Source: Maurice Jackson for Streetwise Reports 04/26/2019

Gregory Beischer, president and CEO of Millrock Resources, speaks with Maurice Jackson of Proven and Probable about the strategic investment his company just received.

Maurice Jackson: Joining us today is Gregory Beischer, the president, CEO, and a director of Millrock Resources Inc. (MRO:TSX.V; MLRKF:OTCQX), a premier project generator. Mr. Beischer, welcome to the show.

Gregory B.: Thanks very much, Maurice.

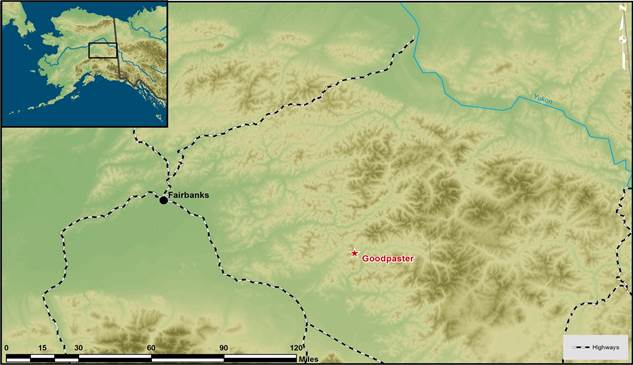

Maurice Jackson: You have some truly exciting news to provide shareholders, which coincides directly with our last interview regarding Millrock’s West Pogo project located in the Goodpaster District of Alaska. Mr. Beischer, before we begin, for first time listeners, who is Millrock Resources?

Gregory B.: Millrock is a project generator company. We acquire mineral rights and then we invite other companies to share the risk of the early-stage exploration. We do that from my home base here in Anchorage, Alaska, all over this great state, but also in Sonora State in Mexico and in the Southwest United States.

Maurice Jackson: Let’s delve into today’s press release. Millrock announces strategic investment by EMX Royalty Corporation, Goodpaster District, Alaska. Mr. Beischer, allow me to be the first to say congratulations, sir. Tell us about this strategic investment.

Gregory B.: Thanks, Maurice. You and I have talked about this quite a bit over the years. I know that you are personally a shareholder of EMX as am I, and you know that it is a generative exploration company, in whose footsteps Millrock would like to follow. We’d like to have the same success EMX has had. EMX, of course, has made a big discovery, which it capitalized having received fairly recently. I believe it’s US$67 million as payment for the project, so a great win for that company.

And I know that it is looking for ways to deploy that capital to make even more money, particularly to create royalties, which I believe is a very smart business model, and I think you’ll agree with me there.

EMX Royalty has been inundated with proposals to help it spend its money. Millrock has been good friends with the EMX folks for quite a while. I know I certainly admire its technical team and abilities. And I hope that that’s mutual. We showed EMX the Goodpaster project last December I think it was, and so it takes a while to work through these things, but now we’ve been able to announce that EMX has invested in Millrock at quite a significant premium to our share price. It paid CA$0.14 for the shares, but in return for that premium, we granted royalties on claims that we have recently staked in the Goodpaster District and upon some claims that we already owned in that emerging gold district in Alaska.

This is a win-win for everybody here. I think EMX got what it wanted, which was a new royalty portfolio, and it owns Millrock shares that I think it believes will be worth more one day. So EMX came out of it good, but it also gave Millrock the capital to act on something we’ve wanted to do for a long time, which was capture a huge land position in the Goodpaster District and to move exploration down the road a little ways.

I think both companies come out very well, and I think as shareholders, we’re doing well too.

Maurice Jackson: Millrock had a number of companies that shared their interest in partnering with you on the West Pogo. Why did Millrock select EMX Royalty as its partner?

Gregory B.: Our partnership with EMX has allowed us to acquire a great land position, but we’ll still need yet another partner to fund aggressively exploration in this district. So, EMX was the toehold that allowed us to get started, but really, we’ll have to find another partner, and, thankfully, we’re well underway on that.

Maurice Jackson: Now what will be done with the proceeds you currently have from the investment?

Gregory B.: Millrock has used a substantial amount already to stake claims. We’ve amassed in excess of 500 square kilometers of mineral rights, and yeah, it’s a big land position, but it’s also a very good one. Maurice, you know that four or five years ago, we purchased some remnant claim blocks in the district, but both acquisitions came with fantastic geologic databases of information that probably cost $15 million to create back in the 1990s and early 2000s after the first big surge of exploration after the discovery of the Pogo mine, a great gold mine in the Goodpaster District.

So we knew where we wanted to stake, and we’ve known this for a long time. It was just a matter of having the capital to do so. And our agreement with EMX allowed that to happen. So we’ve used some of the proceeds to stake the claims. We’ll use some of the money also to do some early-stage exploration and attract partners to fund what it really needs, which I really want to do, which is systematic exploration over a series of years on a district scale.

We’ve got a major part of the district staked now. We also have an excellent project, West Pogo, that’s just about ready to drill, but my preferred course of action would be to find a partner that will underwrite the work, the systematic, long-term work needed to move the prospect forward to drill readiness and test each and every prospect that we can develop in this huge area.

Maurice Jackson: Gregory, for that prospective partner and new shareholder, it may be good for us to share the value proposition we have before us regarding the Goodpaster District, and specifically, Millrock’s West Pogo project.

Gregory B.: The Goodpaster District has produced gold from placer mines over the years, but it was in 1994 that the Pogo gold mine was first discovered. There was a big surge of exploration activity, and it was really the first time substantial modern exploration occurred in this district. I have the feeling that Goodpaster will become a gold camp of significant proportion one day, maybe even like the Val-d’Or camp of northern Quebec, where I’ve spent some time. There have been dozens of mines in that camp over a century of operations. I think the Goodpaster will be the same.

Pogo’s a great mine. The new owner, Northern Star Resources, is doing a great job. It has only owned the mine for about six months, but it seems to be doing an excellent job of tuning up the operation. I think it is going to make a lot of money from it. It’s a high-grade mine that produces about 300,000 ounces of gold a year. Millrock would love to discover a deposit like that being mined.

And so we view this as we’re walking into a gold camp. We’ve had lots of space to choose our ground, and we’ve done that, and amassed a major land position with high priority targets on it using our database. The value proposition before us is through exploration and discovery of one or more deposits like the one being mined at the Pogo gold mine.

And, in fact, the last time we spoke, we talked about our West Pogo project, aptly named because it’s immediately to the west of the Pogo Mine. In fact, it’s within sight of the mine itself. And we know that there’s been some recent discoveries by the mine operators to the west of the mine, in fact, close to our mutual claim boundary. It’s possible that the new discovery it has made comes right onto our claims. So we’d like to do the geophysical surveys needed to image below the surface of the earth, pick drill targets, and then test to see if we’ve got a gold deposit on our side of the claim boundary.

Maurice Jackson: Before we leave, Mr. Beischer, what is the next unanswered question for Millrock Resources, when can we expect an answer and what determines success?

Gregory B.: The next question for Millrock is getting a partner on this particular project. We’ve made a big gamble here, and now we need to capitalize by landing a partner that is willing to fund the kind of exploration we want to do, district-scale exploration to systematically, continuously evaluate the targets, select the very best ones, and to drill them from a position of strong knowledge. And so that’s the next question Millrock has to answer, who’s the partner and when will you get it? And we’re working hard on it.

Maurice Jackson: Mr. Beischer. Let me ask you my favorite question, and that is what did I forget to ask?

Gregory B.: Well, often when you’ve chatted with me, Maurice, we talk about the price of gold and how much of a driver it is for the availability of capital for explorers, and gold’s been up looking good, now it’s down again. I think you probably read a lot of the same things I do, and I think the consensus is gold’s going to move substantially higher in the near term. And that certainly helps junior mining companies and the flow of capital into early stage exploration projects. So, I’m hopeful that the price moves up soon.

Maurice Jackson: Gregory, for someone listening today who wants to get more information regarding Millrock Resources, please share the contact details.

Gregory B.: Sure, you can reach www.millrockresources.com. Melanee Henderson, head of investor relations, may be contacted at mhenderson@millrockresources.com or call 604-638-3164 or 877-217-8978.

Maurice Jackson: And as a reminder, Millrock Resources trades on the TSX.V symbol MRO and on the OTCQX symbol MLRKF. Millrock Resources is a sponsor of Proven and Probable, and we are proud shareholders of Millrock Resources for the virtues conveyed in today’s message.

And last but not least, please visit our website, provenandprobable.com, where we deliver mining insights and bullion sales. You may reach us at contact@provenandprobable.com.

Gregory Beischer of Millrock Resources, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Gregory Beischer: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Millrock Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: Millrock Resources.

2) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Millrock Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Millrock Resources is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

3) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

4) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

5) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Millrock Resources, a company mentioned in this article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.