Source: Rick Mills for Streetwise Reports 05/27/2019

This explorer in the Yukon and British Columbia’s Golden Triangle is ready to make news in upcoming drill season, says Rick Mills of Ahead of the Herd.

May is the month when junior resource companies either spring out of hibernation from a winter spent poring over last year’s results, secure in the knowledge their treasury is in good shape, or return from cash-raising junkets, hopefully with pockets jingling, to prepare for summer drill programs.

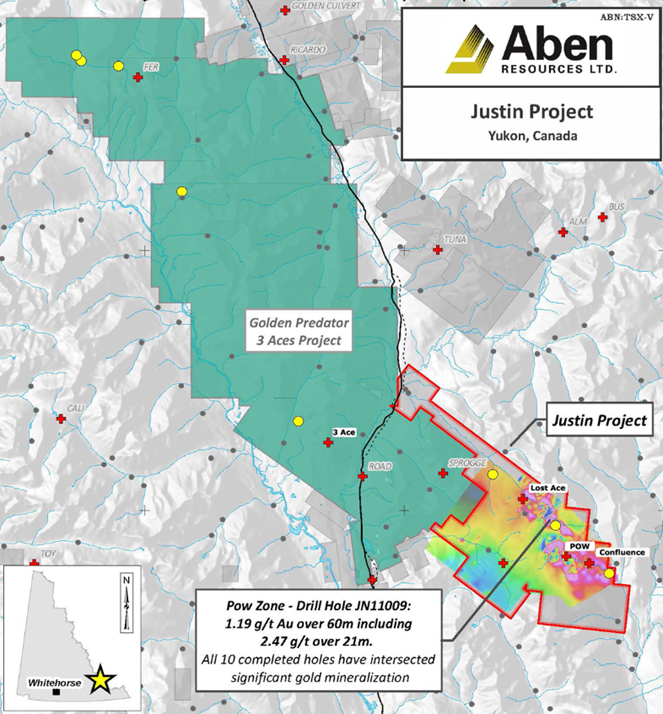

In the case of Aben Resources Ltd. (ABN:TSX.V; ABNAF:OTCQB), it’s the former. The Vancouver-based company is dedicating $1 million toward an exploration program at its Justin project in the Yukon, which butts onto Golden Predator Mining Corp.’s (GPY:TSX.V) 3 Aces property.

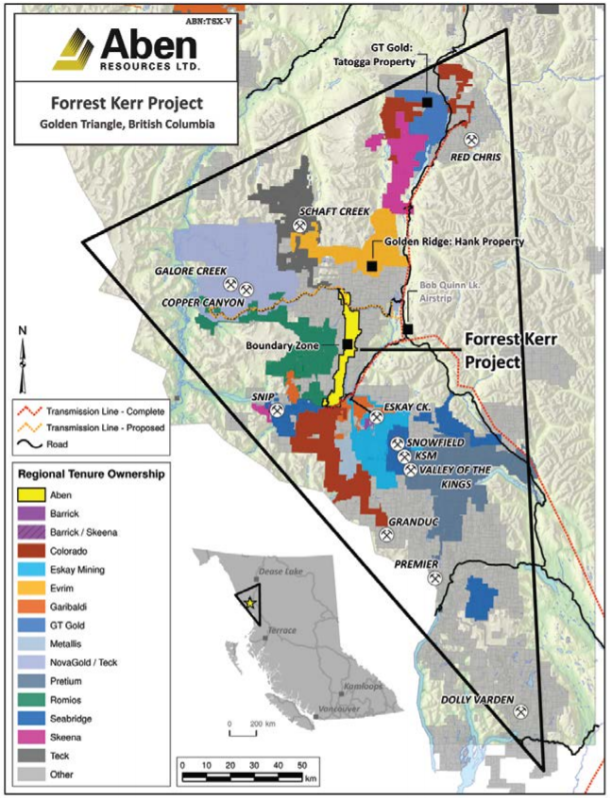

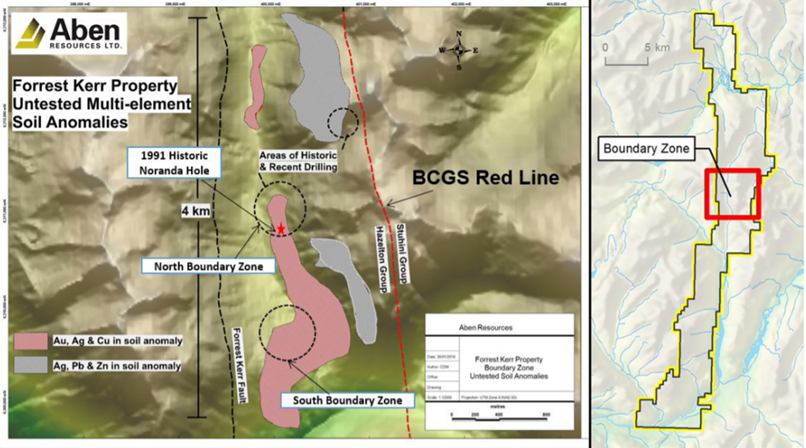

There will also be a renewed focus this summer on Forrest Kerr, located in British Columbia’s Golden Triangle between the past-producing Snip and Eskay Creek mines, where Aben is planning an initial 5,000 meters (5,000m) of drilling to follow up on last year’s expansion of the North Boundary Zone. The company has the opportunity to execute on a number of targets thanks to the authorization of 55 new drill pad locations versus just nine in 2018, which limited the amount, and angle, of drilling.

Justin

Aben Resources is planning on getting an extra month of drilling in at Justin by starting in early June. The 2,000m drill program will involve 1,350m of diamond drilling and 600m of rotary air blast drilling.

The 7,411-hectare land package is contiguous to Golden Predator’s 3 Aces project, which includes six mineralized areas that extend over a 35-kilometer gold trend.

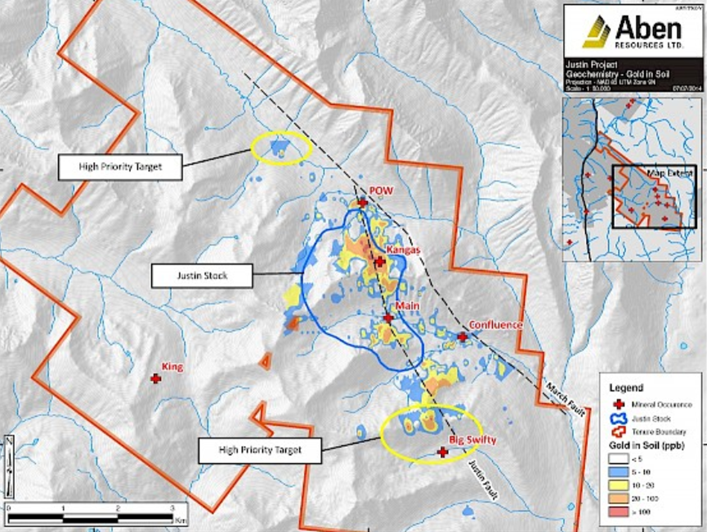

According to Aben, Justin has the potential for both high-grade and bulk tonnage mineralization—epithermal, skarn and sediment-hosted—throughout a 3.5-kilometer by half-a-kilometer trend encompassing the Confluence, Main, Kangas and POW zones. The latter was drilled in 2011–12.

“It’s a classic intrusion-related gold system. You’ve got this younger intrusion coming up into the area, and it’s a massive area. Generally, you would get bulk tonnage from those,” CEO Jim Pettit said in a 2018 AOTH interview, comparing it to Kinross Gold Corp.’s (K:TSX; KGC:NYSE) 4.3 million-ounce Fort Knox operation in Alaska, Golden Predator’s Brewery Creek mine, and the Coffee gold deposit in the Yukon. The latter, owned by Kaminak Gold, was acquired by Goldcorp Inc. in 2016 for CA$520 million.

In 2017 ABN discovered the Lost Ace Zone, which is just west of the POW Zone. The gold-bearing vein system occurs in a geological setting that is very similar to mineralization present on Golden Predator’s 3 Aces project, located immediately northwest of the Justin claim group.

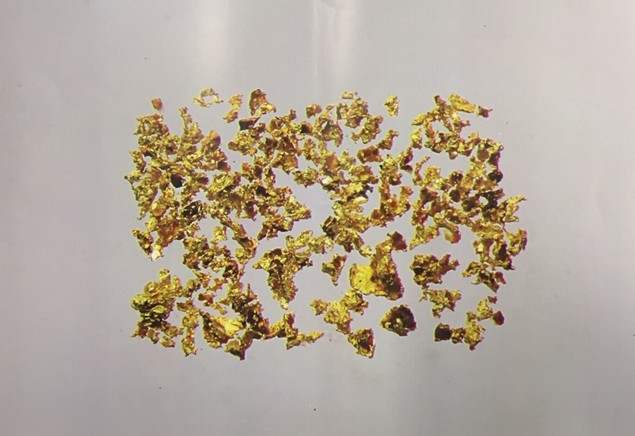

A 3.8-kilogram bulk soil sample collected for gold grain count analysis and classification from a location 115 meters upslope from Lost Ace returned 1,135 visible gold grains. Of the 1,135 gold grains recovered, 1,049 were classified as pristine—meaning the gold mineralization was likely carried to surface by the magma intrusion. As seen from the image below, the gold grains are jagged and flat versus smooth and round, indicating the gold has remained in place and not moved anywhere.

Last summer Aben completed a trenching program at Lost Ace whose results were posted in January 2019. The series of 250m-wide trenches delivered samples of mineralization that are remarkably similar to 3 Aces.

Highlights included 88.2 g/t gold over a meter, within 20.8 g/t over 4.4m. “It is begging for drilling,” says Pettit.

According to the Aben news release: “The new discovery at Lost Ace highlights the existence of a multi-phase hydrothermal system with the potential for overprinting mineralizing systems.”

Overprinting occurs when rock of different ages is jumbled together, meaning younger rock can end up on top of older rock.

That would explain the two distinctly different types of mineralization found at Lost Ace. Pettit explains: “I think these two systems could be associated, where what we’re seeing at surface is more like an orogenic high-grade vein system, brought up possibly from the uplifting of the older quartz veins by the younger magma intrusion. It could be some sort of an enriching event.”

To test that theory, Aben will bring in a rotary air blast (RAB) drill, a small, mobile unit that can explore the 250m area—likely punching in about 20 holes, 50m deep. A diamond drill will follow up on the property’s best targets.

Up to 10 holes (1,350m) of drilling is planned for the POW Zone, to further test the intrusion-related gold system discovered in 2010.

Exploration work at Justin is expected to take three to four weeks. After that, Aben will pivot west, to British Columbia’s highly-prospective Golden Triangle.

Forrest Kerr

Two years ago, continuous mineralization at Aben’s Forrest Kerr project was identified in the first three holes of the then-new North Boundary Zone. Highlights included 21.5 g/t gold, 28.5 g/t silver and 3.1% copper over 6m; 2.91 g/t gold, 5.2 g/t silver and 0.6% copper over 14m.

Fast forward to last summer, when Aben hit a discovery hole early in the drilling season, by positioning the drill 35m northwest of the three 2017 holes (the North Boundary Zone) to investigate the possibility of mineralization at depth.

There was, and not just mineralization, but jewelry-box-style mineralization.

Featuring four high-grade zones all within 190 meters downhole, the highest-grade zone assayed at an impressive 331 g/t over 1.0m, within a broader zone of 38.7 g/t over 10m. Other results from the discovery hole included 22.0 g/t gold and 22.4 g/t silver over 4.0m, 4.0 g/t silver over 13.0m, and 8.2 g/t gold with 1.4 g/t silver over 6.0m.

Guided by chief geologist Cornell McDowell, Aben decided to test new ground 1.5 kilometers south of the North Boundary Zone, going by soil geochemical anomalies and “elevated gold in rock and soil values that are coincident with an historic electromagnetic (EM) conductive geophysical anomaly,” the company stated in a news release.

Watch an interview with Aben’s VP Exploration Cornell McDowell.

Moving down the drainage, the drill crew tapped into mineralization that appeared similar to the three holes that defined the North Boundary Zone, i.e., containing ample chalcopyrite—the copper mineral—and gold pathfinder minerals.

The three collared holes (i.e., drilled from the same pad in different directions) hit quartz-sulfide veins at various depths, with enough gold, silver and copper values to coin the new South Boundary Zone.

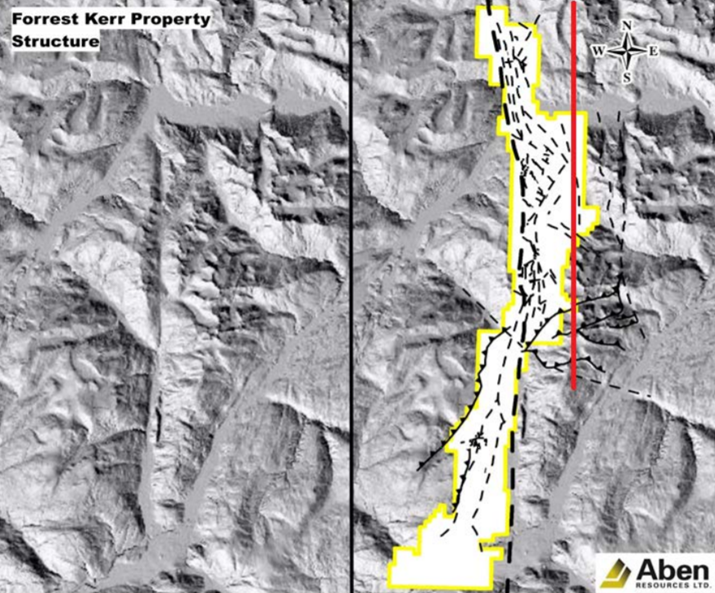

This year, Aben has three objectives for the 23,000-hectare Forrest Kerr property running along the Kerr fault, which acts as a major geological “engine” for the whole region, giving Aben tremendous discovery upside due to the amount of geological activity in the area.

Heavy dotted line is the Kerr Fault

The first goal is to see whether the North Boundary Zone can be extended in a northerly direction. Aben’s news release details the work plan: “Drill activities will begin at the Boundary Zone in late June, where over 12,000 meters of drilling were completed in 2017 & 2018. North Boundary has previously returned high-grade results such as 38.7 grams/tonne (g/t) (1.12 oz/t) gold over 10.0 m (from 114.0-124.0 m) including 331.0 g/t (9.65 oz/t) gold over 1.0 m in hole FK18-10. Drilling to date has shown that mineralization extends several meters outboard of the high-grade area within subordinate shear structures and vein arrays. Due to the availability of new pad locations specific areas of interest will be revisited. Initially drill testing will focus on the potential for a northward extension of the high-grade mineralized core at North Boundary originally defined by holes FK17-4, 5 and 6 and confirmed with holes FK18-10 & 11.”

Next, drill crews will follow up a high-grade hole 200m south of the North Boundary Zone. Encountered by Noranda way back in 1991, the highlight was an eye-popping 326.0 g/t gold.

Aben also wants to know more about the newly discovered South Boundary Zone, where broad intercepts of gold-copper-silver-zinc mineralization were found in quartz veins last summer. This is the third objective.

An airborne magnetic survey will be run across the entire Boundary Zone prior to drilling. The survey is aimed at gleaning more information about Forrest Kerr’s large, complicated structures.

Finally, the company plans to drill-test a previously identified target in the Forrest Zone, located 13 kilometers south of Boundary. According to Aben, “The area of interest at Forrest is defined by highly anomalous gold-in-soil and gold-in-rock values coincident with a strong geophysical conductive anomaly originally reported in 2013.”

For an overview of Aben’s exploration program this summer, view an AOTH video featuring Aben’s President and CEO, Jim Pettit.

Conclusion

In early 2018 my readers were given an opportunity to get into ABN at a very good price ($0.15/share). They had ample opportunity to ride the stock into the high $0.40s, to reap their rewards along the way up, and on the way down as the top was recognized.

When Aben fell back to $0.115 in January of this year I said I liked it again. On Friday the stock closed at $0.20. Now that we have a detailed plan for this summer’s exploration activities, I remain a strong ABN fan. But before I recap let me add a little context here.

Raising money for exploration in the junior resource market right now is difficult, to put it mildly. According to Oreinc, a Vancouver-based research and advisory firm, Canadian-listed mining companies are raising less money and inking fewer deals.

As reported by the Financial Post, Oreinc tracked around 1,400 Canadian mining companies between $100 million and $1.5 billion valuations. It found that in 2018, cannabis companies raised $4 billion versus $217 million by mining companies.

The situation is completely reversed comparing the top 10 Toronto Venture-listed companies in 2016 versus 2019. In 2016 there were nine mining companies and one pot company on the list; this year there are nine marijuana companies and one mining company.

What does this mean for gold exploration? Well, as financings dry up, so does the exploration pipeline. Companies that would normally be out there kicking rocks, sampling, drilling and drumming up shareholders are in a holding pattern, waiting for the market to come back.

One company that is not waiting for the tide to change is Aben Resources.

Consider this: Aben has two excellent properties in areas that have seen a lot of historic exploration. Justin is a sleeper play that holds great potential, in our view. Will the drills confirm the existence of an intrusion-related gold system yielding high grades and tonnage? It certainly seems likely, if the results from the bulk soil sample and trenching are a guide.

At Forrest Kerr the mineralogy is complicated, but Aben is gradually filling in the blanks. How big is the North Boundary Zone? Is it connected to South Boundary? These are puzzles that Aben hopes to solve. The answers are sure to provide plenty of news flow for Aben investors to realize some nice share price gains.

Aben is one of the few junior companies that is already fully cashed up (+CA$4 million in the treasury) and ready to commence two major exploration programs. The company will be on its Yukon project, Justin, in very early June, possibly just a week away. And from there, roughly the start of July, will be drilling on its Golden Triangle project Forrest Kerr.

I expect total meters drilled between the two projects will exceed 10,000m, likely much closer to 15,000m than 10,000m.

Both programs are capable of delivering high-grade to jewelry-box-grade gold assays. Being cashed up and ready to get to drilling means first out of the gate advantage in the race for investors dollars. And because of a sector-wide cash crunch not many juniors are going to be able to deliver as much news as Aben, that makes Aben a top pick AOTH pick in the gold sector.

Aben Resources Ltd.: TSX-V:ABN; CA$0.20 (May 23)

Shares Outstanding: 111.6M

Market cap: CA$22.3M

Aben website.

Richard (Rick) Mills, AheadoftheHerd.com, lives on a 160-acre farm in northern British Columbia. Richard’s articles have been published on over 400 websites, including: Wall Street Journal, USA Today, National Post, Lewrockwell, Montreal Gazette, Vancouver Sun, CBSnews, Huffington Post, Beforeitsnews, Londonthenews, Wealthwire, Calgary Herald, Forbes, Dallas News, SGT report, Vantagewire, India Times, Ninemsn, Ib times, Businessweek, Hong Kong Herald, Moneytalks, SeekingAlpha, BusinessInsider, Investing.com, MSN.com and the Association of Mining Analysts.

Read what other experts are saying about:

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures:

1) Rick Mills: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Aben Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: Aben Resources is an advertiser on Ahead of the Herd. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures/disclaimer below.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Aben Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Aben Resources. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Aben Resources, a company mentioned in this article.

Ahead of the Herd Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as

to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Aben Resources (TSX.V:ABN) is an advertiser on Richard’s site aheadoftheherd.com. Richard owns shares of ABN.

( Companies Mentioned: ABN:TSX.V; ABNAF:OTCQB,

)