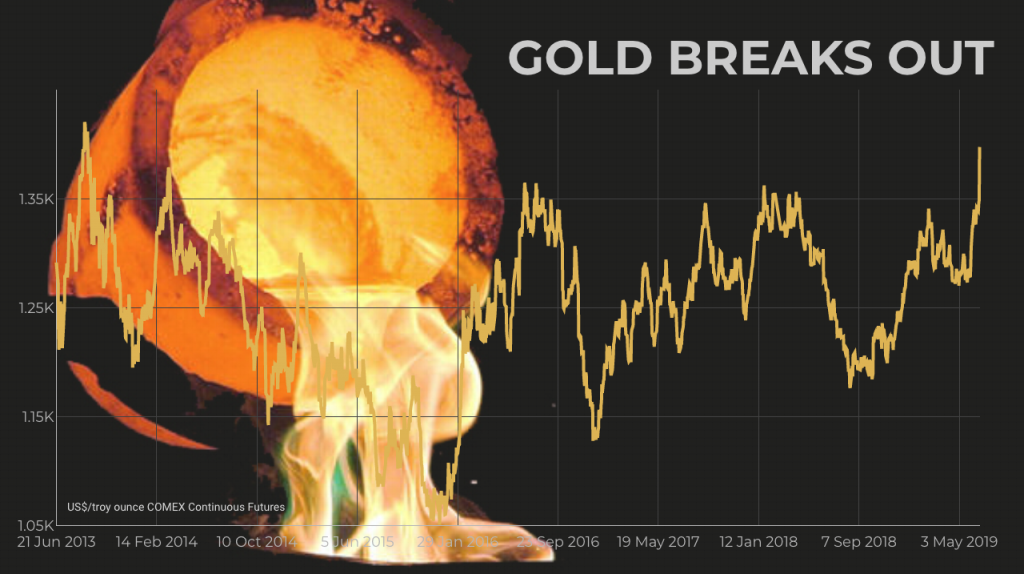

Gold’s gathered momentum on Thursday after hitting a five-year high late yesterday after the US Federal Reserve signalled likely cuts to interest rates in the second half of the year.

Gold for delivery in August, the most active futures contract trading in New York, came close to breaching the $1,400 an ounce level overnight and was trading at $1,392.00 an ounce in lunchtime trade Thursday.

That’s up more than $40 an ounce or 3% from yesterday’s settlement and the highest since September, 2013. By 1pm EST deal volume was already nearly double average daily trading with more than 46m ounces changing hands. That’s almost half annual gold mining production.

Gold has found support from safe haven buying amid geopolitical worries and trade tensions, but expectations of a return to easy money and a drop in bond yields in the US really lit a fire under the metal.

The relationship between long-term interest rates in the US (as proxied by 10-year Treasurys) and the gold price is strongly negative. The yield on the 10-year note dipped to below 2.00% on Wednesday, the lowest since the election of Donald Trump on November 8, 2016.

Rising real interest rates increases the opportunity costs of holding gold because the metal provides no yield and investors have to rely on price appreciation for returns. Lower rates also makes the dollar, which usually moves in the opposite direction of the gold price, less attractive.

Breaking key resistance level

Ross Norman, CEO of Sharps Pixley, the largest bullion broker in London, told Wealthadviser on Tuesday before the jump, that gold could be in the very early stages of a bull run:

“We are seeing distinct similarities with the very early bull run in the late 1990s, just before we saw that inflection moment. There was massive despondency in the physical market for gold, increasing M&A amongst the miners and a market tracking sideways with falling prices and falling volatility.

“Everything changes once we break through $1,360; it is the mother of all resistance levels. […] Once we breach that, we should see a steady rise to around $1,800 an ounce.

“A combination of central bank buying, surging demand from institutional investors for gold ETFs and increased activity on Comex means that the mood is very positive towards gold. It’s only the retail investors that are late to the party.”