The price of copper managed to trade higher, despite simmering trade tensions between the world’s two largest economies erupting into all-out war.

In afternoon trading, copper for delivery in July touched $2.797 a pound ($6,165 a tonne), up nearly 1% from Thursday’s settlement. While well down from its 2019 highs, copper is still holding onto 4.5% gains year-to-date.

The US hiked tariffs on $200B of Chinese imports with nearly 6,000 products now incurring a 25% levy, up from 10% previously.

China imports nearly half the world’s copper and the country’s economic growth had been slowing well before the trade dispute began to impact the outlook for industrial metals.

Copper is particularly vulnerable to a slowdown in global trade as the metal is widely used in construction, transport, manufacturing and electricity generation.

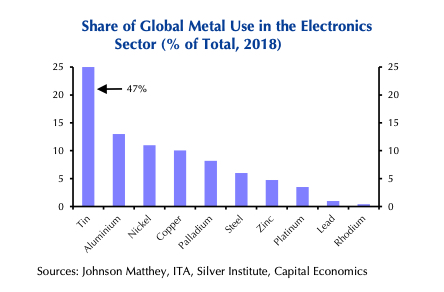

In a note, Capital Economics points out that certain metals are “much more exposed to disruptions to US-China trade than others”:

Given that electronics make up around 30% of total US imports from China, the prices of metals which are used widely in the electronics sector, and tin in particular, appear especially at risk.

For now, however, the London-headquartered independent research firm does not think the tariffs will have a major impact on Chinese GDP, and are predicting a 0.7% drag on growth, but only in the event the higher tariffs are extended to all US imports.

The US imports some $540B worth of goods from China per year, and Beijing was on Friday still mulling countermeasures for the $120B it imports from the US each year. China releases manufacturing, fixed investment and other indicators on Wednesday.

The post US-China trade war isn’t buckling copper price – yet appeared first on MINING.com.