Source: Maurice Jackson for Streetwise Reports 04/20/2019

Michael Rowley, CEO of Group Ten Metals, sits down with Maurice Jackson of Proven and Probable to provide an update on the company’s exploration efforts.

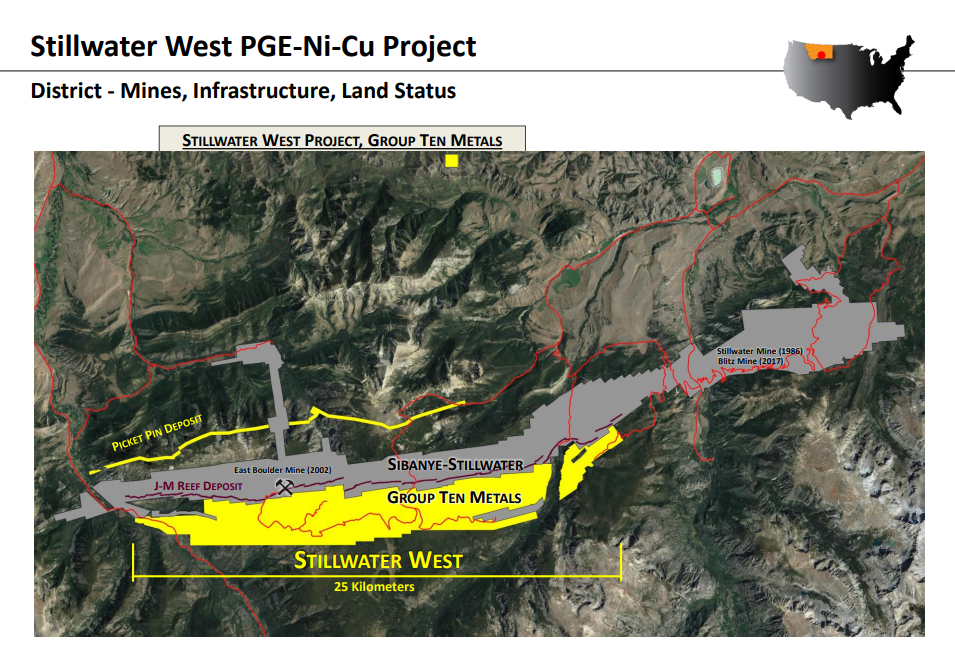

Maurice Jackson: Joining us today is Michael Rowley, president and CEO of Group Ten Metals Inc. (PGE:TSX.V; PGEZF:OTC), which is known for platinum, palladium, nickel, copper and cobalt in the Stillwater district in Montana.

In our last interview we discussed the results you released in the second of a series of news releases with high-grade and bulk tonnage targets in the Chrome Mountain and East Boulder areas of the 25-kilometer Stillwater West project. Since then, Group Ten Metals has released news from the flagship Stillwater project, and also announced results and updates from its Yukon and Ontario projects. Mr. Rowley, for someone new to the story, who is Group Ten Metals and what are your targets and focus?

Michael Rowley: Group Ten has been acquiring and consolidating quality projects in known mining jurisdictions since 2012, so we were able to acquire and build world-class assets in three top-tier mining districts—in Montana, in Ontario, and in the Yukon—on terms that reflect the market’s discount at the time. Since the acquisition of our flagship Stillwater West project in 2017 we have been increasingly focused on monetizing our other assets in order to focus on Stillwater, which we see as having the potential to rapidly advance as a world-class PGE-Ni-Cu-Co project. As a result we are positioned with 100% ownership on large and highly prospective land positions in known mining districts at a time when the markets are turning positive and the appetite for acquisitions is returning. So that really is the point—we are receiving increased interest on our non-core assets in the Yukon and Ontario at a time when deals for these assets will help drive our efforts in Montana at Stillwater.

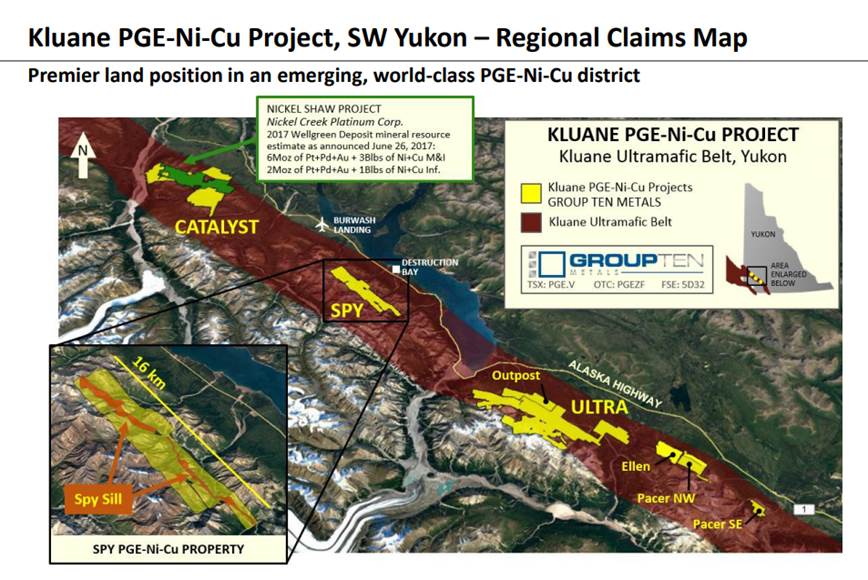

For the benefit of our readers I’ll give a short summary of the Yukon and Ontario projects before we focus on our flagship Stillwater project and the most recent news there. In the Yukon we have the Kluane PGE-Ni-Cu project, which is geologically similar to the Stillwater project, being a layered magmatic system. The Kluane belt is well known for PGE-Ni-Cu deposits and the most advanced is the Wellgreen Deposit now being advanced by Nickel Creek Platinum. That one is 6 billion ounces of PGE+Au and 4 billion pounds of Ni-Cu, with significant Co as well. We have the strike extension of that deposit on our ground, plus known showings and a similar geological setting across our 255 square kilometer land position in the Kluane belt. The project is at an earlier stage than Stillwater, but is highly prospective and is attracting interest from the industry.

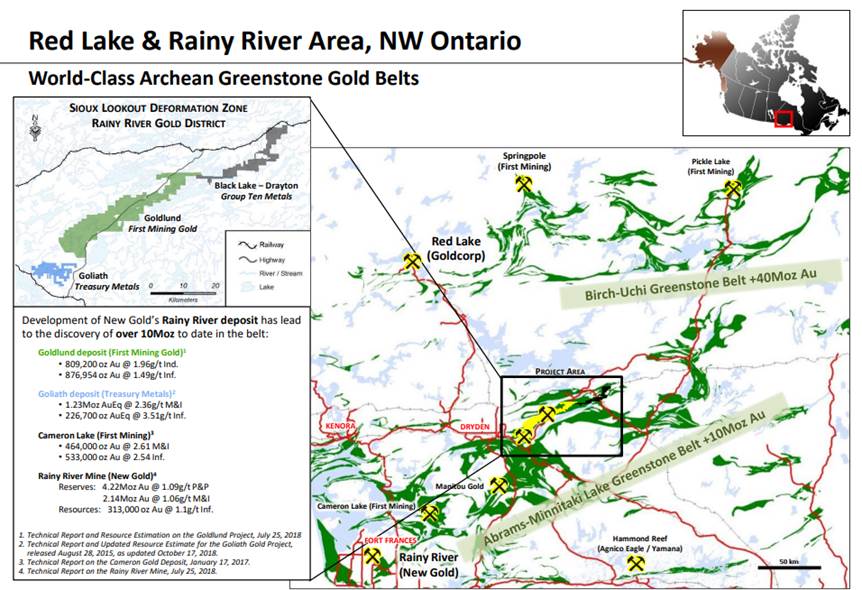

In Ontario we have the Black Lake-Drayton gold project, which adjoins and shares geology with First Mining’s Goldlund project and Treasury Metals’ Goliath project. Both are high-grade gold resources that share geology with our project, however our ground has seen much less exploration since 2000 for various reasons. Our most recent news reports a small till sampling program that, for the time, demonstrated the gold potential of the large middle area of the project where pervasive ground cover has limited past exploration interest. This is compelling because over 10 million ounces of gold has been discovered using this till sampling method in the area, and the hits we are getting correspond to geophysical anomalies.

We also announced completion of the final earn-in at Black Lake–Drayton and that, together with the success of the recent till sampling program, has brought increased interest from industry, which we are now following up on.

Maurice Jackson: Thank you for the overview of your other assets. Mr. Rowley, on to the main event, the Stillwater West project in Montana. Please provide a summary of that project, and the thesis you are attempting to prove.

Michael Rowley: We have a fantastic asset in the Stillwater West project, and we are excited about the targets and potential we see there. As you know, Group Ten is alongside the Stillwater Mines in the iconic Stillwater Igneous Complex. The district is well known as the highest grade major PGE district in the world, and the largest by far in the Western hemisphere. Sibanye bought the Stillwater mines for $2.2 billion in 2017, around the time we were making our acquisition there. Our ground was historically owned by Stillwater, and has been mined for a number of commodities including high-grade nickel and copper, as well as PGEs and chrome.

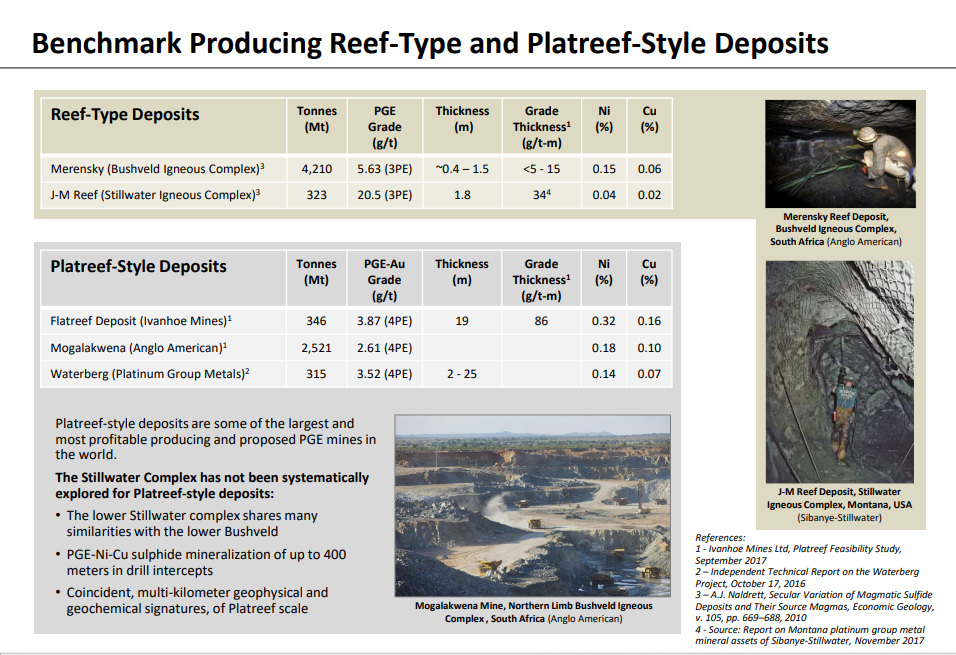

We are the first to systematically consolidate the land package, database and team to target Platreef-style platinum-palladium-nickel-copper deposits. These are 100+ Moz PGE deposits with significant values of other metals, in particular nickel and copper, but also rhodium, cobalt and chrome, found in the northern limb of the Bushveld Complex in South Africa. The Bushveld and Stillwater complexes are both large igneous complexes, and there are many known parallels between the two. Developments in the 1990s and 2000s led to the discovery and development of the Platreef mines in South Africa, but that progression was essentially interrupted at Stillwater. Based on everything we’ve seen, we see the potential to discover massive PGE-Ni-Cu deposits of this type at Stillwater. That thesis took a big step forward late last year when Ivanhoe’s Dr. David Broughton, a key member of the discovery team at Ivanhoe’s 112 Moz Flatreef PGE-Ni-Cu project, joined our team and confirmed that potential. We acquired the project in 2017 and have now begun a series of news releases to reveal what we have found to date, and lay out our plans for 2019.

Maurice Jackson: Mr. Rowley, in our previous interviews you alluded to a possibility of mine closures in South Africa as a potential catalyst for Group Ten Metals. We may have some interesting developments coming from SA. What can you share with us? As reminder for our audience 78% of Pt comes from South Africa, they are not earning their cost of capital, and there are number of geopolitical concerns there as well.

Michael Rowley: There are basically two types of platinum mines in South Africa: narrow, high-grade reef-type mines and the bulk tonnage mines on the Platreef in the north. Many of the high-grade producers have been sub-economic for years and have been underfunded as a result. This is partly because narrow, high-grade mining is always more expensive per tonne that bulk mining, and also because these mines are getting deep and hot and unsafe as well. As a result, analysts are predicting the closure of a number of South African high-grade platinum producers in the coming year or two, and that is expected to be a significant driver of platinum price as a result of decreased supply.

By contrast, the Platreef district is known for its thick mineralized intervals that are very amenable to bulk mining. Anglo American operates the Mogalakwena mine in the Platreef district and it is currently producing platinum at less than $400/oz from four pits, along with palladium, nickel, copper and other metals. Ivanhoe’s adjoining Platreef Mine is now in development and will have similar economics.

We have had a lot of interest from the industry in finding the equivalent “Platreef in Montana,” and to date we have every indication that it is there at Stillwater.

Maurice Jackson: Michael, let’s move from South Africa and go to your flagship project the Stillwater West, which is located in Montana, to discuss the latest press release regarding the Camp Zone Target Area.

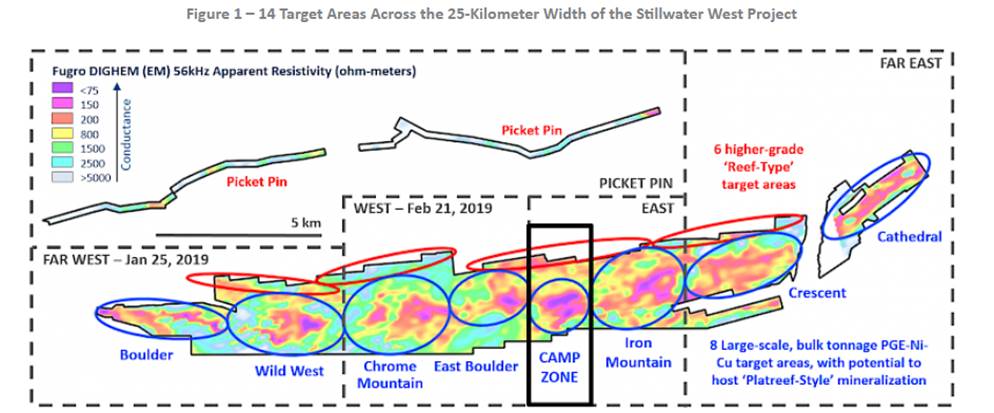

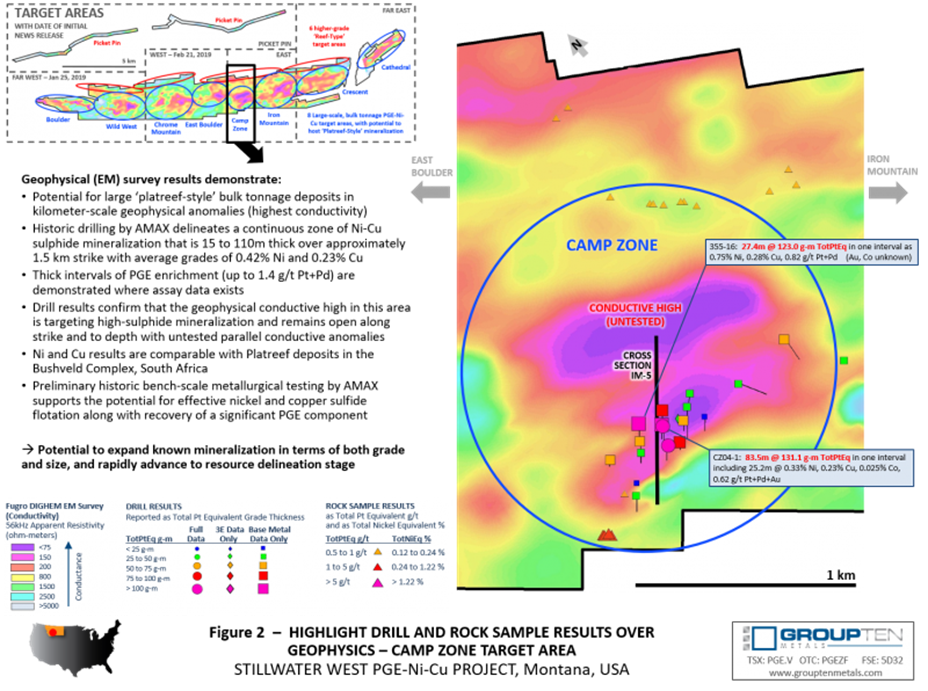

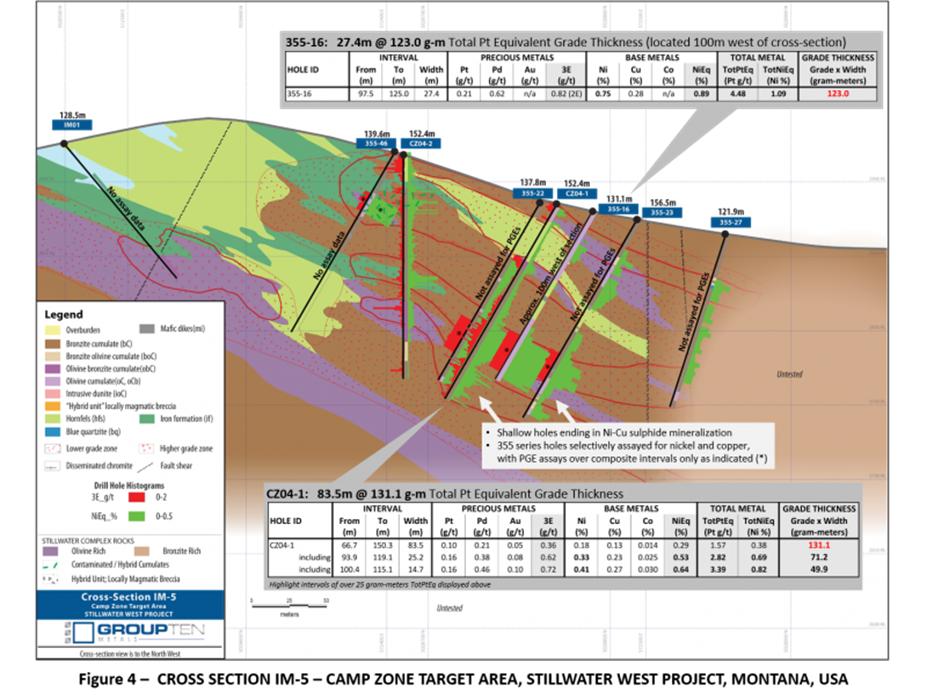

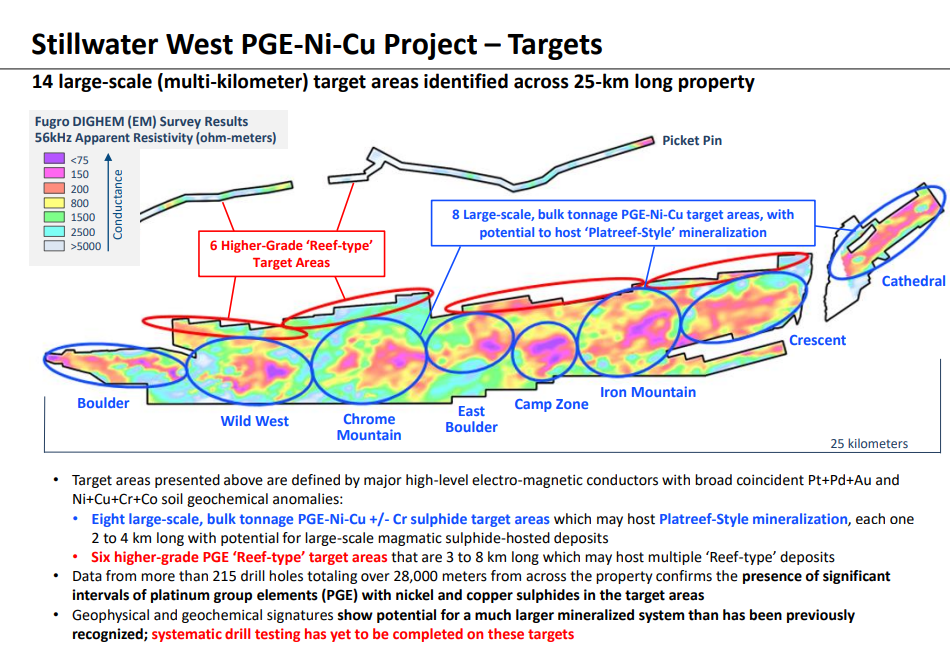

Michael Rowley: The Camp Zone target area is the fifth of 14 kilometer-scale target areas across the 25-km Stillwater West project. Eight of those 14 are “Platreef-type” targets. Like past news releases detailing the west side of the project, we have high-grade PGE “Reef-type” targets in the north of the claim block, higher up in the layered stratigraphy, and bulk tonnage “Platreef-style” targets in the lower portion and basal zones of the complex.

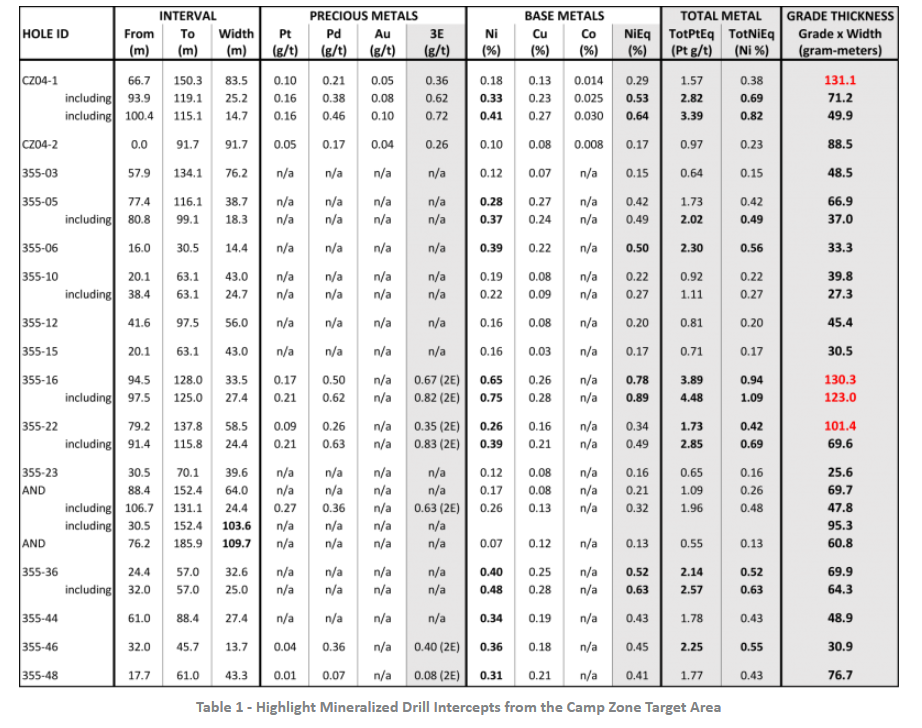

The Camp Zone target area has a lot of historical drilling by AMAX in the late 1960s and early 1970s, which successfully targeted nickel and copper sulphides in the basal zone, and resulted in the delineation of a continuous zone of nickel-copper sulphide mineralization in the Basal Series ranging from 15 to 110 meters in thickness over approximately 1.5 kilometers strike with average grades of 0.42% nickel and 0.23% copper. We also have platinum and palladium assays that were completed as composites over select intervals only. These demonstrate thick intervals of PGE enrichment, running up to 1.4 g/t palladium plus platinum.

Maurice Jackson: Mr. Rowley, overall how would you grade the results thus far from the first five target areas?

Michael Rowley: The first five “Platreef-style” target areas have demonstrated that the conductive highs we are seeing are in fact nickel and copper sulphides in both rock samples and drill core, and that they are generally enriched in PGEs, cobalt and chrome and other commodities. This is essential insight to have.

The results at Camp Zone in particular position it as one of the three most advanced target areas at Stillwater West. We have an enormous land position and a large number of compelling targets across 25 kilometers of strike, so using that historical data to vector in on areas that can be advanced rapidly to resource delineation stage is essential. The known mineralized zone at Camp Zone, like the Hybrid Unit mineralized zone announced in February, provides us exactly that—a starting point to build upon. Both are substantial mineralized zones, drilled with shallow holes without geophysics or optimization, and open for expansion in terms of both grade and size.

AMAX’s work at Camp Zone also included valuable basic metallurgical results which show that standard 1970s-era flotation techniques can be used for effective nickel and copper sulphide recovery, along with a significant PGE component.

Maurice Jackson: Can you comment on the price moves we have been seeing in palladium and platinum, we are in unprecedented territory.

Michael Rowley: Palladium has indeed been on a tear due and is nearly doubling platinum in price. The price, of course, is driven by supply and demand, and the supply of physical palladium has been dwindling for years now while consumption of both palladium and platinum, driven mostly by the automobile sector for use in catalytic convertors, has been rising steadily. In addition, palladium was less affected by the switch away from diesel vehicles as palladium is generally used more in gas applications while platinum can be used in both diesel and gas engines.

We’ve talked about gold and silver ratios in the past and how they historically stay within a certain range. The same is true of palladium and platinum, and at some point auto manufacturers will switch back to platinum and the prices will shift. Add to that the expected closure of platinum mines in South Africa and you have a very bullish case for platinum!

At Stillwater we have both platinum and palladium, and also rhodium, plus also the technology metals nickel, copper and cobalt.

Maurice Jackson: Sir, before we close what is the next unanswered question for Group Ten Metals, when should we expect results, and what determines success?

Michael Rowley: Next up in our series of news releases is the Iron Mountain target area, which is the most advanced area on the project, so we are looking forward to making that release and discussing those results.

In addition we are finalizing our targets and exploration plans for 2019 across the project, and will be releasing those in the coming weeks as well. The project is at an exciting point where the only unknowns are the good unknowns. We have brought together a remarkable land position, database and team, and our exploration programs in next two or three years will show what we actually have in terms of size and grade.

It’s early days; we have a $10 million market cap, a great team, and our neighbour was bought for $2.2 billion. I think it will be a banner year.

Maurice Jackson: Finally, what did I forget to ask?

Michael Rowley: Funding and exploration plans are usually on people’s minds, so let’s touch on that.

In terms of funding, we raised $1.2 million late last year and have about $2.7 million of in-the-money warrants that we can call any time to top that up. We also had some very good meetings at recent trade shows in Vancouver and Toronto. Those conversations are on-going with an eye to driving our best year yet at Stillwater West, and we look forward to making further announcements as the weeks progress.

Maurice Jackson: For someone listening that wants to get more information on Group Ten Metals the website address is www.grouptenmetals.com. And as a reminder Group Ten Metals trades on the TSX-V: PGE and on the OTCQB: PGEZF. For direct inquiries please contact Chris Ackerman at 604-357-4790 ext. 1 and he may also be reached at info@grouptenmetals.com.

As reminder Group Ten Metals is a sponsor and we are proud shareholders for the virtues conveyed in to today’s interview.

And last but not least please visit our website provenandprobable.com, where we deliver Mining Insights & Bullion Sales, in form of physical delivery, offshore depositories, and private blockchain distributed ledger technology. You may reach me at contact@provenandprobable.com

Michael Rowley of Group Ten Metals, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Group Ten Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Group Ten Metals is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Group Ten Metals, a company mentioned in this article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.

( Companies Mentioned: PGE:TSX.V; PGEZF:OTC,

)