A growing interest in Canada’s emerging cannabis sector, which spiked after recreational use of marijuana was legalized in October, is sucking investment away from mining and hitting juniors hardest, a new study shows.

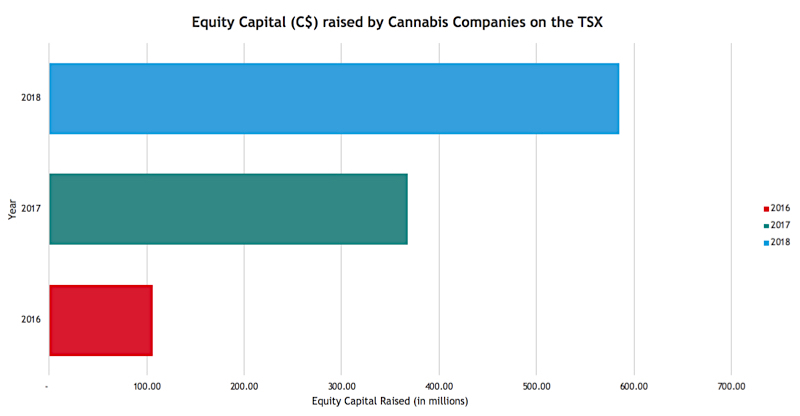

According to BDO Sherif Andrawes, investments in Canadian cannabis companies increased from C$43 million to C$770 million from the first half of 2016 to the same period in 2017, a massive surge year on year. In contrast, total mining companies listed on the Toronto Stock Exchange and TSX-V dropped 25% from 2017 to 2018.

The booming cannabis industry is sucking investment away from mining, and hitting juniors hardest.

“Industry investors traditionally attracted to the junior mining space now have a secondary option. Valuations are higher and forecast demand for the product is being touted in the billions,” the report says.

The analyst, in fact, found that financing for juniors has decreased by 58% for those listed in the TSX and 23% for TSX-V from 2017-2018.

The main problem, Andrawes says, is that investing in mining exploration faces the risk of demand ultimately outstripping supply, with the consequent price spikes and market volatility. Forecast consumption of metals in a world driven by the electrification of industries will inevitably go up, the report notes. But without junior miners being able to secure the right capital, the industry “will forever be stuck in the boom-bust cycle,” BDO warns.

Source: BDO.

While spending in exploration has increased in the past two years, it has been focused on brownfield projects, also known as near-mine assets, located in areas where mineral deposits have been previously discovered.

Struggling to find investors

“Raising money is extremely difficult,” Patrick Downey, head of Canadian junior gold exploration company Orezone Gold told Reuters in February.

For Downey, the current cannabis boom compares to the headwinds juniors faced during the dot-com bubble of the late 1990s.

The marijuana industry is the hot new space, with the promise of massive growth and returns.

BDO warns that if investors continue to shy away from greenfields projects, there would be a very limited number of new projects to be developed in the future, again causing a glut in the market.

The shift of capital is not necessarily negative for established mining companies or their financing prospects.

“The exploration business in Canada, among other sins, wastes way too much money on listing fees and general and administrative expenses,” Rick Rule, chief executive of Sprott U.S. Holdings Inc., told The Globe and Mail. “The hot money is going to go to the sector that’s yielded the most immediate returns. So the very marginal juniors are going to be outcompeted by cannabis.”

For BDO’s Andrawes there is enough evidence to conclude that risk capital has found a new home. The question now is, he says, how and where will junior miners will find the capital needed to sustain their businesses

The post Cannabis fad mows down Canada’s junior mining sector appeared first on MINING.com.