This post 2 Reasons Why Your Refund Isn’t as Big as You Thought… appeared first on Daily Reckoning.

Are you accustomed to receiving a fat tax refund from the IRS… money that you often use for a summer vacation or to save for a rainy day?

This year, though, you might’ve gotten a smaller one than expected. Or worse yet, you may have had to include a check when you submitted your 2018 return.

You’re not alone.

According to the IRS, the average 2018 refund check for early filers was $2,640… 16% less than in 2017.

So why were so many caught off guard when the tax overhaul had promised relief?

Two reasons…

First, the Tax Cuts and Jobs Act (TCJA), which became law last year, lowered the rates for five of seven tax brackets. And the IRS changed its withholding tables to more closely match the amount owed.

So rather than withholding the same amount of tax as they did from your paychecks in 2017, your employer took out less.

That means your refund may not be as big as you expected because less tax was taken out of your paychecks and you got more money throughout the year.

Second is that many folks were affected by the biggest set of major changes in 30+ years, such as:

- The end of personal exemptions

- The elimination of the job-related expense deduction

- Doubling of the standard deduction

- Doubling the maximum Child Tax Credit for dependent children from $1,000 to $2,000 per qualifying child

- The $10,000 cap on the deduction for state and local taxes

Retool Your Tax Withholding…

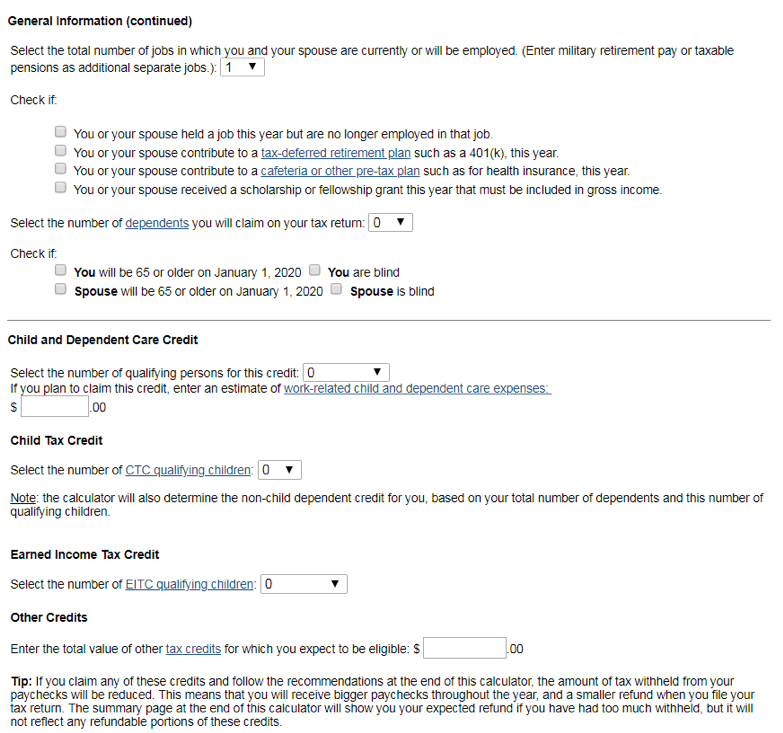

To prevent the same shock from happening this tax year, you may want to fine tune how much is withheld from your paycheck and how big of a refund you’d like. Factors include: marital status and how many dependents you have.

You don’t want a too big refund, because that’s like giving Washington an interest-free loan. Nor do you want to owe a big balance, since you could also get slapped with a penalty.

My advice: File a new Form W-4 so that your employer can withhold the correct amount of federal income tax from your pay.

The good news is that the IRS has a free withholding calculator that makes the job of completing a new Form W-4 a snap. You’ll need two documents: most recent pay stub and most recent tax return.

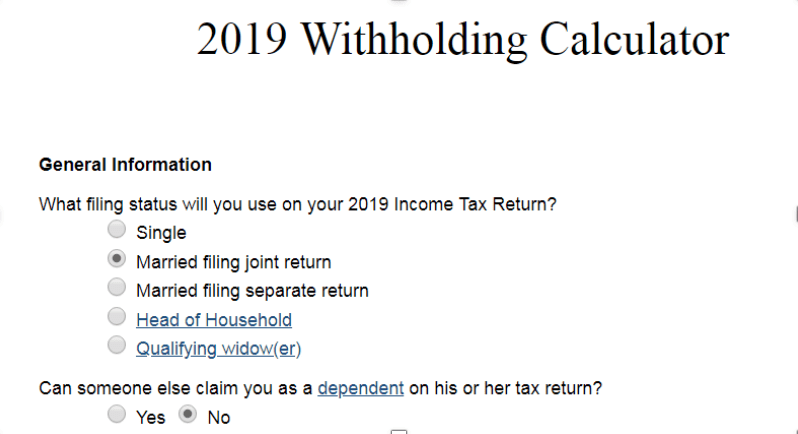

For an example how the calculator works, suppose you’re married, file jointly, and both of you are 60 years old.

Next,

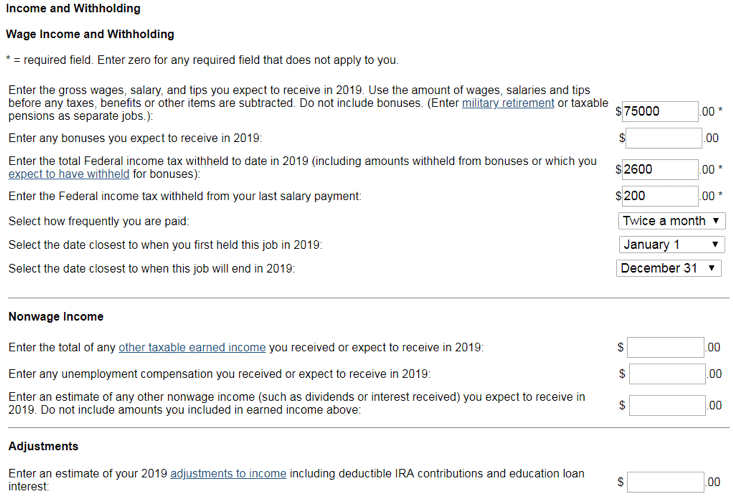

Next, your salary is $75,000. Through mid-June of this year, $2,600 has been withheld with $200 coming out of each paycheck.

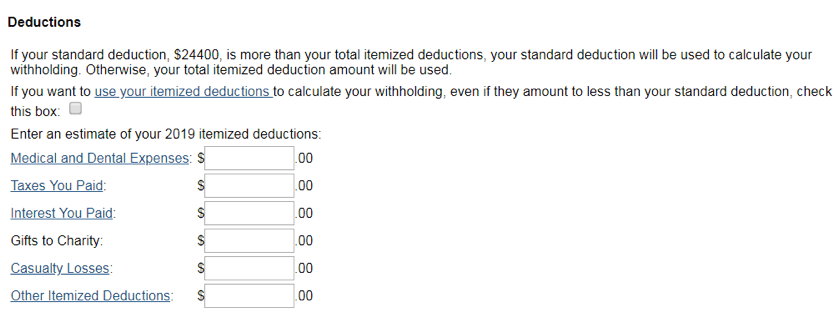

Let’s assume you’ll take the standard deduction…

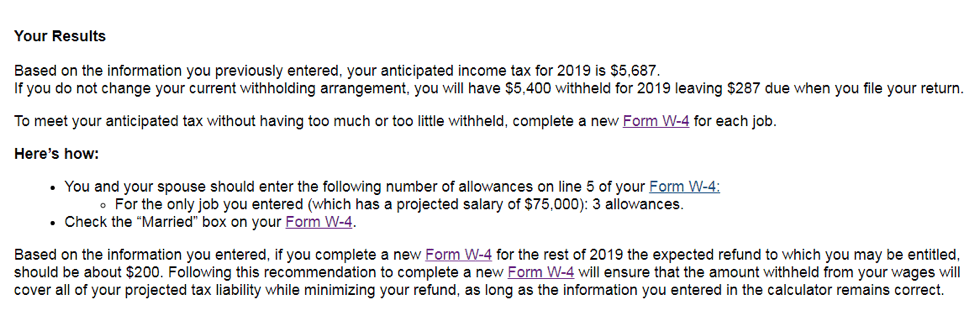

Results…

As you can see, figuring what to put on Form W-4 is a piece of cake. The calculator provides specific recommendations on the number of allowances you should claim. It might also recommend an additional flat-dollar amount withheld from each paycheck… again so there’s no surprises when you file your return in 2020.

In our example, if you don’t make any changes, you’ll owe $287 come tax filing time. But if you follow the “Here’s how” instructions and file a new Form W-4, you’ll receive a refund of around $200.

As soon as you complete the Form W-4, give it to your employer so you can make up withholding shortages, or recover overages, by year end.

Also, check your withholding whenever there is a major change in your life, for instance, getting married, getting divorced, or starting a part-time business.

After you’ve finished with the Form W-4, you might want to checkout…

More Free Stuff from the IRS!

The IRS’ homepage has a boatload of free tools for you that can make the tax filing process a tad easier.

For instance, you can:

- Get your refund status

- Make payments

- Get answers to tax questions

- Find forms and instructions

And as long as your income is below $66,000, you can file your taxes for free with Free File’s easy to use software.

However, there’s a potential drawback if you use the program… one that Washington doesn’t talk about…

Some preparers have found that in reviewing clients’ Free Filer returns the IRS had made adjustments on those returns that were in the government’s favor and did not apply all rules to the taxpayer.

And those erroneous adjustments resulted in demands for payments, rather than refunds.

Although up to 100 million taxpayers, or 70% of filers, are eligible to use the Free File program, whether it will continue is a coin toss.

On June 10, 2019, Congress passed the Taxpayer First Act of 2019. It’s meant to modernize the IRS and strengthen taxpayer protections.

The original version of the bill included a provision for Free File… the final approved version did not.

Understanding refunds can be tricky, but hopefully this issue was able to clear things up for you a bit.

To a richer life,

— Nilus Mattive

Editor, The Rich Life Roadmap

The post 2 Reasons Why Your Refund Isn’t as Big as You Thought… appeared first on Daily Reckoning.