Source: Keith Kohl for Streetwise Reports 06/25/2019

A small-cap company sitting on a massive field with potentially several billion barrels of crude oil has caught the attention of Keith Kohl, managing editor of Energy & Capital.

I was wrong.

When we last talked about Torchlight Energy Resources Inc. (TRCH:NASDAQ), I told you that this company is sitting on a massive new field with potentially a billion barrels of crude oil at stake.

Again, I want to apologize for getting that wrong. Torchlight isn’t sitting on a billion-barrel field.

It’s actually 3.7 billion barrels of recoverable hydrocarbons.

Yes, you read that correctly.

Now, for those of you who were able to listen to the conference call on March 22, this blockbuster news won’t come as a surprise. If you weren’t able to catch that call, I highly recommend you listen to a replay of it. It was an extremely detailed presentation, and you can find a full re-cast of it right here.

So let’s have a quick recap…

Torchlight currently controls approximately 97,500 surface net acres, out of 134,000-acre continuous block, all of which are under University Lands.

Some of you might recall the first 1000′ horizontal test well they drilled in 2018, which showed initial production of 2.2 million cubic feet of natural gas per day, and had a sustained rate of 1.2 million cubic feet of natural gas per day. The company holds a 72.5% working interest, and so far has drilled five pilot wells that have been instrumental in evaluating the Orogrande Basin’s potential thus far, and proven the play has a working petroleum system.

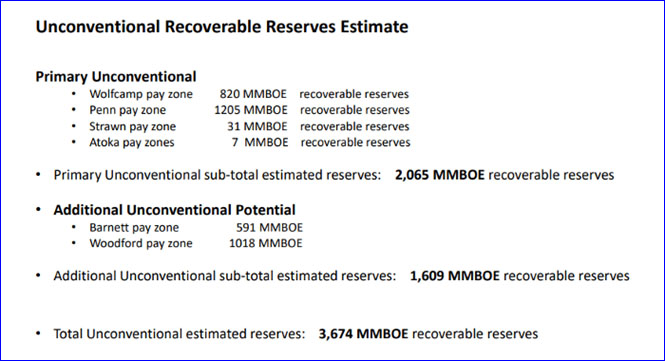

One interesting note you may see is that roughly 2 billion barrels of oil equivalent (2000 MMBOE) is located in just the Wolfcamp and Penn pay zones! Below, you can see a slide straight from the company’s presentation that breaks down these recoverable reserve estimates:

So, in addition to the Wolf-Penn potential, Torchlight has more than 1600 MMBOE of additional unconventional reserves that are considered recoverable.

Keep in mind that the Orogrande is more than just an unconventional play. This play also has areas with potential conventional pay zones, and Torchlight has confirmed the existence of structural pay and potential 4-way closures/fault closures (a structural feature of conventional pay zones) through its first vertical test well testing the structure, as well as the 2D seismic, gravity and magnetic information available.

In fact, that work shows potential of up to 20,000 acres of multiple conventional structural features. Factoring in both the unconventional and conventional resources at play, we’re talking about an absolute mind-blowing amount of hydrocarbons.

Remember, the U.S. Geological Survey’s (USGS’) most recent oil assessment in the Permian Basin pegged the amount of undiscovered, technically recoverable reserves in the Wolfcamp and Bone Spring formations at 46.3 billion barrels of oil.

Since the USGS assessment is based on public data in the Midland and Delaware basins, it didn’t factor in the potential of the Orogrande!

THAT, dear reader, is why we’ve been targeting trades in this area.

Furthermore, I completely agree with Torchlight that Texas will become the world’s new swing producer.

So you’re probably asking, “Okay, so what comes next?” Well, the company has said that it is now moving into the sales process.

In other words, it may be time for the big fish to come and scoop up Torchlight, and deliver some potentially monstrous value for its shareholders. Over the short term, the plan is for Torchlight to continue to define the potential size and scalability of the Orogrande. However, let’s not forget the kind of attraction that the drillers have had over in the Permian Basin. My readers and I took a nice profit from Energen after Diamondback Energy shelled out $9.2 billion for the company in 2018.

Just to give you an idea of some of the deals noted on the conference call, consider that WPX paid $2.75 billion to acquire RKI, or that Encana shelled out $7.1 billion for Athlon to help boost its presence in the Permian Basin.

Of course, Exxon paid $5.6 billion back in 2017 to double its Permian Basin resources.

Remember that as I write this, Torchlight is only trading with a market cap around $75 million.

Now it’s time to take the next step…

The company announced recently that it had made seven individual presentations to publicly traded industry majors and private equity-backed firms. Granted, they won’t tell us who they’re speaking with, but they’ve said that these potential buyers range in size from an enterprise value between $400 million and over $100 billion.

Truth is, Torchlight is sitting on a lot of oil, no matter how you look at it.

And Occidental’s $55 billion acquisition of Anadarko may have paved the way for more high value deals West Texas.

I told my readers at the end of 2018 that the harsh selling that took place was a strong buying opportunity for us.

And I was right…

Shareholders saw their position explode 212% higher between December 24th and April 8th.

I think the latest sell-off is an even bigger opportunity for investors. You see, this time around we KNOW the potential size of the Orogrande play is absolutely massive. I wouldn’t expect companies with enough of cash in the bank or treasury stock to overlook a fresh 3.7 billion-barrel field.

And now that Torchlight is officially courting potential suitors, and whoever takes them to the prom may end paying a hefty premium to do so.

If you’ve been looking for a strong trade that the market hasn’t quite caught onto yet, Torchlight is it.

Investors interested in learning more can find Keith’s latest energy trades at Energy Investor and Pure Energy Trader. Request Information

Keith Kohl is the managing editor of Energy & Capital, an independent research service that focuses primarily on opportunities in the world’s energy markets. Kohl shares his vast knowledge of the global energy complex and the unprecedented opportunities offered in those markets with members of Energy Investor and Pure Energy Trader.

Read what other experts are saying about:

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Keith Kohl: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: I am a shareholder of Torchlight Energy Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Torchlight Energy Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Torchlight Energy Resources. Please click here for more information. An affiliate of Streetwise Reports is conducting a digital media marketing campaign for this article on behalf of Torchlight Energy Resources. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Torchlight Energy Resources, a company mentioned in this article.

( Companies Mentioned: TRCH:NASDAQ,

)