Image by Brad Holt on Flickr

Elon Musk has no shortage of detractors – and judging by the tone struck by some of them, that’s not nearly a strong enough word.

Neither does the Tesla CEO have a shortage of short sellers, and every so often long sellers get in on the action too. Bears turn bulls with gusto and bulls turn bears with alacrity.

Musk frequently muddies the waters himself, making outlandish – and sometimes ludicrous claims for his current and future vehicles. And the tweets. The tweets. The reckless tweets.

The result of which is that those those who want to make a sober assessment of the company have few places to go.

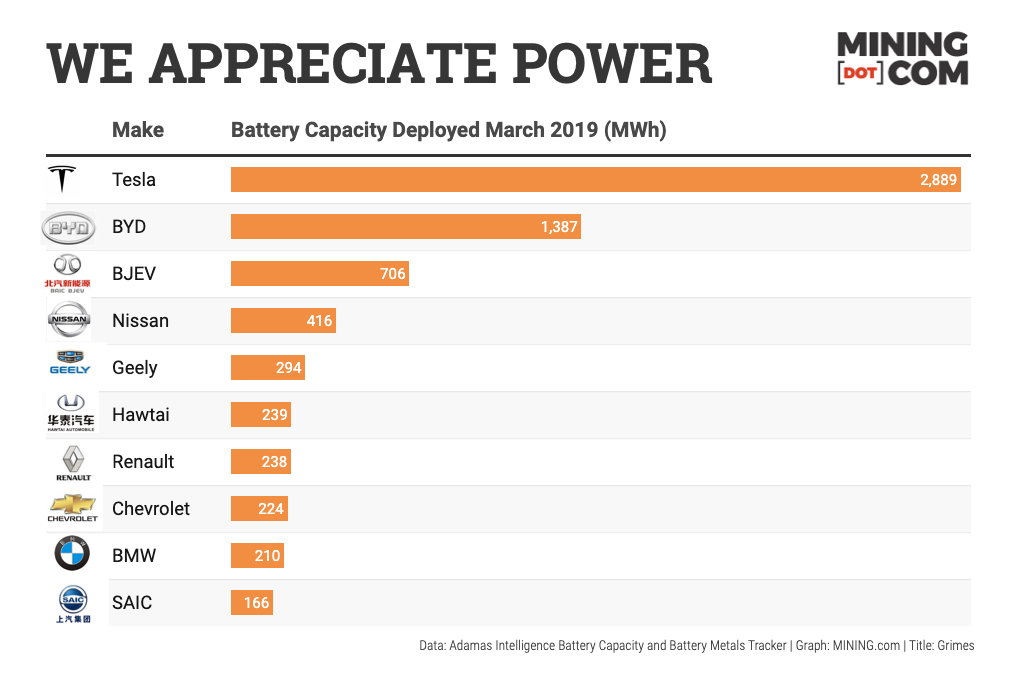

On a MWh-basis the Muskmobile is not just shaming US and European competitors, but also the 486 EV manufacturers registered in China

So how does the rubber really hit the road for Tesla?

Adamas Intelligence tracks the battery capacity (and the metals used in them) of electric vehicles sold in more than 80 countries around the world, representing more than 90% of the global EV market.

The numbers are based on electric vehicle registrations including hybrids, not sales projections, production forecasts, thumbsuck extrapolations, or crystal balling that keep so many Tesla followers busy on Twitter and elsewhere.

The latest report by Toronto-based Adamas on global EV battery deployment in passenger vehicles should make Tesla bulls’ eyes water.

Tesla is simply miles ahead of the competition.

On a MWh-basis the Muskmobile is not just shaming US and European competitors, but also the 486 – yes, four-hundred-and-eighty-six – EV manufacturers registered in China.

In March this year Tesla deployed more battery power than its next four biggest rivals combined. That includes no.2 BYD (Build Your Dream) backed by Warren Buffett as long ago as 2008, which Tesla beat on a 2:1 basis (I’m only mentioning BYD because who’d ever thought the Sage of Omaha could be caught in the Musk reality distortion zone).

Tesla also outcelled (that’s a word now) state-owned giant BAIC’s electric car company BJEV by a factor of four, despite Beijing’s helping hand lifting annual growth rates at the unit to beyond 250%.

At 2,889 MWh the California company comes close to equalling the combined total of the scores of manufacturers – include some big names like Ford, Mercedes-Benz and Volkswagen – outside the top 10.

Tesla’s outperformance also comes despite the fact that the combined MWh in the batteries of the Model X and S deployed in March, declined by more than 40%.

The Model 3 had to lead the charge increasing battery power out on the road by 773% year over year.

The combined MWhours in the batteries of the Model X and S deployed in March, declined by more than 40%

Granted, Teslas have always had bigger batteries than competitor cars to help with fast-charging and reduce the number one anxiety of first time EV buyers – range.

But battery sizes have been growing across different makes with the sales-weighted average capacity 55% higher in March compared to 2018 according to Adamas.

China is actively encouraging this trend, earlier this year eliminating subsidies for vehicles with a range below 250km (155mi) entirely.

March 2019 was clearly hot sales month for Tesla, but the company’s had better ones.

In March 2018 Tesla employed 45% of the battery power among the top 10, a higher share than this year. And in September last year Tesla came up just short – a mere 39MWh – of outdoing the rest of the top 10 global EV manufacturers together.

The post Tesla is turning rivals into roadkill – even in China appeared first on MINING.com.