Shipping has not been a great industry–for management teams or investors–for several years now.

I warned readers to avoid the sector like the plague back in 2016 with this story here: http://bit.ly/tankersoversupplied

The sector is capital-intensive, has no product differentiation (ie. one ship is the same as the next), and frankly, my experience has been that management teams are not very good. They’re willing to drive shareholder value into the ground (like American natgas producers!) to grow.

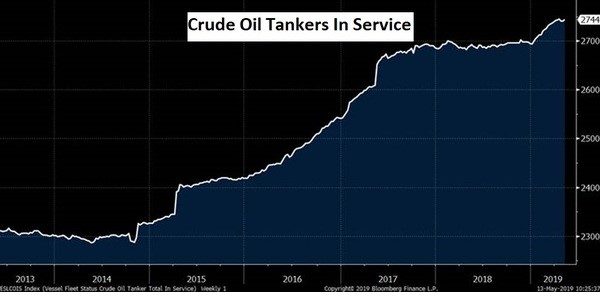

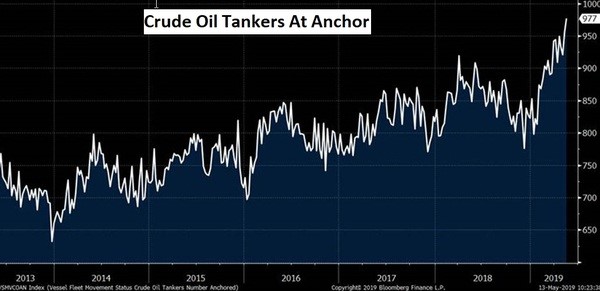

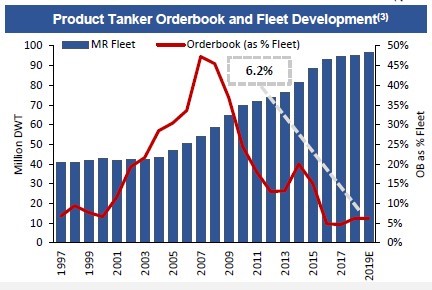

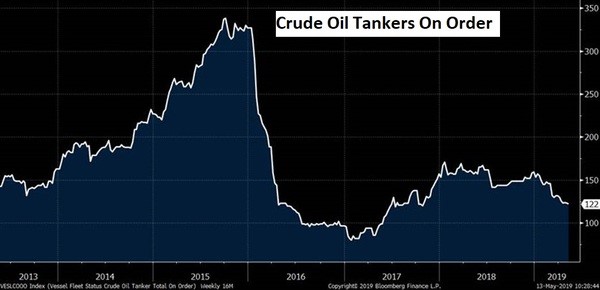

All this and years of cheap credit have led to overcapacity for 10+ years. Here’s two charts that show the growth in the global fleet:

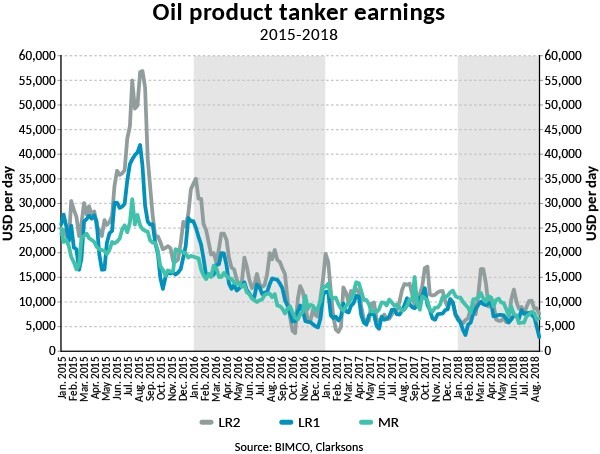

Those are not bullish charts. And of all the segments of the shipping business, the clean tankers have been one of the worst.

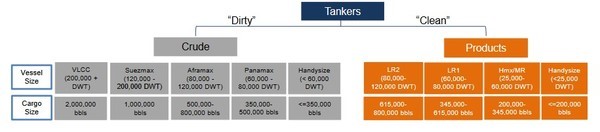

Clean tankers carry refined products like gasoline, diesel, distillates as well as chemicals. This contrasts with dirty tankers, which carry crude.

Source: Scorpio Tankers Stifel Conference Presentation

The misery in the sector reached its peak in 2018 when rates for MR (mid-range) tankers collapsed to below $5,000 per day last summer.

It has been bad for so long. So when someone starts talking bullish, and I mean REALLY bullish, I take notice.

Last Thursday Scorpio Tankers President Robert Bugbee was answering a question on their conference call when he said it would not be unreasonable to see cash flow of $25/share at some stage in this cycle.

Wait, what was that?

Scorpio Tankers is a $28 stock. Only a few weeks ago, it was an $18 stock.

$25 per share of cash flow? Now that’s bullish!

What’s Going On Here?

It seems too good to be true, so I dug in.

There are a couple of things at play.

First, we have a 20 year low in shipbuilding orders. The product tanker order book stands at multi-year lows.

It has gotten so bad that shipyards are being paved over for commercial real estate. Those that remain have consolidated.

The order book today stands at 134 ships. That is 6.2% of the fleet delivering over the next 3 years.

Source: Ardmore Shipping December Presentation

Here’s a Bloomberg chart that shows somewhat the same thing:

With so few new ships on the horizon, net fleet growth over the next few years is expected to be below 2%.

On top of that you have healthy scrapping. There were 49 MR tankers scrapped last year. Expectations are for similar numbers going forward.

The only thing that will slow down scrapping are higher rates.

Summary: the supply side will remain very constrained in the near term.

The Demand Side: Refinery Starts and IMO 2020

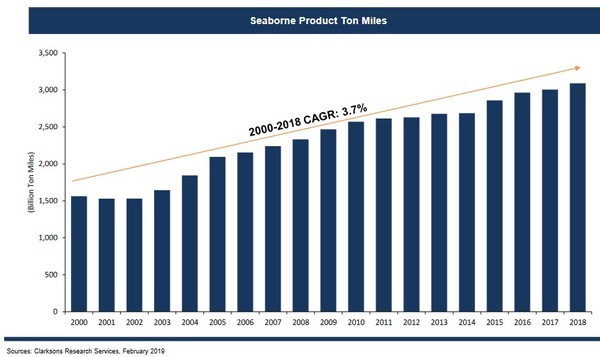

Demand hasn’t been a problem for clean tankers. MR tanker demand has been growing close to 4% for the last 18 years. That is expected to continue going forward.

Beyond the long-term trend, there are reasons that demand could accelerate even more in the short-term.

First, the new refining capacity the Middle East has been building for the last few years is coming online now. Governments there want to diversify their economies away from upstream production. That means refineries are producing fuels for export.

That means new MR and LR trade routes and more product being shipped.

Second, IMO 2020. While the ban on high-sulphur fuel oil (HSFO) in ships is likely to disrupt the entire industry, the biggest disruption will be on the product tanker sector.

Why? Because all that replacement low-sulphur fuel needs to be shipped on clean tankers – MR’s and LR’s.

IMO-2020 is like a one-time step-change for shipping refined product.

IMO-2020 is also expected to improve refinery margins. This will provide incentive for refiners to produce more product IN GENERAL. Gasoline, diesel, and distillates will all see increases.

In fact, on the Scorpio earnings calls there was even a question about the potential need for floating storage next year–but for gasoline, not oil.

It is hard to believe but stranger things have happened. That the question is even asked tells you something about the changes on the horizon.

End Game

Here’s the next big question – does this all end badly?

At the 13th annual Capital Link Shipping forum, Bugbee put it like this:

“Of course, we won’t change as an industry”. “Of course, we will shoot ourselves in the foot in the future. But right now, after 11 years of a terrible market the gun has been taken away from us.”

“We’re little children. We’ll never grow up and if you keep feeding us candy, we are going to be sick and you guys will have to clean the mess up – that will happen again. Its just not going to happen for a little while.”

Like I said, that sounds like it could have come from US natgas producers. But it speaks to my comments about management in the industry. Ironically, the most bullish thing about the tanker business is that even the executives have no faith in it. It has been so bad for so long – shipping companies have worn out their welcome.

Even their own executives refer to themselves and their peers as children!

It will take more than a few months of blow-out earnings to earn the trust of the capital markets back.

Where Are We In The Cycle?

If it really is going to get good, it should start this fall.

The Market is going through a period of lots of refinery maintenance in the US Gulf Coast (USGC). That means reduced supply of refined product.

Thanks to IMO 2020 this year’s maintenance is particularly heavy. Every single refinery is giving guidance that their maintenance schedule is longer than expected.

They are doing the maintenance now to make sure they can run hard and fast in the fall and next year to fully benefit from IMO 2020.

Yet in spite of that we are not seeing a weak rate environment. Even the companies themselves have been surprised at the strength.

In the first quarter freight rates for all the clean-tanker classes (LR2, LR1, MR and Handymax) were at their highest level since 2015. They were strong through January, February, March, and now April.

The storm of refinery maintenance is almost behind us and rates haven’t given an inch.

This bodes well for the market in the fall. That is when the demand from IMO 2020 will begin to ramp. It is also a seasonally strong period for tanker rates.

Throughput is expected to ramp through the summer, climbing towards a seasonal peak in August. Product supply is expected to increase 4.6 million barrels a day from March levels.

Both the end users and charterers see what’s coming. Lot’s of talk on the calls about customers wanting to extend their books.

But apart from the weakest hands, the tanker owners are balking at chartering their vessels on period rates. This is their change to capitalize – finally!

Super Cycle?

The million-dollar question is – how long will this last?

Here are a few points to consider:

- The benefit from IMO 2020 will continue for 2-3 years.

- Vessels from the last super cycle (2003-2008) are going to become 15+ year-old vessels as we hit the next decade (Most terminals don’t take clean petroleum products in ships that are more than 15 years old.)

- The capital markets remain tight for these players – meaning very few new ships until at least 2021

I don’t like using the term super-cycle. It’s a good way of ending up with egg on your face.

My gut reaction is – this is bound to end badly; I just don’t know when.

But maybe that is the point.

Again, turning to Bugbee – the best thing for the industry is investor derision. These are, after all, “children”.

As long as the market keeps the candy hidden on the top shelf, these companies can generate big cash-flows. If those cash flows can continue for a few quarters, maybe years, they could actually make some money for their shareholders.

For a while.

Its enough to make me want to get my feet wet. But I’m reluctant to jump right in–because the good times will end and in the shipping business it tends to end faster than anyone anticipates.

Remember, Halloween is a party, but only lasts one night.

Copyright © 2011

This feed is for personal, non-commercial use only.

The use of this feed on other websites breaches copyright unless you have written permission from Keith Schaefer of Oil and Gas bulletin to republish. If this content is not in your news reader, it makes the page you are viewing an infringement of the copyright. (Digital Fingerprint:

3r5723475234957asdgvaisduthadsfg)