Source: Clive Maund for Streetwise Reports 03/28/2019

Clive Maund sees some rough waters with gold and discusses how to play it.

Note: This article was published on CliveMaund.com on March 27.

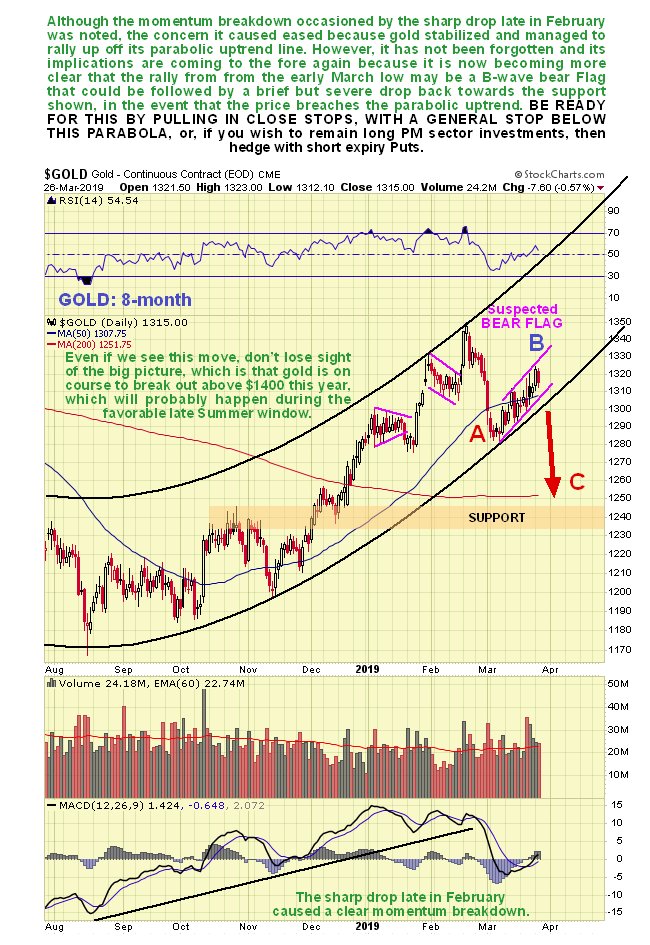

I have not been happy about the pattern that has been forming in gold since it plunged rather rudely and sharply around the end of February. The concern that was engendered by that plunge and the accompanying momentum breakdown, that we can see on gold’s latest 8-month chart below, were allayed by its managing to stabilize above its parabolic uptrend line and then rise off it. However, the rally this month has been hesitant and unconvincing, and it is now becoming clearer that it may be a B-wave bear Flag to be followed by a C-wave breakdown through the parabolic uptrend support line that would lead to a sharp drop probably towards or to the support shown in the $1240 area, where it would stabilize before later reversing to the upside again. If this is the scenario that is set to unfold, it is likely to happen soon, as the bear Flag looks about complete.

Obviously a near-term $70 or so drop by gold will inflict some pretty heavy damage on many precious metals stocks. We therefore require a strategy or strategies to deal with it. Basically the choice is to set close stops that take you out of most precious metals sector investments if gold breaches the parabolic uptrend, or alternatively, if you want to stay long, the losses can be cancelled out by hedging using Puts, using perhaps a mix of Puts in gold proxy GLD (SPDR Gold Trust) and in the gold miners 3X leveraged bull ETF NUGT (Direxion Daily Gold Miners Bull 3X Shares), where it should be noted that spreads are considerably wider than with GLD, and there are other possibilities.

If you get taken out of your positions due to such a drop, you then aim to buy them back at a better price as gold arrives at the support shown on our chart. Note that what is set out here overrides most comments made on individual stocks, which is because they are like sheep and tend to all move together during bigger sector moves. Finally, if you agree with what is set out here, you don’t need to wait to take this evasive action, and sell at lower prices by being taken out by stops, and also pay higher prices for Puts, you can take evasive action immediately. The scenario set out here would only start to be negated by a gold breakout above the top line of its bear Flag.

Posted at 7.40 am EDT on 27th March 2019 on CliveMaund.com.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years’ experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.