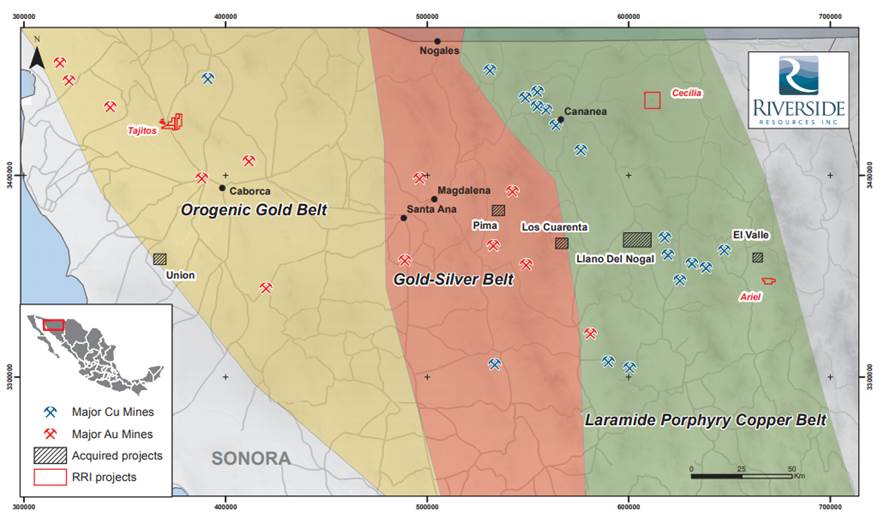

John-Mark Staude: Well, I think one of the key projects Riverside is excited about is the Los Cuarenta project that you can see on the map above. We’re in the state of Sonora; there’s a location map on the left corner. In the northern part of Mexico, along the border, we have the Los Cuarenta project, which is a very good project, close to other mines such as Las Chispas and also the Mercedes Mine. Great location.

A second project we like a lot is in the west, Union. What we like about this project is it’s in the orogenic gold belt, similar to where we have our Tajitos project and many other mines in this region of western Sonora, Mexico. Three projects to the east, Llano del Nogal, El Valle and Pima, also are porphyry copper related systems that we see as possibly fitting with BHP.

We’re very excited to have this portfolio now ready to go with a locked-in partner, BHP, and you can see it fits around our other projects, the Cecilia, Ariel and also Tajitos, so we’re in a great location that we know how to operate. This fits Riverside like a hand to a glove, a perfect fit.

Maurice Jackson: John-Mark, I noticed that a lot of excitement there and attention was put on Los Cuarenta. What specifically excites Riverside here?

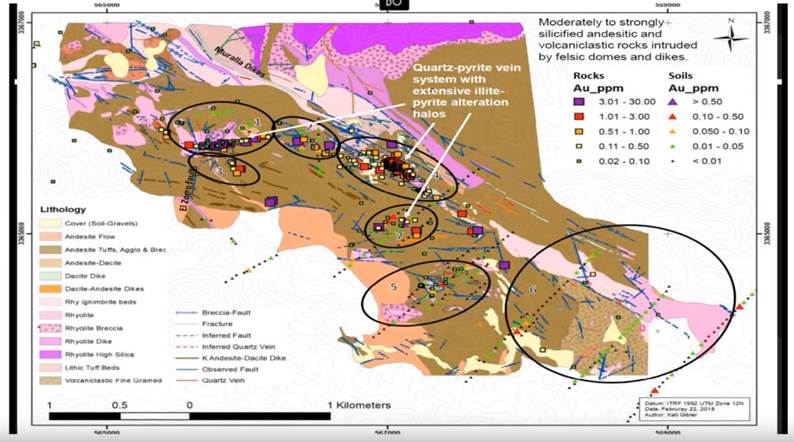

John-Mark Staude: The thing about Los Cuarenta that excites us is the location. It’s near other deposits and also has really great geology. Taking a closer look at the geology, we have seven different areas of mineralization along a trend that is over four kilometers. The veins shown here are similar to the veins and mineralization we see at the Mercedes Mine that’s operated by Premier Gold, and also similar to the over half a billion dollar value, very exciting project that’s only 30 kilometers away, Las Chispas that’s operated by SilverCrest Metals.

So Riverside having a project that’s very much like SilverCrest Metals’ with high-grade mineralization on veins, lots of good extent and in a largely un-drilled area makes this a really great acquisition. Riverside’s excited to add Los Cuarenta to the property bank. As you can see, we have much to be excited about from the images on the map.

Maurice Jackson: John-Mark, congratulations on what looks to be a very prudent move on the behalf of shareholders. I continue to be impressed with the geological and business acumen of Riverside Resources. It’s strategic moves such as these that increase Riverside’s probability for the next big discovery. Let’s switch gears here. John-Mark, Riverside is thriving, juxtapose to the share price that is near a 52- week low. What would you like to tell the shareholders regarding the current share price?

John-Mark Staude: I think the share price has been pushed low and I think we’ve demonstrated we have cash, have we have deals, we have deal flow, and we also think that now gold are prices going up, it really should help rebound the share price. Gold has gone up quite a bit, well over $1,400, and we see Riverside having gold resource assets and having gold royalties and having gold deals, makes Riverside in a very good position. So we see ourselves as really undervalued in this condition and we think that these types of deals will help us to get the share price going.

Maurice Jackson: Are you currently buying shares?

John-Mark Staude: During July, I look forward to buying shares. I couldn’t buy any now; I’ve been in a lock-up period waiting for the completion of this deal and recently before that the BHP deal. So being locked out of that because we had material information and we never want to have trading on that, but now that we’re in a position, we’ll move ahead. I’ll have an opportunity to accumulate more shares. I’m already a large shareholder. I’ve never sold a share of Riverside in my whole life, but look forward to adding more into my portfolio of Riverside.

Maurice Jackson: Well, that speaks volumes. John-Mark, for the next unanswered question for Riverside Resources, when can we expect an answer and what will determine success?

John-Mark Staude: In the coming three weeks, we look forward to having more results coming out from some of our programs and I think what we’ll see from those programs is increased high-grade gold. We have some high-grade gold results coming along, working those up and that’ll be good. Also during the latter part of this summer, we’ll look forward to expanding in Canada and giving the investors just an update on our Canadian program that we’re working, taking advantage of the summer where our VP exploration Freeman Smith and the rest of our team have been adding there as well, so we’re in a great position coming into the fall. Really good for Riverside.

Maurice Jackson: Dr. Staude, before we close, what keeps you up at night that we don’t know about?

John-Mark Staude: You know for me, the key thing is people and what keeps me up at night is just how do we keep these great people working with the BHP alliance and program. Working with BHP is a great place, so I’m so excited. I’m sleeping much better at night now, having such a major partner and we’re now moving forward with programs to bring forward with them. So Riverside’s really in a great position for coming years. Really having fun with Riverside now.

Maurice Jackson: All right, Dr. Staude, for someone listening that wants to get more information on Riverside Resources, please share the website address.

John-Mark Staude: www.rivres.com

Maurice Jackson: Riverside Resources trades on the TSXV symbol RRI and on the OTCQB symbol RVSDF.

As a reminder, I’m a licensed representative for Miles Franklin Precious Metals Investments, where we provide unlimited options to expand your precious metals portfolio from physical delivery, offshore depositories, precious metal IRAs and private blockchain distributed ledger technology. Call me directly at 855-505-1900. Or you may email maurice@milesfranklin.com.

Finally, we invite you to visit provenandprobable.com, where we provide Mining Insights and Bullion Sales. Riverside Resources is a sponsor of Proven and Probable and we are proud shareholders of Riverside Resources for the virtues conveyed in today’s message.

Dr. John-Mark Staude of Riverside Resources, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Riverside Resources and Millrock Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Riverside Resources and Millrock Resources. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Millrock Resources and Riverside Resources, companies mentioned in this article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.

( Companies Mentioned: MRO:TSX.V; MLRKF:OTCQX,

RRI:TSX.V; RVSDF:OTCQB,

)