Speedy progress in

blockchain technology is prompting companies to reinvent the way they operate

and deliver products and services to their clients, particularly in the mining

and metals industry.

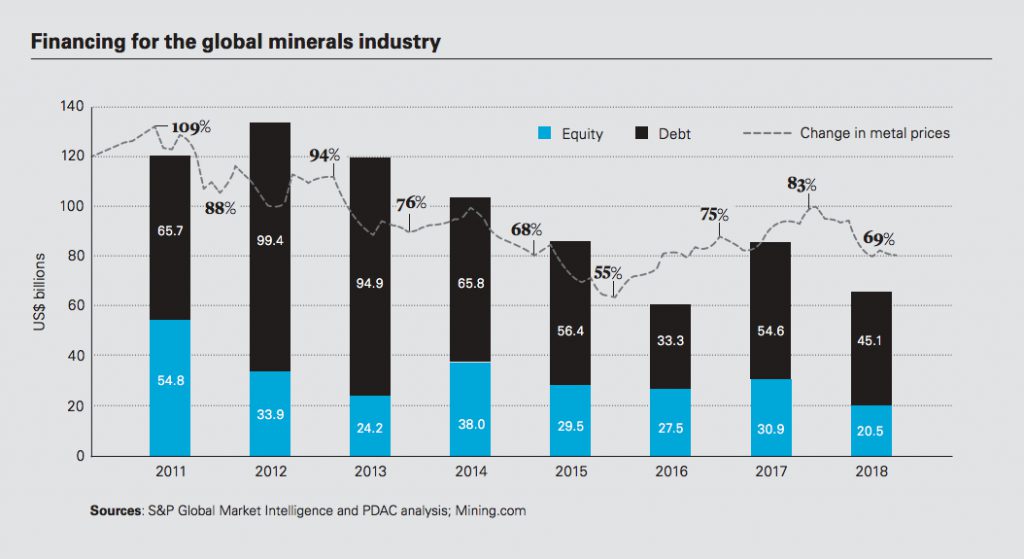

Though

traditionally slow in adopting technological innovations, miners are

increasingly adopting blockchains and smart contracts as a source of

productivity and transparency gains, a study

by global law firm White & Case shows.

According to

authors Rebecca Campbell and Andrzej Omietanski, the same technologies could

also herald new sources of finance, particularly for small to medium miners,

which continue to struggle to raise equity and equity-like capital to fund

ventures.

While traditional

financing options — bonds, loans, project finance, prepayment, convertible

bonds, equity — remain generally the most attractive and understood, it is now

common for companies to access multiple financing sources.

Mining royalty and

metal streaming financings, say Campbell and Omietanski, have been particularly

popular with miners in the last decade as an alternative financing source for

growth projects, allowing access to early-stage capital without diluting equity

ownership.

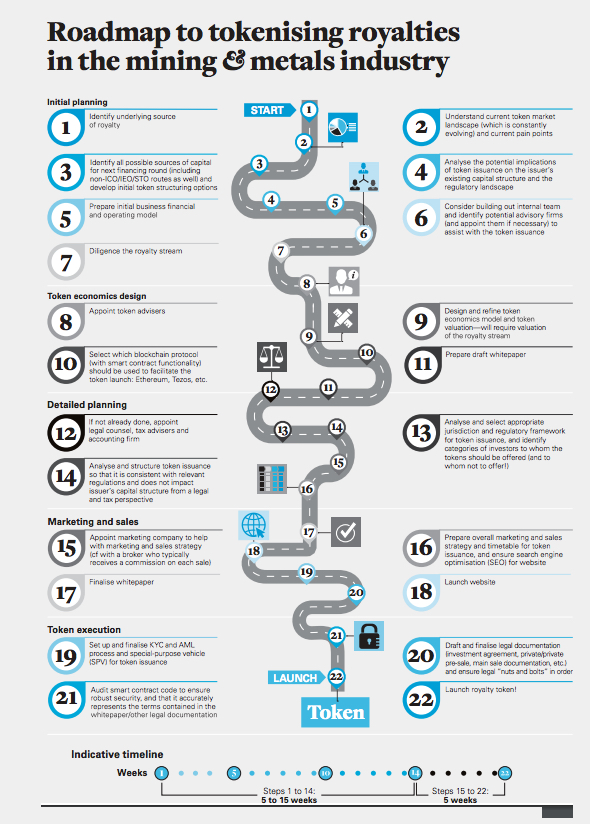

White & Case

argues it’s time for digital token offerings to become an alternate or

supplement to traditional financing options available to mining companies. The so-called

“tokenization” is gearing up as a standardized mechanism for providing access

to the ownership of traditional assets by representing them in digital and

programmable form on public or private blockchains. It’s particularly being

applied to illiquid assets in the belief that the collective digitization and

unitization of the underlying asset can make it more tradeable.

In a report published

earlier this month, the Financial Stability Board warns however that, while

digital tokens could be an answer to lack of investors, they could potentially

create an appearance of liquidity in assets that are inherently illiquid, which

would may also have negative implications for financial balance.

Campbell and

Omietanski believe the arrival of tokjenization to the mining industry is

imminent. They foresee traditional mining royalty financings, wrapped in a

security token offering (STO), as the first blockchain-based digital financing

structures to be widely applied in the worldwide sector.

They conclude that while it may take some time for the traditional ecosystem to change, it’s a question of when, not if.