If you’re as much a consumer of financial news as I am, chances are very good you’ve seen Keith Fitz-Gerald as a regular contributor on Fox Business, CNBC and elsewhere. That, or read his invaluable market commentary online.

Nothing beats catching him in person, though, and I highly advise you do so if you get the opportunity.

Part investment guru, part motivational speaker, Keith manages to make you feel as if you can conquer the world… and have a great time doing it. I’ve had the privilege of seeing him present a number of times before—most recently at Money Map Press’ Black Diamond Conference in Delray Beach, Florida—and I’m always in awe not just of his depth of market knowledge but also the amount of energy he brings to the table.

The longtime writer of the popular Money Map Report and High Velocity Profits newsletters, Keith was gracious enough to chat one-on-one with me recently. Below are highlights from our conversation, during which we touched on a number of topics ranging from portfolio construction to the similarities between investing and the martial arts.

You have a unique story about how you first got interested in investing. If I remember, it began with your grandmother.

Thanks for remembering! We all called her Mimi. She was widowed at a very young age and turned a small life insurance settlement into everything she needed to live out the rest of her life and then some. She became a global investor long before that term even existed. When I turned 15, Mimi didn’t give me the usual books or sweaters other teenagers might have received. Instead, she got me subscriptions to Value Line and Forbes, and every Sunday afternoon we would meet over martinis and ham sandwiches to talk about the markets.

Mimi wanted me to understand that the world was much bigger than my garage. Our discussions weren’t necessarily about investing, but about the companies, products and services that were changing the world I would inherit. We talked about how and why that mattered and, of course, how to invest in markets that would change dramatically during my investing lifetime.

Mimi was an exceptionally bright and astute observer of the world around her. Yet, at the same time, she was a very humble person. I miss her today but have no doubt she’s out there watching the markets carefully and looking, as she always did, ahead for cues as to what’s next.

Hopefully, those are traits that I’ve picked up. I am a big believer in “boots on the ground” when it comes to exploring potential investments. I’ve traveled widely all over the planet over the past 36 years, often on my motorcycle with my wife. I want to see the world around me so I can accurately ascertain where the best opportunities are because there is no proxy for firsthand knowledge.

Speaking of your wife… I understand she has two black belts? What’s that like?

That’s right, she does. I’ve been doing martial arts since I was 15 years old, and Noriko’s been doing it since she was about five, so we’re a good match. Practically speaking, I don’t worry very much about home security if she’s on the case! Noriko’s the love of my life and we’ve been together nearly 24 fabulous years.

Many people don’t realize that the martial arts are not about defense or even attack. Instead, they’re really about personal growth and character—who you are as a person. One of the very first things you learn when you obtain a black belt, for example, is just how much you don’t know. In the Western world people commonly believe that a person with a black belt knows everything and must therefore be an expert. Yet, the first time you put one on, you realize just how much you don’t know and what a student of life you have become. In that sense, a black belt is really another door opening… to more advance and highly personal learning. And having married Noriko, and being exposed to the martial arts, and subsequently my life in Japan over the last 30-something years, I very much have that mindset.

It sounds like there’s a lot of crossover between martial arts and investing.

Absolutely. I think about that every day, in fact. I’ll give you a great example. There’s a Japanese proverb—and I’m paraphrasing here—the bamboo that bends is stronger than the oak that resists. That’s just as true in martial arts as it is in the markets. If you try to block a punch or a kick straight on, chances are you’re going to have to take the blow and risk getting hurt. But redirect that energy or sidestep it before impact, and now you’ve got the upper hand.

Investing is very similar. You will lose money if you remain inflexible. Success and big profits come from constantly adapting to changing conditions rather than trying—as a lot of investors do—to second-guess the unguessable.

You’ve been in the capital markets for a while now. What’s the hardest lesson you’ve had to learn during that time?

That’s an interesting question with many possible answers. However, if I had to choose just one, the single toughest lesson is learning to pay attention to the environment around you. And I don’t just mean reading the headlines or the internet either. I mean really becoming a student of what’s happening around you and why.

You can’t ignore the past like a lot of investors do. History won’t repeat, but it rhymes, and the markets have a very defined upward bias, which means that you can align your money with some really super profit potential if you understand how, why and where the move “fits.” The other thing people don’t realize, because they get so focused on the trees that they cannot see the forest, is that the financial markets have a very defined preference for moving forward. That’s why there are future-looking valuation methods. And if you’re trapped in the past making decisions on data that’s based solely on the past, on emotion, on stuff that should be in the rear-view mirror, you’re going to miss the opportunities.

You’re known for the 50-40-10 portfolio, among other things. Describe that for us.

Thanks for pointing that out. Let me start by saying that conventional thinking about diversification is, I believe, badly flawed. The theory is a lot like throwing spaghetti against a wall and seeing what sticks. The proposition is that you have lots of great stocks that don’t go up and down at the same time, but the reality is that it’s more like rearranging the deck chairs on the Titanic in today’s highly computerized markets, when correlation is higher than it’s been at any point in financial history.

If you want to get ahead and diversify your portfolio, the irony is that you don’t spread it all over. You don’t, for example, see buildings named after “diversifiers,” but you do see ‘em named after people who have made a boatload by taking well-reasoned, calculated risks. If you can do that, the returns—the giant profits, really—will come.

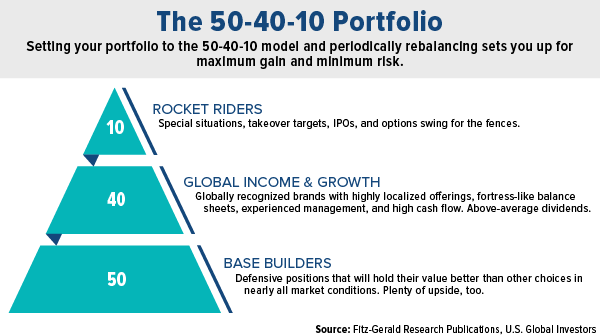

The simplest way to describe the 50-40-10 portfolio is to think of your money like a food pyramid. The stuff at the bottom is what I call the “50”—the 50 percent, the Base Builders—that’s like the stuff your mother told you to eat even though it tastes like wallpaper because it’s good for you. The stuff in the middle, the 40 percent, is what I call Global Income and Growth. That’s the stuff that you wouldn’t mind having another helping of because it actually tastes good and it’s good for you and your money. But then you get to the 10 percent, the Rocket Riders. That’s the chocolate ice cream, the beer, the chips—whatever your favorite indulgence is.

This structure gives you unprecedented stability, lowers your risk… yet keeps you profit-oriented at all times even in market conditions that send other investors packing.

Unfortunately, many investors “invert” the pyramid. They think that they’re investing but find out the hard way they’re speculating, and when the markets go against them, they lose a lot of money. That’s because instead of having 10 percent in speculative stocks, they’ve got 50, 60, 70 or even 80 percent in speculative stocks. And then they get slammed up one side and down the other. Emotion takes over and they sell out, often at huge losses they’ll never make up.

But if you’re using the 50-40-10, even on the market’s worst days you can confidently stride into the future knowing that the bulk of your money is built on a solid foundation. Your volatility is lower and you have the freedom to screw up every now and then. Plus, periodically rebalancing means you are forcing yourself to buy low and sell high over time.

In today’s market, what are some examples of speculative stocks?

Defining that term depends on how you view the future. I view the future through a very simple lens that I’ve developed over the years and which builds upon the 50-40-10 portfolio model I’ve just described. I divide the world into companies using two categories… those making “must-have” products and services you can’t live without and those that make “nice-to-have” products and services. The former is what you want to own every chance you get while the latter is usually a risk you can do without.

Examples of nice-to-haves today would be Lyft or Uber. Those companies are nothing more than glorified taxi companies with software to help you hail a ride. They’re no different from picking up the yellow pages 50 years ago, except now you’re using your smartphone.

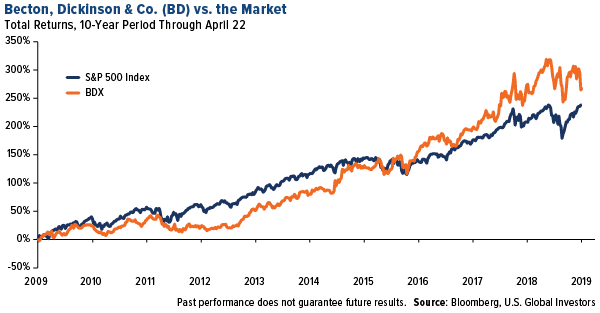

Compare that to a company like Becton Dickinson (BD), which makes billions of single-use syringes at a time when the population is aging and insulin injections are made more and more.

Both groups have their ups and downs, but Becton Dickinson is far more stable and will continue to pull ahead over time thanks to a combination of appreciation and income. Many investors underestimate the impact that yield can have on their money.

Lyft and Uber, on the other hand, may never be profitable according to their own documents and information. Last time I checked, hope was not a viable investment strategy.

I’m a simple guy. That’s one of the things that I learned from Mimi. If you can’t explain a product, a service or even a company to your grandmother, then maybe it’s too complicated or too risky.

I think it was Einstein who said that if you can’t explain something simply, you don’t understand it well enough.

That’s my understanding. Take Fitbit and GoPro. Those are great examples of nice-to-have companies. I use their products myself. They’re interesting devices, but they’re not must-haves.

Apple, on the other hand, is transitioning from a nice-to-have to a must-have because it’s getting into medical devices. It’s making a medical pivot, really. Imagine the profit potential when doctors begin prescribing Apple devices—something I think is a very real possibility within the next few years. That’s a real game changer.

Some analysts sounded the warning bell in March when the yield curve inverted for the first time since the financial crisis. At the recent Money Map Press Black Diamond conference, though, you downplayed the significance of the inversion. Why aren’t you as concerned as some others are?

Well, you have to remember where they’re coming from. Much of Wall Street wants you scared and confused because they know that you’ll trade more and generate hundreds of millions of dollars in commission for them.

Instead of doing that, let’s look at the data. It’s very clear. Just because you have an inverted or flat yield curve doesn’t mean you get a recession right away. In fact, one data source that I saw recently suggests it takes as many as 44 months before you get an actual recession. And during that time, the market may continue to rise another 70 percent—possibly more.

Pessimists rarely make money. How many times over the past 100 years have we heard that the end is near? Better run for the hills! All of those folks ended up looking pretty foolish when they took their money out of the market and it continued to run for another 20 to 50 months and they missed every penny of the profit potential.

Again, I’d rather concentrate on the upside potential in the must-have companies and the 50-40-10 model because I know those things can create huge profits year in, year out and in all sorts of market conditions. Missing opportunity is always more expensive that trying to avoid losses.

Playing devil’s advocate here, but let’s say a recession is imminent. Where would you recommend people be positioned right now?

The same way I’d recommend they’re positioned now. It’s logical to assume that we’re in a late stage of economic growth, but then again, people have been saying that since 2009 when they thought the end of the financial universe was upon us. But that’s where risk management comes in. If you’ve got it in place, then that concern goes away. Instead, you can concentrate on the pursuit of profits knowing your money is protected if the markets go against you. There’s no second-guessing required. I am particularly focused on dividend-paying stocks with global market share, well-known brands and the ability to protect margins. They’re going to run higher faster and be more stable if there’s a downturn for any reason. People will still buy the stuff they make if the you know what hits the proverbial fan.

You’ve been the chief investment strategist at Money Map Press since 2007. Talk a little about some of the newsletters you’re involved with there.

It’s a real honor. Coming from very simple beginnings oriented around a single publication, the Money Map Report, I think we are now the single largest private investment research publisher. Today we have a family of newsletters covering everything from structured long-term investing, like the 50-40-10 I advocate in the Money Map Report, to more sophisticated options, resources, cryptocurrencies, cannabis and more.

I personally still write the Money Map Report as well as High Velocity Profits and have recently launched Straight Line Profits. The latter are more active momentum-oriented services. I can also be found at Total Wealth Research, which is a free e-letter published three times a week. That’s where a lot of folks start as they get to “know” me and, eventually, our team.

Thank you for your time, Keith! It was a pleasure speaking with you.

Thanks for including me! It’s a real honor.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 3/31/2019.