Asia’s mining sector continues to boast the greatest rewards globally, with positive business environments, rich mineral deposits, supportive infrastructure and political stability in countries holding the top positions in Fitch Solutions’ Asia Mining Risk/Reward Index.

Asia’s mining sector continues to boast the greatest rewards globally, with positive business environments, rich mineral deposits, supportive infrastructure and political stability in countries holding the top positions in Fitch Solutions’ Asia Mining Risk/Reward Index.

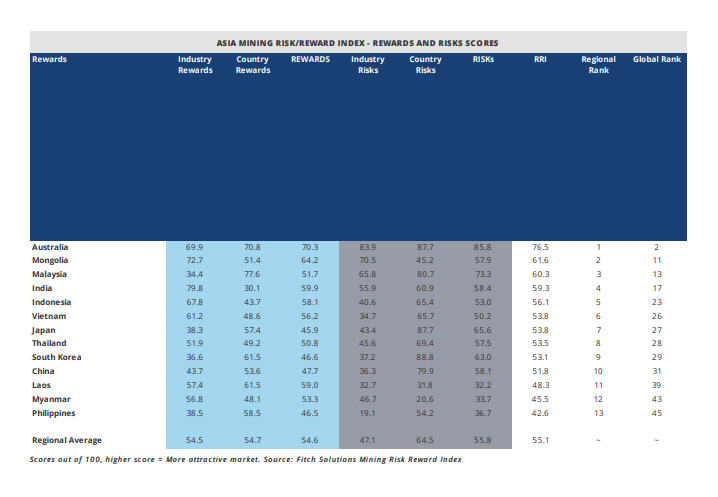

The analyst’s latest report, released Thursday, revealed that Australia continues to reign at the top, while Myanmar and the Philippines, in an emerging Asian market, remain the regional laggards.

Factors enabling Australia’s outperformance include positive business environment, rich mineral deposits and supportive infrastructure.

Mongolia emerged as an investment hot spot for untapped reserves, and the availability of rich reserves will continue to attract investors.

Contrary to the high scores for rewards, the Asia region ranks second lowest for industry risks, just above Sub Saharan Africa, Fitch reports.

This partly is due to Asia having the second greatest vulnerability to commodity price volatility globally, after MENA, which measures the relative vulnerability to price volatility by country according to the three largest mining commodities produced locally. Nevertheless, Asia has the second best score for country risks globally, balancing the weak industry risk results.

Globally, Asia has the second highest score, after Europe, on the Mining Risk/Reward Index, with a score of 55.1, maintaining its position from last quarter. Asia stands out with the highest average industry rewards due to having the largest mining sector size globally.

Emerging markets including Myanmar and the Philippines will continue to underperform, Fitch predicts. The two countries are characterised by weak mining reserves, poor regulatory framework, corruption and increasing resource nationalism.

Read the full report here.

The post Asia’s mining sector offsets risk with reward — report appeared first on MINING.com.