Invest now or later. Image by artemuestra

Gold was trading just shy of the $1,320 an ounce mark in overnight trade in New York on Thursday, a three-week high. The latest bounce comes after Wednesday’s Federal Reserve meeting confirmed market expectations that interest rates remain on hold for the rest of the year.

A panel of 22 gold analysts surveyed by FocusEconomics in March sees a gentle rise for gold in 2019 to average around $1,350 an ounce this time next year.

While gold’s prospects in 2019 are rosy if not spectacular, gold mining equities have hardly begun a run-up in value.

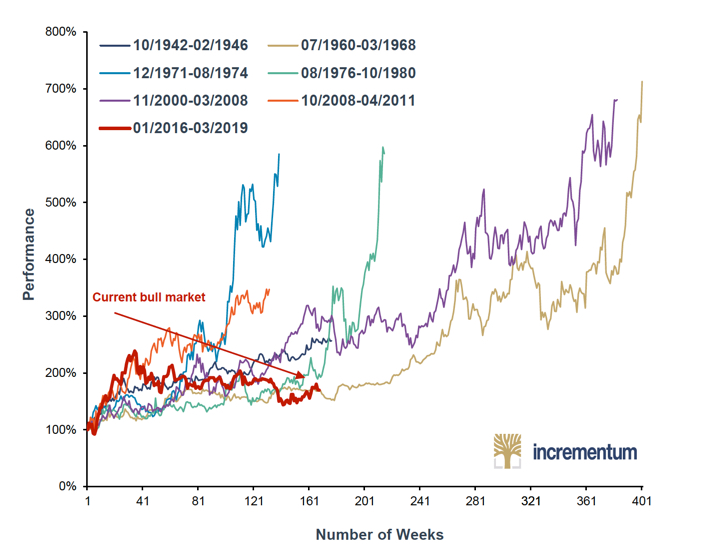

Incrementum’s 13th annual compact In Gold We Trust report released this week (the full 2019 handbook will launch end-May) analyzes the performance of gold stocks using the Barron’s Gold Mining Index stretching back to 1942.

The Liechtenstein-based asset managers points out that the current uptrend for equities in the sector is still relatively short and weak compared to previous rallies in precious metal stocks.

The chart shows there is still “plenty of upside potential” and the authors Ronald-Peter Stoeferle and Mark J. Valek believe gold bulls could be in for a pleasant surprise later in the current cycle:

The chart shows that every bull market in the sector ended in a parabolic upward spike which lasted nine months on average and resulted in price doubling at a minimum.

Source: Incrementum In Gold We Trust 2019

The post 77-year chart shows upswing in gold mining stocks have hardly begun appeared first on MINING.com.