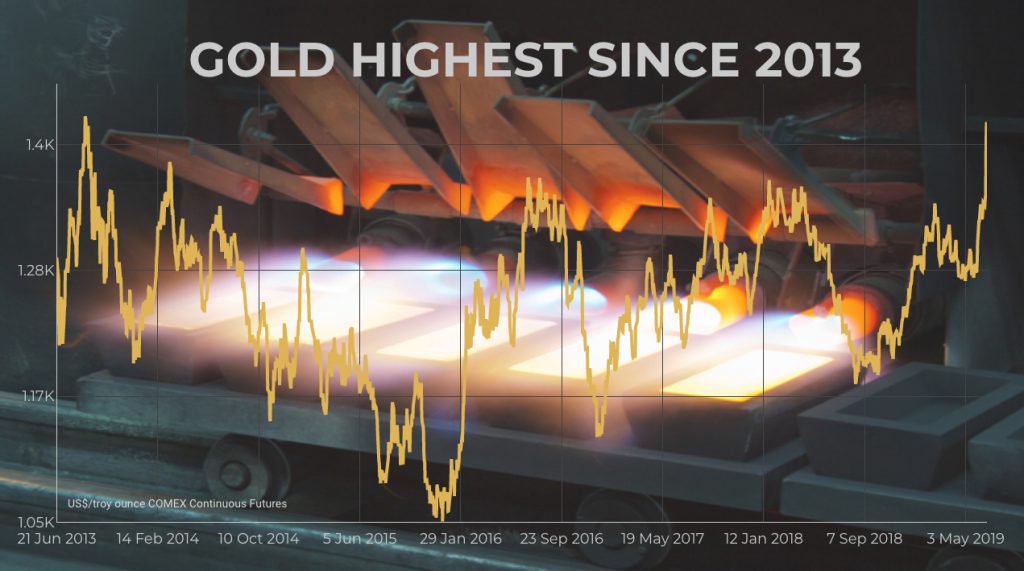

The rally in the price of gold went into overdrive on Friday with the metal hitting a near six-year high on a combination of a weaker dollar, slumping bond yields, geopolitical uncertainty, trade tensions and institutional money pouring into the sector.

Gold for delivery in August, the most active futures contract trading in New York, touched a high of $1,415.40 an ounce level overnight but by lunchtime was back just above the $1,400 level.

That’s up nearly $50 an ounce for the week and the highest since September 2013. Contracts representing 45m ounces had been traded by 1pm in New York on Friday meaning that over the last two days the equivalent of almost a year’s worth of gold mining exchanged ownership.

“There has been a dramatic change in sentiment,” Adrian Day, president of Annapolis, Maryland-based Adrian Day Asset Management told Bloomberg.

The wire service also quotes from a report by investment bank Citigroup saying “the enthusiasm is justified” and $1,500 to $1,600 an ounce is possible in the next 12 months under a bullish-case scenario that includes borrowing costs falling below zero.