Source: Michael J. Ballanger for Streetwise Reports 04/15/2019

Precious metals expert Michael Ballanger, along with discussing Winston Churchill’s brilliance with the English language, covers recent moves in the market and a uranium company that he believes is well situated.

“‘Success consists of going from failure to failure without loss of enthusiasm.” – Sir Winston Churchill

Throughout history, society has always canonized certain political, military, and religious icons for reasons seemingly obvious, but after drilling down into the fabric of such, what surfaces is that generational memory is aided and abetted by those who would seek to monopolize public opinion by piggybacking upon those very achievements responsible for the canonization. Sir Winston Churchill was a soldier, an author, a politician, a Prime Minister, and finally, an historical icon of immense magnitude.

Not only was he one of the most distinguished users of the English language, he was a brilliant strategist. The famous Lady Astor was the first female ever elected to the British Parliament who was also vehemently opposed to everything that Churchill represented to the degree that this exchange of wit toppled stanchions:

Lady Astor said to Churchill: “If you were my husband, I’d poison your tea!”

Churchill to Lady Astor: “Madam, if you were my wife, I’d drink it!“

Another superb exchange just prior to a high-profile Masquerade Ball…

Churchill to Lady Astor: “What do you think I should wear?”

Lady Astor to Churchill: “Sobriety.”

The greatest of all Churchillian zingers was his interaction with a certain Bessie Braddock, with whom, it was alleged, he had been flirting (by repeatedly pinching her buttocks) where at the end of a very long evening:

Bessie Braddock: “Mr. Churchill, I do believe that you are DRUNK!”

Churchill: “Miss Braddock, You are correct. I am indeed drunk. You, however, are UGLY. In the morning, I shall be SOBER whereas YOU shall still be UGLY.”

In all of my years of following markets, I have always been able to appreciate the importance of history in its relationship to movements in markets but those movements are over very long periods of time. For example, world wars are long wave events and totally “event driven” as every headline as to the success or failure of the battles contained within the wars could send sentiment either soaring or plummeting. This is the world in which we live; we are forced to take the gold-silver narrative and minimize the importance of short wave moves as “noise.”

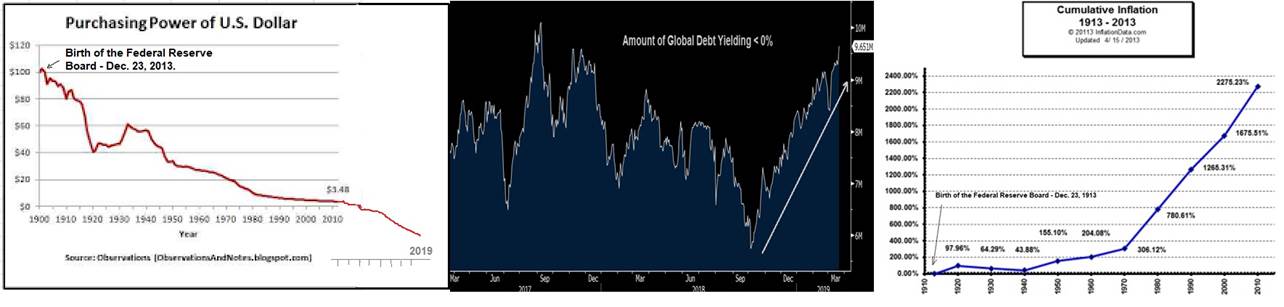

It is the long wave utility of gold and silver that counts because the drivers for gold and silver priced in U.S. dollars are anchored in the actions taken by the Federal Reserve and the U.S. Treasury department over long stretches of time. By example, cumulative U.S. debt has grown from $14 trillion to $23 trillion in ten years since the U.S. Treasury and the Fed combined to rescue the banking system from surefire default and failure. However, that exogenous shock to the money supply has been muted through intervention and faulty reporting of the economic data, aided and abetted by equally massive monetary expansion by the Europeans and the Chinese. This has had the effect of supporting the dollar index, which keeps the rate of change of U.S. import prices tame such that reported “inflation” is easily understated. On that note, it is interesting that the costs for domestic “services” including health care and education have been inflating wildly for years and are accelerating sharply since the 2009 bailouts and the explosion in debt.

As investors, we must always remember that the Great Financial Crisis/Bailout/Fraud of 2008 was “fixed” by way of a colossal experiment, the result of which is yet to be determined. Despite what the economists and the bankers and the politicians and Fed Governors are telling the world, the reality is that they have gotten it wrong for decades. Quality of life for the average American worker has been in decline for decades and we see that in wage growth and in the types of jobs available. As Ray Dalio stated on “60 Minutes” last week, “that capitalism is broken and desperately needs to be fixed lest we have a revolution,” followed by the assertion that with wealth inequality so prevalent everywhere, it has now become a political football with both Republicans and Democrats lining up on each side of the aisle.

Here in Canada, while we are different in some respects, our government (and its citizens) are sporting a hefty 83.81% Debt-to-GDP ratio compared with China at 54.44% and Russia at 19.48%. Japan is numero uno at 234.18% with the U.S.A. at 109.45%. However, as you go down the list, you come to realize that Canada is particularly at risk because the Eastern Canadian Establishment, dominated by Quebec, has been alienating Alberta with greater intensity in the past five years to the point where Alberta’s dependence on energy has become a veritable Achilles Heel and the failure of Ottawa to build a pipeline out of the province for its tar sand oil has created a clarion call for separation.

The ineptitude of the current Canadian Liberal government is surpassed only by the insanity of the Canadian banking monopoly whereby foreign capital, until recently, has been washed and rinsed through real estate transactions, which have artificially inflated prices in the major cities like Vancouver and Toronto. While Vancouver is now suffering from the absence of the China “bid,” Toronto has yet to feel the same corrective wrath but when that arrives, the Canadian banks are going to come under immense pressure to set aside enormous amounts of capital as loan loss provisions escalate. With all of these things to consider, it is easy to grasp the importance of gold (and silver) ownership and yet, both metals continue to struggle against the competition represented by common stocks and real estate.

Last weekend, I issued the missive “Rudderless ships and shifting sentiment” during which I stated “For the record, I am trading from the short side of the metals via DUST:US and selected puts on the GLD.” DUST closed out last week at $17.91 and traded down to $16.86 Wednesday as gold did its utmost to move (and stay) above the 50-dma at $1,309.70 based on Stockcharts’ Continuous Contract chart for gold futures.

However, the Comex chart for June gold futures has the 50-dma at $1,314.00 so yesterday’s top tick at $1,313.10 was a classic example of how the bullion bank traders let out just enough line to suck in the technical traders and then lower the boom into the wee hours of the morning. At 2 a.m. on Thursday morning, the trickle of selling started but it wasn’t until precisely 7 a.m. EST that the dam burst at $1,308 and exactly sixty minutes later, the first downwave stopped at exactly $1,298. After a brief $5 rally into the NYSE opening, it then proceeded to tank, bottoming late morning at $1.292.90.

The Commercial Cretins sucked everybody in with the brief pop to (or above) the 50-dma, most certainly adding to their aggregate short position (See the COT below) and then cratered it perfectly to coincide with the GLD ETF opening on the NYSE amidst a flurry of sell orders. My “DUST:US” and “selected put options” have had a great day with the DUST hitting an intraday high at $18.69 and the GLD losing $1.54 on the day and the GLD May $122 puts adding $0.64 for a 106% move on the day. Remember that $1,280 is the “line in the sand” for those holding longer-term positions and as we approach that level, I will be keeping tight stops on all shorts.

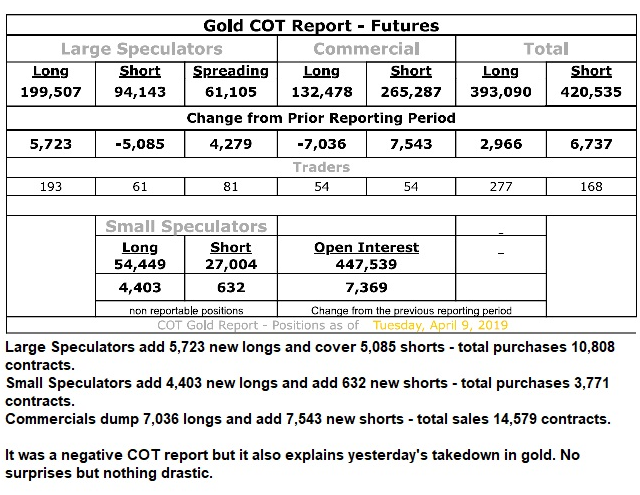

COT Report

The bullion bank traders continue to play games and smack the Large and Small Specs around like common farm animals. As stated above, the Thursday slam was in response to the 14,579 new bullion bank shorts added for the week ended midnight Tuesday. As gold stabilized on Friday, I would expect that this week I’ll see Commercial short covering as they continue to keep gold (and silver) on very short leashes, content to scalp trade at the expense of the Large and Small Specs.

It appears as though Western Uranium & Vanadium Corp. (WUC:CSE; WSTRF:OTCQX) will be closing its $0.98 funding shortly and it looks as though it blew through the US$2 million mark and then exercised the 50% overallotment option, which is apparently almost filled as well. With US$2 million feeling like a bit of a stretch thirty days ago, to be oversubscribed this week with US$3 million in the bank is quite an accomplishment but not exactly surprising. Despite the pullback in uranium and vanadium prices in the last four months, the WUC private placement has attracted serious interest from the investors and speculators alike; speculators are betting that a positive Section 232 outcome ignites the share prices of the domestic producers (and developers); investors are buying into the uranium supply/demand story.

I am enthused with the company engaging in underground drilling that will move the historical resource to a category such as “inferred” or “indicated” while providing excitement regarding some of the extremely high-grade vanadium sections of the SMC. The uranium price is undoubtedly headed higher because nuclear energy is the most efficient and cleanest form of power available to mankind. When the Millennials finally wake up and realize that their electric cars will be sucking more electricity out of the grid that wind farms and solar panels replace, they will glom onto nuclear with a vengeance.

The key to price performance for WUC/WSTRF is obviously the underlying commodity prices contained in the SMC but the near term risk is going to be execution. The terms sheet spells out under “Use of Proceeds” that the funds raised are to be used to re-open the SMC, extract and deliver samples of vanadium ore for delivery to prospective end users, underground drilling, and general working capital purposes. I would expect the bulk of the remaining 2019 budget to be on the former (the SMC) with relatively modest expenditures in the latter (general working capital purposes) and it makes sense because the latter is primarily for funding efforts.

Fully funded, once it gets underground, news from the analysis of those samples and the drill results should provide a steady and impactive flow of news, which should (and I believe WILL) result in a big lift in valuation. Hopefully, the long awaited resurgence in the price of U3O8 materializes and an early-2000’s type of macro-shift into the sector results in spectacular run-ups with particular emphasis on Section 232 beneficiaries with domestic uranium resources.

I have tried twice to short the S&P 500 since the lows in late-December taking small losses in January and a very small profit mid-March when it lost almost 100 points from the first assault on 2,800. Now we are comfortably above 2,900 and within 1.13% of all-time highs as macro-economic risks have been ignored as investors correctly EMBRACE, rather than FIGHT, the Fed and the tape.

In early January, I was ruminating over the obscenity of the Fed and Treasury Department interference so blatant in late December and early January when I typed: “However, as I debate the notion of a V-shaped bottom for stocks leading to new highs in 2019, I am mindful of the results of the results of the Santa Claus rally and the First Five Trading Days rule which would suggest that 2019 has a 70-80% chance of being an “up” year.” Would that I could have listened to my own advice by going outright long instead of awaiting the now-archaic “re-test,” which can only occur in free markets, not the abominations with which we must contend today.

We are so very close to all-time highs with the interventions so powerful that it is a near certainty that 2,940 will soon be in the rear-view mirror. I will refrain from joining the crowd of euphoria and avoid long positions but I will be looking to establish shorts in the event that the champagne corks are popping in the next two weeks. For the gold sector, the danger lies in the disappearance of “The Fear Trade” and with the seasonally dormant “Love Trade” (Indian wedding season and Italian jewellery trade) purchases months away, the precious metals are vulnerable to irrelevancy, no surprise given the hostility of the interventionalists and the fickleness of cannabis and crypto zealots.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Western Uranium & Vanadium Corp. My company has a financial relationship with the following companies referred to in this article: Western Uranium & Vanadium Corp. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Western Uranium & Vanadium. Please click here for more information. Within the last six months, an affiliate of Streetwise Reports has disseminated information about the private placement of the following companies mentioned in this article: Western Uranium & Vanadium Corp.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Western Uranium & Vanadium Corp., a company mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

( Companies Mentioned: WUC:CSE; WSTRF:OTCQX,

)