Source: Michael Ballanger for Streetwise Reports 06/25/2019

Precious metals expert Michael Ballanger looks at the recent run-up in gold and reveals his recent trades.

I am so confused tonight that I had to crowbar the booze cabinet in order to calm my scrambled soul and ease the pain in my pseudo-analytical chest. That’s right. “PSEUDO” as opposed to “QUASI” and as opposed to “FAUX.” The latter two adjectives imply vagueness and deceit and I would expect that my ramblings are a far cry away from vague and, despite the fact that I spent thirty-seven years employed peddling securities to people, certainly not with “deceit.” Well, maybe a tad of deceit but never of my making and always with honorable intent. Then again, deceit is deceit and it might take a hard look into the inner workings of the mirror to honestly decipher “intent.” Outcome and impact are far better conditions to observe in order to make any semblance of “moral judgement” so I beg you all to be the final arbiters of this tripe.

What sent me into veritable agony was the ease with which the surgeons of market operations were able to pivot from “fiscal integrity” to “monetary irresponsibility” with nothing more than a “written statement” and a “rehearsed press conference.” Every single Federal Reserve Board “event” is rife with drama, suspense and the inevitability of surprise, but not this one. It was carefully scripted, cautiously crafted, and magnificently delivered by a man who claims that the current POTUS has no authority to “fire” him. The result is that we have just entered into the Twilight Zone of pre-election politics with the “mightily revered stock market” as the scorecard from which the U.S. voting public will decide. You will recall that in all elections prior to the Millennium, GDP and employment numbers were all that mattered while the stock market averages were a mere yawn on the face of John Q. Well, welcome to the world of instantaneous satisfaction, delivered by others and appreciated by none. The scorecard has been now officially rendered: Speculators 10, Savers 0 (as in a great big fat ZERO). No need to ever again shop the oh-so-trustworthy banks for a “competitive rate”; they have been ordered to screw you by taking your savings with a positive-return “teaser” with the full knowledge that in due course, you will be paying THEM for the privilege of using their “services,” which is capsulized by the term “usury,” which is a felony in most countries.

We, as a global money-changing populace, are now officially embarked upon the ultimate fiscal and monetary voyage of “Spin ’til you Win” processing; it is government officials telling you upon which horse to bet, which lottery ticket to own, which roll of toilet paper to buy. It is about everything about to which Ayn Rand objected; she wrote “Atlas Shrugged” in 1957 and spoke of “totalitarian capitalism” where citizens were no longer assisted by government but where government DEMANDED the assistance (obedience) of its citizens, resulting in a total and complete breakdown in cause-effect outcomes. Anyone who has never read the book has zero knowledge of the significance of what this Russian Jew told us. Her father, well-trained in free market capitalism until 1917, had his business taken from him by the Bolsheviks in the year after the revolution, the impact of which prompted his daughter’s masterful work. It is now far beyond the time that citizens of North America demand that our elected and non-elected “officials” step up to the plate of fiscal integrity and swing the bat as opposed to hiding from TV cameras and radio microphones and every other type and sort of digital sound byte audit trail. Elected officials absolutely MUST defer from any person representing the banks because the Canadian banks are the financial valets for the government; bankers and government bureaucracy are like moss and lichens: they are completely dependent upon one another and represent the true and final definition of the “symbiotic relationship,” where both parties are totally reliant upon one another for survival.

Speaking of co-dependence, gold and uncertainty used to enjoy a wonderful symbiosis; in the 20th century, every time a saber rattled, the gold price shot up and took gold miners and gold explorers along for a wonderful ride, and every time that peace was celebrated, it declined. It was only in the 1970s with the oil shock that people actually began to understand the relationship between oil and cost-push inflation. A higher gasoline price was the primary component of consumer inflation and when the supply of gas at the pumps in Des Moines, Iowa, and Little Rock, Arkansas, and Stockton, California, became non-existent, creating huge lines of cars waiting for fill-ups, then and only then did the American public arise from the post-WWII slumber upon which the media and politicians dwelled until the Vietnam War defeat cemented the definition of failure, so alienated from the American conscience until then.

Here in the very early days of summer 2019, we have a rocketing gold price and an elevated stock market. We have trade wars and partisan battles and those that would have us eagerly believe that all is well in the world of “Growth” and “Productivity” and “American Capitalism” have pulled out all the stops to ensure that stocks continue to fuel the lifestyle requirements of the elite classes. As much as I detest the methods used to create asymmetrical wealth by way of rising equity values, I sit back in awe of the sheer genius behind the execution whether from the central banker news cycle management to the FOMC drumrolls to the financial media coverage finally resting with the futures markets interventions which conveniently and collusively confirm that every bullish murmur uttered by POTUS, Mnuchin, Jay Powell, Mario Draghi, Kuroda, Leishman, Santelli, and finally, Jim “BUY,BUY,BUY” Cramer must absolutely be true.

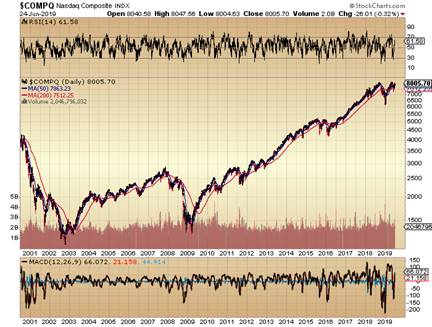

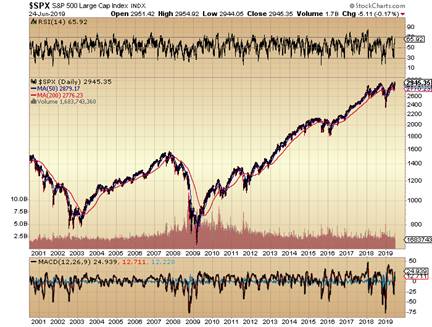

As a result, I present the first of a series of charts. First and foremost resides the reigning heavyweight champion of the financial world, the mighty NASDAQ, replete with every wild-eyed IPO-runner on the planet and the birthplace of every great technology company of the past fifty years. Beside it is the chart of the S&P 500, the index most representative of the broad market and its performance has been utterly magnificent. The last bastion of conservative companies is the Dow Jones Industrials and one glimpse at all three as they are presented below gives you all that need; they are all governed by the same master and that is why they all look so much alike. Those three charts are the hideous horns of “managed capital markets” where only the privileged few are allowed unblemished entry into “the club.”

Ladies and gentlemen, the charts posted above are 20-year charts that clearly show how effective the price management doctors have been in ensuring the patient’s health. Just as an aging superstar is forced to listen to his doctors, these aging bull markets have been attended to better than Bobby Orr’s knees, Whitey Ford’s elbow or Mickey Mantle’s liver. These are masterfully painted charts and they embody the highest order of excellence and vigor in both their form and their symmetry, and it is the word “symmetry” that has, over the years, sidled me with Bobby Orr’s knees (from kicking the dog), Whitey Ford’s elbow (from throwing far too many quote monitors from the 9th floor window), and Mickey’s eviscerated liver (from over-medication brought about by maniacal frustration) all the result of government intervention in our once-sacred FREE capital markets. Now, does ANYONE, ANYWHERE, for as much as a New York minute, believe that the charts shown above represent “FREE” capital markets? It is as if we are looking at three sisters, all less than a year apart, and all daughters of the greatest plastic surgeon in world history. They all appear youthful and spry with vivacious smiles when in reality they are old and saggy and very frail, filled with steroids and opioids and sedatives and tranquilizers all designed to make all around them feel happy and SAFE in their presence. In reality, they are clinging to life because their bankster doctors have no other recourse than to administer meds they surely know shall kill the patient.

Now, the charts posted below are of a shorter-term duration than the equity charts shown above but the intent is to define where we are in entry-point analysis. As I have boasted about since late 2015, the birth of the “New Bull Market in Gold” occurred in early December 2015 with the miners following in January 2016. You can see most clearly the unmistakeable bottom in the metal but you really don’t see the bottom in the miners until a month later. Importantly, those investors (like me) that were long (and levered up to the small intestine) were able to get that first double off the lows in unimaginable speed. It was on April 25th of this year that I posted a chart of the JNUG at $6.35 with the annotation that it “could be the bottom” only to watch it close on Friday at $12.70. However, of utmost importance to all is a) what to do with the basket of gold stocks we owned BEFORE the rally and b) what to do if we had NONE and want to own SOME. Well, turn off your TVs and block your gold bull Twitter feeds and try to think and process the charts on your own and by yourself.

Before I explain the obvious caution I am advocating in the arrow and dotted lines in these charts, be it known that the explosion in RSI levels, which has taken my beloved gold and gold miners to record RSI levels, is emphatically bullish from both sentiment and technical perspectives. Massive changes in DESI (not shown here) and RSI are incredibly bullish inputs to the monthly charts and to the weekly charts BUT (and I shout “BUT BUT!”) they are NOT telling you to load the gun tomorrow. I have liquidated all of my late-April leveraged gold positions (GLD calls, NUGT, JNUG) while retaining all non-leveraged ETF positions (GDX, GDXJ) and getting whacked for a 0.1% portfolio hit on DUST and a 0.07% hit on the GLD puts. Make NO mistake; when the RSI went into the 70s 10 days ago, I was taking profits like a drunken sailor with 40% gains across the board on the leveraged gold miner ETF’s and as I look back, I was in error. I THOUGHT I was going to be a “legendary timer” in the call but you just know that just when you think you are the next coming of Nostradamus, you wind up as “The Simpleton of Saint Pierre” and wind up in well off the beaten track, at least for a while. The impact of the jump from RSI 72 to RSI 85 was significant in that it took many of the positions up another 30% from my exit level. AS much a bummer as it was, you will recall that the only reason the GGMA portfolio outperformed the S&P in the past 24 months is that I used RSI and the COT report to avoid the drawdowns that have been horrific for long-term portfolio managers dealing specifically in gold and gold miners.

Listen carefully: Gold has been in a bull market since December 2015. It has been experiencing a series of higher lows and higher highs since 2016 and has slowly decoupled from the trend of the U.S. Dollar Index. It is now unarguably in a MASSIVE bull uptrend called to the exact DAY by this publication 3.45 years ago; it is today in a feeding frenzy mania of buying from generalist portfolio managers following the likes of Paul Tudor Jones, Ray Dalio and Stanley Druckenmiller. Despite all of that, I urge you all look at the charts posted above and ignore all of the “I told you so” rhetoric you’re now hearing from the gold newsletter crowd. The metal (which I love) and the miners (which I adore) are in the singular most overbought position EVER. I advise that you take profits on 50% of your holdings NOW while getting ready to sell the balance at HUI 205 (now 195). I swore I would never sell my physical metals back in 2009 and I will not; I will however put up 50% of the GDX @ $27 (cost $20.27) and 50% of the GDXJ (cost $30.22) @ $37.

These markets have now become unglued with the unbridled thirst for gold exposure and if you have never been exposed to “gold fever,” you have zero clue to which I refer. RSI readings above 80 are massively bullish when accompanied by sustained above-average volumes and there is no question that some very large unencumbered pools of capital have decided to descend upon our market like terminal predators, therein creating the problem for us all. Have these monstrous pools of capital finally decided to take on the bullion banks? IF (and that is a very large “IF”) they have, then we have a problem in that it is a problem based upon the definition of “infinity.” Since central bank liquidity has been proven to extend into “infinity,” where is the point where they are incapable of being issued a margin call? Better still, does the Fed “ever” get a “margin call” that requires a cash injection? We absolutely KNOW from experience that the average investor and the typical fund all get “calls” but if the bullion banks are short 500,000 August gold futures contracts, are they obligated to deliver if called? Or is it a “delivery notice” presented to the U.S. Treasury? This is what is going to emerge now that the CNBC mega-Titans have decided to engage. Whether or not you decide to invest, we are in a continuation stage of a massive bull market that began on December 4, 2015, and received validation when Jay Powell told the world that “Trump can’t fire me” in June 2019.

You all know where I sit on gold and silver; there is nothing more I can write that could convince you.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Article originally written on June 20.