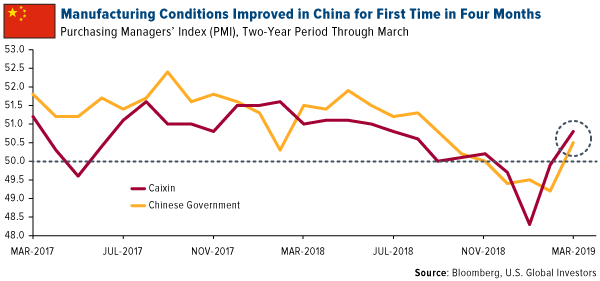

A resolution to the China-U.S. trade dispute is still in the works, but China’s manufacturing sector just returned to growth for the first time in four months, a sign that its government’s economic stimulus appears to be working. Both the private Caixin and official Chinese government purchasing managers’ indices (PMI) beat consensus by rising sharply above 50.0 in March, indicating factory expansion.

The strong upward move likely reflects the outcome of a record $83 billion China’s central bank injected into the financial system back in January. At the time, policymakers also signaled they may cut rates this year if the stimulus doesn’t bear fruit.

So far, it seems to be helping the world’s second-largest economy come off a weak end to 2018. According to research firm China Beige Book, the country’s economy showed “an unmistakable first-quarter recovery,” with company borrowing at its highest level since mid-2013.

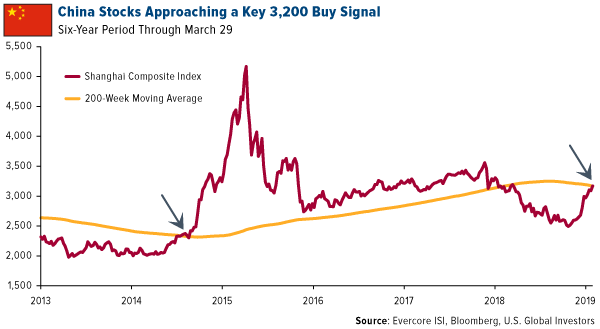

China A-Shares Nearing a 12-Month High on Trade Progress

Chinese stocks, as measured by the Shanghai Composite Index, climbed to a nine-month high last week and are currently up some 27 percent from their low in December 2018. On Friday, A-shares flashed a bullish sign by cracking their 200-week moving average for the first time since September 2014. In a report dated April 1, Evercore ISI analyst Rich Ross wrote that “a breakout above 3,200 will generate a bigger global cross asset buy signal.”

The rally is being driven by not only the stimulus but also record foreign investment and MSCI’s acceleration of China’s A-shares weighting in its Emerging Markets Index, according to the Financial Times. The country’s non-financial sectors received an all-time high of 885.61 billion yuan ($131 billion) in foreign direct investment last year, with inflows growing 25 percent year-over-year in December alone.

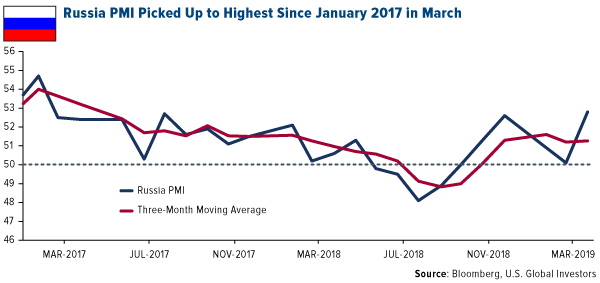

Factory Expansion Continues Elsewhere

China wasn’t alone in expanding factory activity last month. Russia’s PMI rose from a neutral 50.1 in February to 52.8 in March, its highest level since January 2017. Business optimism dramatically improved as rates of output and new orders accelerated.

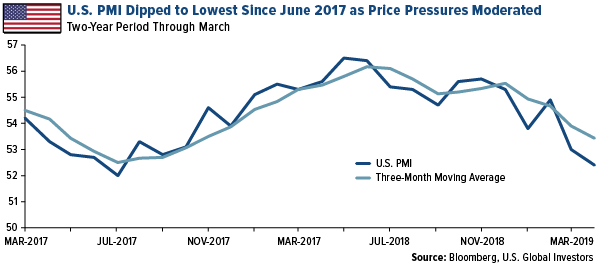

Here in the U.S., we saw an uptick in manufacturing growth in March, although at a slightly slower pace than in the previous month. A key factor behind the lower figure, according to IHS Markit, was a slower rise in output. “The rate of expansion eased to a marginal pace that was the weakest since June 2016 and below the series trend,” according to the monthly PMI report.

Input price inflation fell to its slowest pace since August 2017. Goods producers cited higher raw materials prices as a result of the ongoing impact of tariffs and greater demand for inputs. As expected, companies largely passed this increase on to consumers.

Want more timely insight into global markets? Subscribe to our FREE award-winning Investor Alert by clicking here!

The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. The Caixin China Manufacturing PMI (Purchasing Managers’ Index) is based on data compiled from monthly replies to questionnaires sent to purchasing executives in over 400 private manufacturing sector companies.

The Shanghai Composite Index (SSE) is an index of all stocks that trade on the Shanghai Stock Exchange. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.