Global demand for gold grew to 1,053.3 tonnes in Q1, up 7% year-on-year, according to the latest report by the World Gold Council. A big reason for the stronger demand is central banks, which continued to buy gold for diversification and liquidity purposes. Another is improvement in the India market.

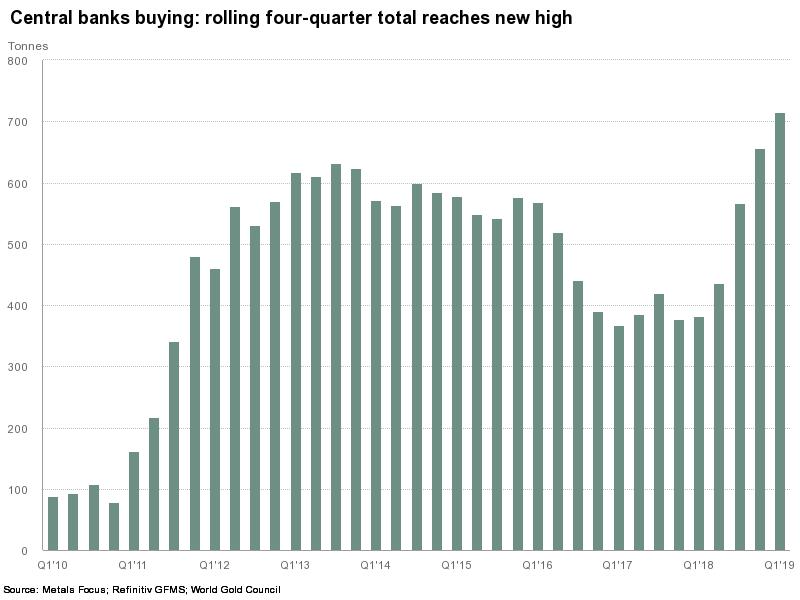

Central banks around the world bought 145.5 tonnes of gold this quarter, the largest increase in global reserves since 2013 (179.1 tonnes). The buying volume also comfortably exceeded the five-year quarterly average of 129.2 tonnes.

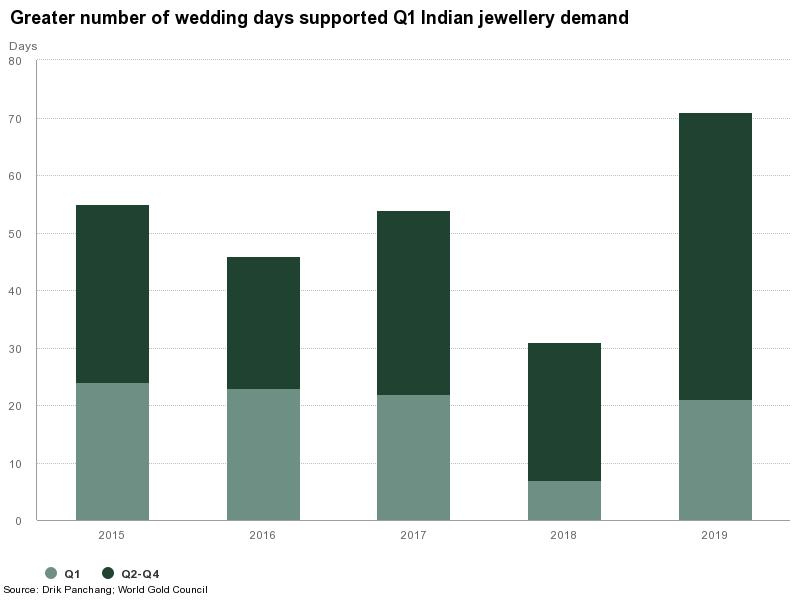

An uptick in demand for gold jewellery also contributed to the stronger Q1 gold demand. Much of this growth came from India, the world’s second-biggest gold consumer, where a lower rupee gold price in late February/early March coincided with the traditional gold-buying wedding season to lift jewellery demand up to 125.4 tonnes, the highest since Q1 2015.

This could continue on heading into the second quarter. The Hindu calendar shows 37 auspicious dates for weddings in Q2, compared with just 21 in the second quarter a year earlier. Indians will also celebrate Akshaya Tritiya on May 7, when buying gold is considered auspicious.

“Prices are attractive. In the second quarter we might see a surge in demand due to Akshaya Tritiya and higher auspicious days for weddings,” said Somasundaram PR, the managing director of WGC’s Indian operations.

The post Gold demand up 7% in Q1, boosted by central banks, India appeared first on MINING.com.