British Columbia’s mining sector posted positive results for the second straight year in 2018 coming off a period of lower commodity prices and reduced activity, according to PwC Canada’s latest BC Mine report.

In total, BC miners posted a record high gross revenue of C$12.3 billion, compared with C$11.7 billion in 2017. Capital expenditures also fell to C$1.2 billion from C$1.5 billion.

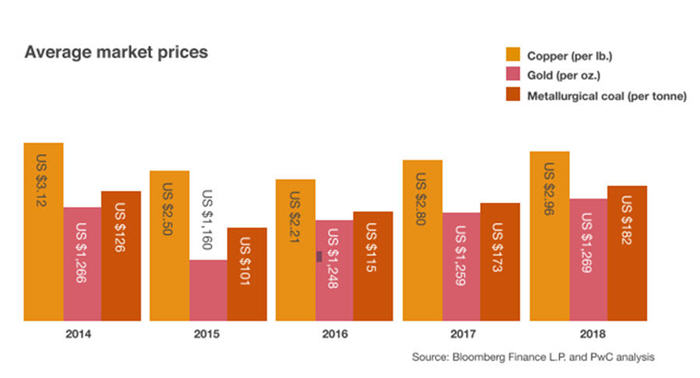

Key contributing factors were a recovery in the commodity market and increased mining activity within the province. On average, copper and metallurgical coal prices were 6% and 5% higher respectively in 2018 than the prior year, while gold price remained steady.

There were a handful of mergers and acquisitions involving BC miners in 2018, signalling a steady turnaround and renewed optimism in the industry. Notable transactions include Newmont Mining Corp.’s acquisition of a 50% interest in the Galore Creek Partnership from Novagold Resources Inc. (forming a partnership with Teck Resources) and Taseko Mines Ltd.’s purchase of Yellowhead Mining. Newmont also completed its acquisition of Vancouver-based Goldcorp earlier this year.

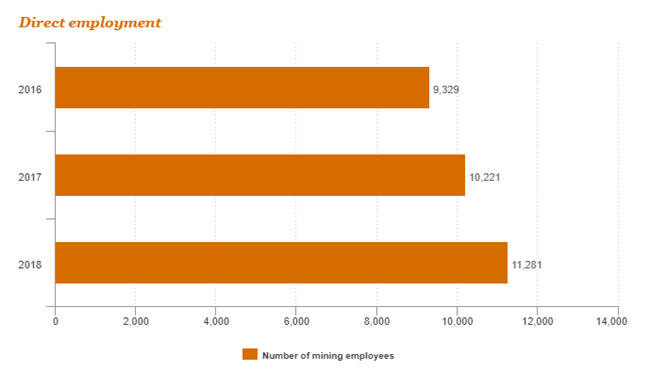

Confidence in mining projects was also reflected in the growing workforce in the sector. The number of mining employees grew by 10% in 2018 compared to 2017, partly a result of new projects coming online and expansions at existing projects (ie Teck’s operations).

“There are great opportunities here in BC, and it’s up to the industry, the government and all other stakeholders to bring certainty to the mining sector, which is a major contributor to the provincial coffers,” said Mark Platt, Mining Partner, PwC Canada.

The post British Columbia miners post record high revenues in 2018 appeared first on MINING.com.