Source: Rick Mills for Streetwise Reports 05/07/2019

Rick Mills of Ahead of the Herd explains why he believes investors should take a look at one company whose rare earth elements project could provide a secure supply of desperately needed metals and could have a “potential gross in-situ metal value of CA$7.6 billion.”

Because of the heightened global climate of aggression, chaos and fear the need for the protection of strong militaries is heightened.

Put simply, the world is a dangerous place:

- Russian troops taking over Crimea and a Russian troop build up on the Russian-Ukrainian border

- Russians in South America and Russian Arctic military build up

- Terrorism

- North Korea returning to the bad not-so-old days of flinging its nuclear capable missiles everywhere

- Clashes between the U.S. and Chinese navies

- Chinese aggression towards Taiwan

- India and Pakistan long-simmering tensions

- The possibility of another financial crisis (Brexit, unsustainable global debt)

- Trade wars, cold wars and water wars

- Nuclear capable Iran and Saudi Arabia

- The current U.S. administration’s non-traditional way of doing things is upsetting ‘normal’ world order

There is evidence of ever-increasing aggression and militarization among the three largest military powers in the world right now: the U.S., China and Russia.

All of this means the United States needs Security of Supply: the U.S. needs sources of critical metals that can decrease its dependence on hostile foreign powers like China and Russia, basket-case economies like Venezuela and Zimbabwe, and failing mining states like South Africa.

Here is a list of 23 minerals the U.S. Geological Survey identified in 2017 as being critical to U.S. national security and the economy. Rare earths are central to the whole spectrum of defense technologies that are vital to every military.

The U.S. is almost 100% dependent on China for supply of its rare earth oxides, metals, powders and alloys—without rare earths mined and processed in China, America would be unable to manufacture military hardware.

We’ve written about this before.

The $392-billion F-35 Lightning II Joint Strike Fighter program was close to being canceled about seven years ago but for intervention by the Pentagon to prevent further delays. Reuters reported in 2014 that the chief U.S. arms buyer allowed two F-35 suppliers, Northrop Grumman Corp and Honeywell, to use Chinese magnets for the plane’s radar system, landing gears and other hardware.

“The first assay results of the bulk sample program at DEFN’s Wicheeda Project have been released…they’re spectacular.” – Rick Mills, Ahead of the Herd

Through a program called the United Launch Alliance, U.S. rockets are powered by Russian engines. Our Cold War enemy for 30-odd years, which ironically started the space race with the 1957 launch of Sputnik, all use RD-180 engines made by NPO Energomash, a Russian state-owned company.

Fortunately, regaining control over the high technology sector and national defense is becoming “mission critical” for the U.S.

At Ahead of the Herd we’ve identified a project in central British Columbia, Canada, that has all the elements in place for a successful rare earth element (REE) mine.

Defense Metals Corp. (DEFN:TSX.V; DFMTF:OTCQB; 35D:FSE) Wicheeda Project

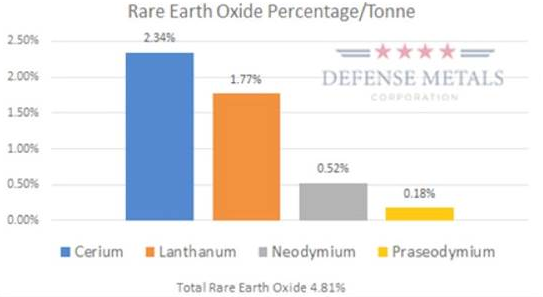

The first assay results of the bulk sample program at DEFN’s Wicheeda Project have been released…they’re spectacular. A 30-tonne random sample taken from the deposit revealed the presence of four defense and clean energy (magnet/lithium-ion battery) rare earth elements: cerium (Ce), lanthanum (La), neodymium (Nd) and praseodymium (Pr).

These results are impressive for three reasons:

- The presence of neodymium and praseodymium is critical, because these two REEs are used in the manufacture of Nd-Pr-Iron-Boron permanent magnets that go into a number of high-tech applications.

- All four rare earth elements are used in the manufacture of lithium-ion batteries found in electric vehicles.

- The results indicate a potential light rare earth deposit of significant value.

At Ahead of the Herd we did some calculations to determine what the gross in-situ value (i.e., before processing or other costs) of the metal in the ground at Wicheeda would be, extrapolated from the 30-tonne bulk sample.

We know that the Wicheeda deposit has an inferred (historical, not NI 43-101 compliant) resource of 11.2 million tonnes. If the material in the 30-tonne bulk sample is spread evenly throughout the mineralized area we are looking at a potential gross in-situ metal value of 7.679 billion Canadian dollars! (CAD$685.69/t x 11,200,000 tonnes = CAD$7,679,728,000)

To put this into terms most resource investors can understand, that is equivalent to a 6 million oz gold deposit grading about 12.7 grams of gold per tonne (or 555,000,000 oz of silver)—which any precious metal exploration company would be extremely lucky to have.

Permanent magnets (the market for this type of magnet is estimated at $11.3 billion) and lithium-ion batteries (the global lithium-ion battery market size is estimated to be valued over US$100 billion by 2025) made from REES are central to:

- The electrification of our transportation system

- Clean green wind and solar energy

- The whole spectrum of defense technologies that are vital to every military

Defense Metals will be targeting magnet manufacturers, lithium-ion battery manufacturers, green energy companies and defense contractors to buy their rare earth concentrate and oxides.

Rare earths are great multipliers, they are used in making everything from computer monitors and permanent magnets to lasers, guidance control systems and jet engines. In most cases there are no substitutes.

Shareholders of Defense Metals (TSX-V:DEFN, OTCQB:DFMTF, FSE:35D) can expect significant news flow starting soon. Metallurgical testing of the 30 tonne bulk sample continues and the company is planning on a massive drill program for 2019 leading to an NI 43-101 compliant resource estimate this fall.

While nearly all rare earth mining and processing currently takes place in China, the United States is making moves to end the monopoly.

This is great news for exploration/development companies like Defense Metals that can step in to replace foreign rare earths with domestic supply.

Defense Metals

TSX-V:DEFN CA$0.15 May 3

OTCQB:DFMTF, FSE:35D

Shares Outstanding 23.7 million

Market cap CA$3.55 million

Defense Metals website.

Richard (Rick) Mills

Ahead of the Herd Twitter

Ahead of the Herd FaceBook

Richard (Rick) Mills, AheadoftheHerd.com, lives on a 160-acre farm in northern British Columbia. Richard’s articles have been published on over 400 websites, including: WallStreetJournal, USAToday, NationalPost, Lewrockwell, MontrealGazette, VancouverSun, CBSnews, HuffingtonPost, Beforeitsnews, Londonthenews, Wealthwire, CalgaryHerald, Forbes, Dallasnews, SGTreport, Vantagewire, Indiatimes, Ninemsn, Ibtimes, Businessweek, HongKongHerald, Moneytalks, SeekingAlpha, BusinessInsider, Investing.com, MSN.com and the Association of Mining Analysts.

Read what other experts are saying about:

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures:

1) Rick Mills: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Defense Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: Defense Metals is an advertiser on Ahead of the Herd. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures/disclaimer below.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Defense Metals. Click here for important disclosures about sponsor fees. An affiliate of Streetwise Reports is conducting a digital media marketing campaign for this article on behalf of Defense Metals. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Defense Metals, a company mentioned in this article.

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Defense Metals (TSX.V:DEFN), is an advertiser on Richard’s site aheadoftheherd.com. Richard owns shares of DEFN.

( Companies Mentioned: DEFN:TSX.V; DFMTF:OTC; 35D:FSEQB,

)