Gold jumped out of the gate on Friday, rising more than 1% in heavy volumes as investors seek a safe haven amid a widening trade war unleashed by US President Donald Trump.

Gold for delivery in August, the most active futures contract, reached a high of $1,311.80 an ounce, the highest in seven weeks with 29m ounces changing hands in New York by lunchtime.

Trump’s plan to impose a 5% tariff on all Mexican goods to force the country to do more to stem immigration, coupled with a Chinese threat to blacklist foreign companies in retaliation to punitive US tariffs on its exports rattled markets and hurt the dollar.

Trump’s plan to impose a 5% tariff on all Mexican goods to force the country to do more to stem immigration, coupled with a Chinese threat to blacklist foreign companies in retaliation to punitive US tariffs on its exports rattled markets and hurt the dollar.

The S&P 500 index and Dow Jones Industrial Average are on course for the biggest fall for the month of May in nine years.

Gold is seen as a store of value in turbulent times and the price of the metal usually moves in the opposite direction of the US currency. Gold is also finding favour as bond yields in the US fall and a rate cut in the world’s largest economy moves from possibility to probability.

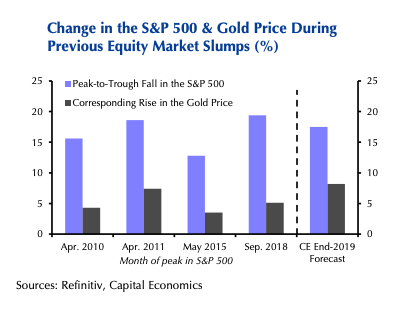

A note from Capital Economics, a London-HQed independent research and advisory firm, forecasts safe-haven demand will continue to lift the price of gold this year.

However, we suspect that the main trigger will be a slump in the S&P 500 as the US economy slows, rather than elevated trade tensions.

The post CHART: Worst May for US stocks in 9 years lights fire under gold price appeared first on MINING.com.