Source: GlobalData Mining Intelligence Center

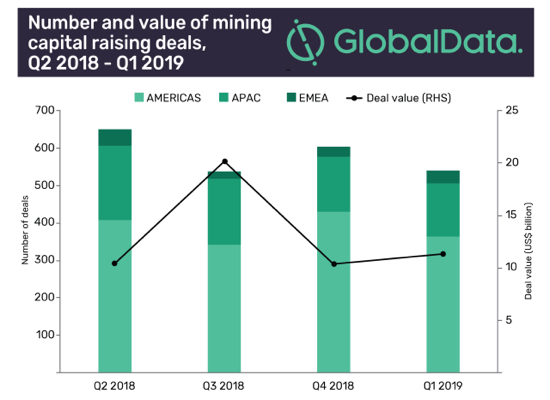

A new report by GlobalData shows the value of capital raising deals in the metals and mining sector increased from the final quarter last year to over $11 billion in Q1 2019 despite the number of agreements inked falling sharply.

GlobalData said overall, the total volume of completed capital raising deals decreased from 378 in Q4 2018 to 273 in Q1 2019, a 27.8% decline.

In contrast, however, during the same period, the number of announced deals increased from 226 to 268, an 18.6% rise noted Vinneth Bajaj, senior mining analyst at the independent analytics firm:

“The slowing Chinese economy alongside the ongoing China-US trade war has weighed on the completion rate of mining capital raising activities.”

According to the report the largest of the completed deals during the first quarter 2019 was the $1.3B capital raised by Chilean state-owned copper giant Codelco which offered international bonds due in 2049. This was followed by India’s Tata Steel which raised $967m in a private placement of shares.

India, China, Chile, Canada, and Switzerland were the five largest countries globally in terms of deal value, accounting for over 81% or US$9.2bn of the global total.

Robust mining M&A

A recent report by GlobalData showed overall deal value of mergers and acquisition in the sector in Q1 2019 grew by 6.3% to $22.5B from $21.2B in the same period last year. Deal volume decreased by 8.7% from 358 in Q1 2018 to 327 deals in Q1 2019.

Among advisers CIBC topped the list, with the Canadian bank advising on two deals worth $18.7B edging out M. Klein & Company. Cravath Swaine & Moore and Davies Ward Phillips & Vineberg shared first place among M&A legal advisers.

The four firms worked together, advising Barrick Gold (which last year bought Randgold Resources) on its attempted takeover of Newmont Mining launched in February.

The all-share mega-merger did not materialize, but the two gold miners did combine their operations in Nevada to create the world’s largest gold mining complex with annual production of more than 4m ounces. Newmont’s acquisition of Goldcorp closed in April.

The post Codelco leads $11 billion mining capital raising in 2019 appeared first on MINING.com.