Source: Peter Epstein for Streetwise Reports 04/18/2019

Peter Epstein of Epstein Research provides an update on a mining exploration company that is diversifying into the hemp market.

This article is about California Gold Mining Inc.’s latest news regarding its industrial hemp segment. I will stick to the hemp segment and not discuss the gold exploration side of the business, as there’s no new news on that front.

California Gold Mining Inc. (CGM:CSE; CFGMF:OTCQB)(CGM) announced that it received a non-binding Letter of Intent (LOI) from industrial hemp consulting firm Delta Valley Logistics (DVL) for the purchase of the company’s entire production of feminized, high-CBD content industrial hemp seeds in 2019 and 2020. The proposed agreement is only for the first greenhouse that CGM is building (GH#1) on its 100%-owned Fremont property in Mariposa County, California. (See press release.)

GH#1 is expected to be completed in the third quarter, and the first harvest of seeds and first revenue is anticipated in the fourth quarter. As far as I know, there are no plans for a second greenhouse. However, in my opinion only, if GH#1 is a success, and if seed demand warrants, then a GH#2 could be built next year. GH#2 (if built) would presumably be self-funded from the profits of GH#1.

Delta Valley Logistics & California Gold Mining Form Partnership

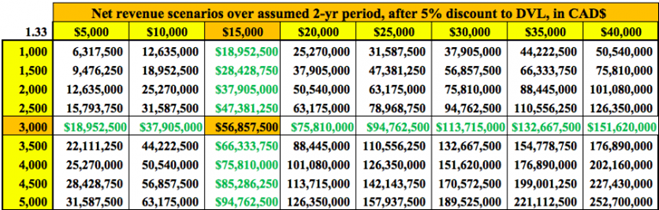

The LOI received by CGM expresses DVL’s intention to purchase up to a combined total of 5,000 pounds of high CBD-content hemp seeds from CGM this year and next. The pricing of the seeds will be determined at each harvest time, derived from prevailing wholesale market prices, minus 5%. Note, most online offers of premium quality, high-CBD content hemp seeds like the ones that CGM proposes to propagate are only available by calling or emailing the sellers.

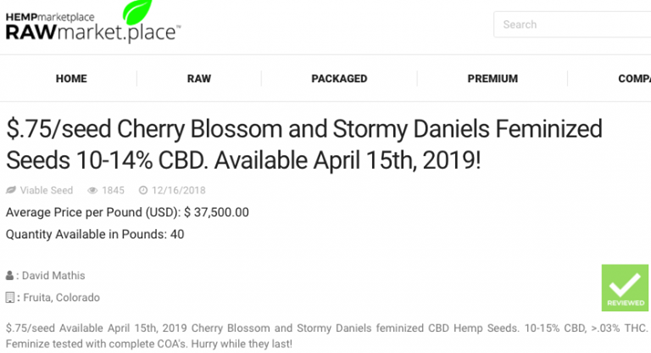

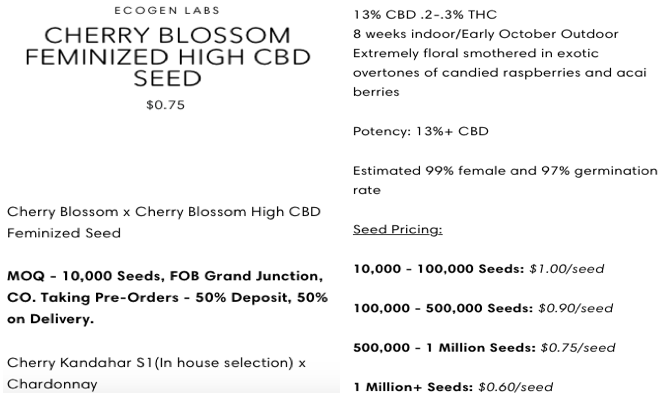

The press release refers to Oregon CBD Co., Blue Forest Farms and Cheyenne Mountain Seed Co, but for competitive reasons, these companies do not reveal pricing online for their premium quality seeds. According to the press release, current wholesale prices range from US$15,000 to US$30,000 per pound (based on quotes from the above mentioned companies). I have found three examples of what could be comparable high CBD-content hemp seeds. (See images above and below). NOTE: These are just the items I could find online, they may or may not be representative of the overall wholesale market for premium quality hemp seeds.

How Big an Opportunity Is This? Pretty Big. . .

As a frame of reference, let’s play with the math, remembering though that construction of GH#1 has not yet begun! Five thousand pounds x US$15,000 = US$75,000,000 in gross revenue, minus a 5% discount to DVL = net revenue of US$71,250,000. But, that’s over only about a 1.5 yr. time frame—through 2020; GH#1 might not be capable of that much production so quickly. I’m assuming a total of 3,000 pounds of seed can be sold to DVL by the end of next year. That would generate net revenue of C$56,857,500. To be clear, DVL would get a well-deserved portion of that amount in fees, call it 10%, leaving ~C$51.2 million in adjusted net revenue to CGM. Compare that figure to the company’s market cap of ~C$33 million.

Management also announced that it has signed a comprehensive consulting agreement with DVL. CGM is very wisely outsourcing all operations related to the its industrial hemp seed cultivation project at Fremont. As part of the agreement, DVL and CGM agreed to work exclusively together for the cultivation of industrial hemp seed, oil and fiber within the states of California, Oregon, Washington, Nevada and Arizona.

President and CEO Vishal Gupta stated, “The relationship between California Gold and DVL has not only been consummated with the signing of the Agreement, but it has been further strengthened by the inclusion of an exclusivity clause for the five states mentioned, and DVL’s intention to purchase all of the Seed produced from our first greenhouse at Fremont in 2019 & 2020. The formation of this multifaceted relationship is a very important milestone in the Company’s bid to successfully launch its recently announced industrial hemp seed propagation project in California.“

This Is Truly a Win-Win for Both Companies

DVL’s compensation is described as including “a greenhouse construction oversight fee, a greenhouse management fee and a modest bottom-line profit-share based on numerous production thresholds.” So, not much insight there, but I think that CGM is getting a great deal with DVL, assuming that it delivers on its end. Even if DVL were to end up with 20% of GH#1’s economics, but it sounds like it’s closer to 10%–15%, that would still be very attractive for CGM. Importantly, CGM maintains 100% ownership of GH#1 and everything relating to its industrial hemp seed propagation business segment.

This is also a good deal for DVL, a true win-win relationship, because it will have the fully permitted, funded and built GH#1 at its disposal (it will be operating it), to test new hemp seed and plants. Recall that the partners intend to develop and patent high-end strains of hemp. Patented strains are expected by DVL to be more valuable and to remain higher priced for a longer period of time. DVL will also have a guaranteed supply of seeds, which it can presumably sell at higher prices (in smaller quantities). Importantly, it has to execute at GH#1 in order to get its supply of seeds, so both parties’ interests are aligned.

What to make of the mention of the four states: Oregon, Washington, Nevada and Arizona. It would have to mean acquisitions or joint ventures with other companies because CGM has no business interests outside of the state of California. While it’s exciting to speculate about what CGM might do with excess profits from GH#1 or perhaps even a GH#2 (if built), I have no idea if the company is pursuing opportunities outside of California at this time. My guess is that all eyes are on GH#1 for the remainder of the year!

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University’s Stern School of Business.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about California Gold Mining, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of California Gold Mining are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned shares of California Gold Mining and the Company was an advertiser on [ER]. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein’s disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Graphics provided by the author.

( Companies Mentioned: CGM:CSE; CFGMF:OTCQB,

)