The downside potential in precious metals discussed last week is playing out as Gold and gold stocks have broken down technically.

The global economy appears to be firming and that is evidenced by a sustained rebound in global equity markets.

As a result, the potential for a rate cut which pushed precious metals higher is now unwinding. That has caused the breakdown in precious metals and there is more unwinding to go.

We have trumpeted the need (in precious metals) for a rate cut as a fundamental catalyst for the next bull market. But there is another scenario that plays well for Gold.

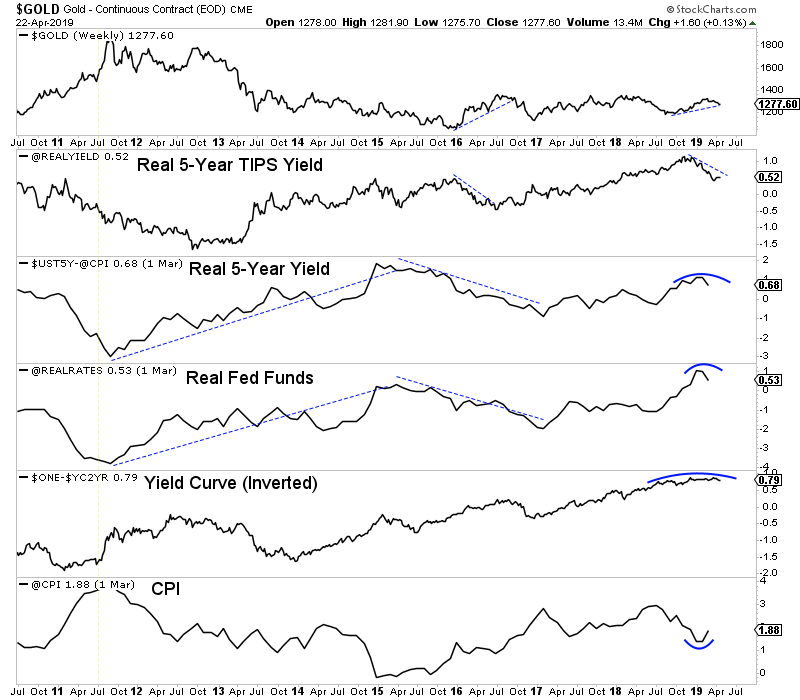

Let’s step back for a second and remember that Gold is driven by declining real interest rates and secondarily, a steepening yield curve. Either essentially entails Fed rate cuts or inflation rising faster than short-term rates which in other words equates to rising inflation expectations.

In the chart below we plot Gold along with a number of fundamental indicators for Gold. These include the real 5-year TIPS yield (as calculated from the TIPS market), the real 5-year yield, the real fed funds rate and the yield curve (upside down).

If the Federal Reserve is not cutting rates in the next 12 months then the best case scenario for Gold would be a bump in inflation that leads to a material decline in real interest rates and a steepening of the yield curve.

The CPI is rebounding and if it were to reach 3% while the Fed stands pat, that would equate to a real Fed Funds rate of -1.6%. That would imply a decline of -2.1% from here.

Gold would definitely rally in that scenario but for now, the market is focused on the declining expectations for a rate cut in the next 12 months. Until the unwinding of that trade is complete, Gold is likely to trade lower.

However, the point is that we should not be bearish for long if inflation indicators and inflation expectations increase in a sustained fashion. That equates to falling real interest rates which is bullish for Gold.

The CPI may ultimately need to exceed 3% or even 4% to spring a huge breakout in Gold, but a return to 3% with the Fed remaining paused could push Gold back to the wall of resistance.

The gold stocks are extremely oversold on a short-term basis and a rally should begin within the next day or two. That being said, the path of least resistance is lower until the market shifts its focus from a rate cut to rising inflation. That will take some time.

The months ahead could be an especially opportune time to position yourself in this sector. We will be looking for anything we missed in recent months that gives us a second chance opportunity. To learn what stocks we own and intend to buy that have 3x to 5x potential, consider learning more about our premium service.