I LOVE buying a stock that’s going up. And Pareteum (TEU)M-NASD has been one of the best performing stocks of 2019 so far – up an astounding 300%+ in the last two and a half months. (Sure beats oil stocks, and that’s why I’m looking here.)

I’ve watched the run – and the chart has been tempting. I’m not afraid to jump into a run after doing some due diligence hints at a higher valuation a year out. But I couldn’t bring myself to buy TEUM then, and I still can’t.

Why?

I just have too many questions.

And before I sound too self righteous here, I get that in one sense I’m wrong – one of my market lines is: At The End Of the Day, it’s The Tape That Matters. Price. And the stock has done fabulously well.

But you also have to go with your gut and be comfortable with your stock picks. One of my other lines is… The Market is about Peace First, and Prosperity Second.

I want to step through my thought process and tell you why I decided to take a pass on this stock. I think it’s worthwhile to know why I haven’t participated.

What They Do

Pareteum offers backend software to telecom service providers. Their customers are mobile service providers, IoT vendors, security system vendors and other over-the-top providers of telecom related services.

Most of their customers operate Mobile Virtual Network Operators (MVNO). An MVNO is a company that provides wireless communication to customers but does not own the network infrastructure. They rent bandwidth from one of the big guys, like AT&T or Bell Canada.

One of the larger examples of an MVNO would be a company like Virgin Mobile. But most MVNO’s are much smaller and operate local or regional businesses.

An MVNO often doesn’t want to to develop its own billing, customer service, marketing and sales software (collectively these are called operations support system/business support system, or OSS/BSS). So they purchase those products from a company like Pareteum.

QUICK FACTS

Trading Symbols: TEUM

Share Price Today: $5.21

Shares Outstanding: 102 million

Market Capitalization: $531.42 million

Net Debt: $5 million

Enterprise Value: $536.42 million

2019 Revenue Estimate $110 (mid range guidance)

Price/2018 Sales 4.87x

2019 EBITDA Estimate Positive – that’s all they said

POSITIVES

– Enormous $600+ million backlog

– Grew revenues from $4 million in Q1 to $14 million in Q4 2018

– Management forecasts huge revenue and EBITDA growth over next few years

NEGATIVES

– Hard to track down who customers are and how they generate such large contracts from them

– Difficult to reconcile revenue guidance

– Reason for sudden improvement in business prospects is difficult to pin down

– Acquisition forecasts appear to be aggressive

– Management background is murky

– Questions, questions, questions

BACKGROUND

Pareteum was a fledging business as recent as 2016. In late 2016, facing further losses, they completed a major restructuring that saw headcount reduced from 360 to 60.

At the time Hal Turner took over the reigns as Chairman of the Board. The turnaround that Hal has delivered since is nothing short of remarkable.

In 2017, after shedding ¾ of their workforce, Pareteum went from 2 customers to signing up 50 in 2017. They had signed up 72 customers less than two years later. Over the last year and a half Pareteum has amassed an amazing backlog of business that hit $615 million in February of this year.

It made me wonder how such incredible growth could be achieved on the backs of a bare bones staff?

Q4 18 Results

On Tuesday March 12 Pareteum announced their fourth quarter results. The stock jumped another 25% on the news.

That left with me even more questions.

My problem with the Q4 18 numbers are similar to those I had when I looked at the company a month ago. I see what I think are inconsistencies and missing pieces to the puzzle. It keeps me out of the stock even as the chart tells me to get in.

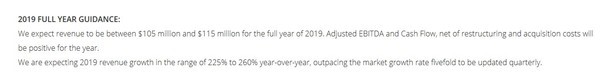

Take the 2019 guidance. Pareteum guided from $105 million to $115 million:

The top-line growth looks impressive. But it includes two acquisitions, something that isn’t mentioned in the press release.

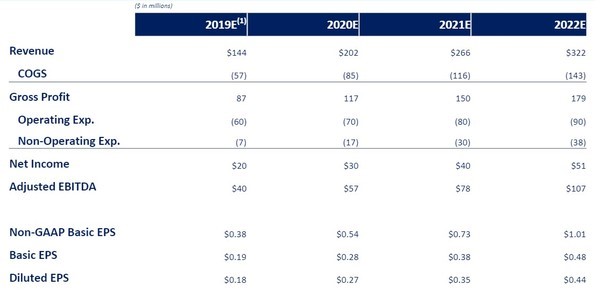

But even taking the numbers at face value, I’m left scratching my head. The slide below is from the December 2018 presentation.

In December the company guided to revenue of $144 million in 2019. Three months later, they drop guidance by 30%. And the stock goes up 25% that day. Huh?

What does management say about this?

Hal Turner, the Chairman of the Board at Pareteum, addressed it as follows:

“We operate our business daily with a management business case. That management business case significantly exceeds the initial quarter’s guidance that I’ve just given you. Also, we have an extraordinary business case, which incents everybody in our whole company to achieve materially higher revenues than are even contained in our management case.

“Finally, the operating management case and the extraordinary aspirational case, either meet in the case of the management case or exceed greatly in the case of the extraordinary case the SEC required iPass tender offer projections, which were used in setting forth our acquisition of iPass and contained revenue projections’ view that was based upon fairness opinions of our advisors and was used by our Board in the acquisition consideration.

I have never heard of management guidance versus “extraordinary aspirational guidance.” That is not mature CEO language, IMHO, and a Big Red Flag for me.

I believe Turner is trying to explain why guidance is lower than December. He’s saying it is because they have other internal numbers they expect to hit that are much much higher.

That would be okay, I mean plenty of management teams have a separate set of numbers for the Street. But they don’t share them. It’s not an internal forecast if its in the presentation.

Again, it’s a bit of a head scratcher.

Okay so let’s get past that and ask another question – is the difference between the press release guide and the December presentation guide really just a conservative SEC required projection as Turner suggests it is?

It doesn’t look like it to me.

The SEC does require a forecast as part of acquisition disclosure. Pareteum made two acquisitions in the last 6 months. One was a company called Artilium, which they completed in October. The second was for iPass, which they completed in February.

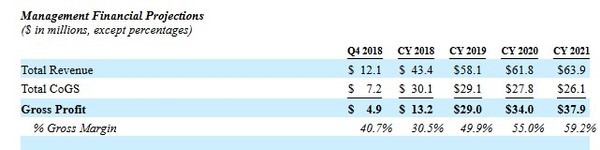

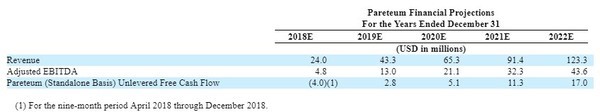

The forecast for the iPass business is below, from Page 69 of the S-4 disclosure:

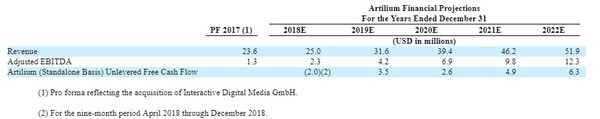

A similar disclosure for Artilium and the pre-acquisition Pareteum in the S-4 for that merger from August 3rd is here:

Adding up the 2019 estimates for iPass, Artilium and pre-acquisition Pareteum gives $133 million of revenue.

Now we have 3 different sets of numbers. And the SEC numbers aren’t the lowest.

We were told that the “operating” and “aspirational” guidance should exceed the SEC projections. But that’s not the case – at least as far as I can tell.

It’s a bit confusing, but I’ll go out on the limb here and say this was a lower guide.

Pareteum did layer in a real reason for the lower numbers. They chalked it up to a lower conversion of the backlog. From the conference call:

The 2019 number will be roughly in the $115 million range and as we look at our guidance relative to that. As we’ve got very good comfort in our ability to close roughly 80% of that, I would say 75% to 80% of that within this year.

They are expecting they can close on 80% of the backlog. That’s low for them. They have previously said that they would convert 100% of backlog.

But it explains the guidance.

Why are they converting less of the backlog?They gave some reasons, risk of implementation on their part (sounds like they are still developing features their customers want) and that of the customer, speed of customer subscriber ramps, dependency on local network connection, and the potential that some customers will go bankrupt.

THE BACKLOG

The backlog is worth digging into. The lynch-pin of the bull case is the huge and growing backlog. All the analysts point to the conversion of backlog into ever greater revenue.

It is impressive. Over the last year and a half Pareteum has amassed an amazing backlog of business. This year the three-year backlog hit $615 million!

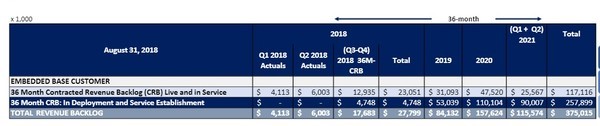

The last time Pareteum broke out the backlog by year was in their AGM presentation in September. It was $375 million at the time. Here it is:

What is curious about this table is that the 2019 revenue backlog is $84 million.

At a glance that makes sense – the guide was higher than that after all. But wait, Pareteum has made two acquisitions that are included in guidance. This backlog should be for pre-acquisition Pareteum as neither acquisition was closed. What’s more, Pareteum has added more than $200 million to the backlog since that time. One would think some of that would fall into 2019.

If we take the SEC projections for iPass and Artilium at face value, the 2019 guidance is only forecasting $15 million to $25 million for stand-alone Pareteum.

How does that align with this massive backlog? It’s actually lower revenue than stand-alone Pareteum had in 2018.

Again, I’m left wondering how to make the numbers work.

Who Are The Customers?

When the numbers don’t add up – I wanted to dig deeper. In this case, the details are the customers.

Pareteum typically does not disclose its customers. They tell us about a “UK Telecommunications Company” or a “US based Managed Service Communications and Network Solution provider”.

That’s fine. Lot’s of companies don’t disclose their customers.

But there were two press releases where Pareteum did give us names.

In the September 17th press release Pareteum announced the following:

They said they have signed contracts with 6 brands and listed 4 of them by name, including links to their websites:

I decided to check out each of these customers.

The Secure Watch link takes you to the www.mysecurewatch.com website, where we learn that it is this operation:

A quick google search of “secure watch” pulls up the instagram of Brandon Clyde, who appears to be the owner of the establishment. Brandon posted this picture of his new business February 6th:

The obvious question is: what happened to mysecurewatch?

In case there was any doubt, Brandon posted this back in July:

He branded to SecureWatch in July and six months later rebranded again.

This isn’t necessarily good or bad, but it does add questions for me. (And I’ve only got so much time for due diligence!)

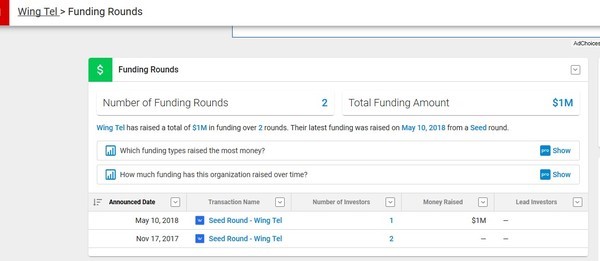

Then there’s Wingtel. Wingtel was a start-up in 2017. They have raised $1 million in funding over the past two years.

While Wing Tel appears to be a legitimate MVNO, it does not appear to be very big. This article, written in June, notes “hundreds of happy customers”.

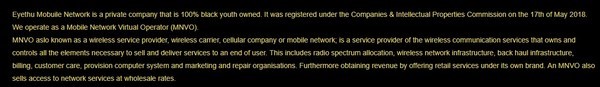

The third company in the list, Eyethu Mobile, (which is misspelled Eyethu Mobuile on their own website below) is an MVNO in New Zealand. But MVNO might be using the term loosely.

Eyethu was registered May 2018:

It’s a bit hard to read so here is what it says (including spelling mistakes):

“Eyethu Mobuile Network is a private company that is 100% black youth owned. It was registered under the Companies & Intellectual Properties Commission on the 17th of May 2018.”

Eyethu goes on to say says that they will launch their service at some point in 2019. They aren’t actually a revenue generating busines yet:

Company #4 is ACN Europe. They are the most likely revenue generating business of the four. ACN Europe provides telecom services to customers. They are based in the United States but expanded to Europe in 1999.

ACN is also a multi-level marketing business (like Amway, Arbonne and such) and like most of these businesses, they have been accused of being a pyramid scheme (by the state of Montana in 2010). The New York Times recently linked ACN to US President Trump in an article discussing “usage of the Trump name in sham business opportunities”.

According to a lawsuit launched in late 2018, ACN was one of the companies that secretly paid Trump to promote them. Evidently, ACN required investors to pay $499 to sign up to sell its products, like a videophone and other services, with the promise of additional profits if they recruited others to join. Please note that ACN is not accused of anything in this lawsuit.

A quick search uncovers that most “independent sales people” that pay the $499 don’t ever make it back.

ACN offers mobile services through its MVNO subsidiary JOi Telecom. Joi was launched in 2014 and operates in the United Kingdom and France.

JOi offers low cost, entry-level 3G device services. There doesn’t seem to be much information available on how big JOi Telecom is. There is zero press on the company since 2015.

Reviews are sparse which is a stark contrast to other UK MVNO’s I looked at, where there were multiple reviews.

The user reviews are full of unfavorable references with the word “scam” used frequently.

Together these four companies are of the 6 making up $50 million of backlog.

On to the second press release.

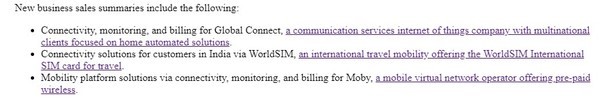

On October 23rd Pareteum announced $11 million of new business:

As in the first case, Pareteum only names 3 out of 5 companies. So we can’t be sure what portion of the $11 million these companies represent:

First, Global Connect. When I attempt to access Global Connects website I am warned by Chrome:

On to WorldSim. WorldSim is a sim card distributor that promises worldwide connectivity. They sell sim cards out of the United Kingdom.

It’s hard to know how big WorldSim is. Their LinkedIn account notes 22 employees. Owler, an online business intelligence service, says their annual revenue is $6 million. While it appears to be a legitimate business, it doesn’t look like it’s very big.

Finally the website for Moby doesn’t work, but redirects you to Mobi.com, which they have apparently rebranded to.

Mobi is a wireless MVNO in Hawaii. They are “proud to help connect thousands of families, friends, and colleagues across Hawaii. They list two retail locations on their website, but one appears to be closed. Their head office on the website is this building:

Does it add up?

As good as the backlog looks, its only as strong as the customers that make it up.

I can only examine a tiny sub-set of the customers that make up the backlog. Even from the two press releases where they did name names, I am only looking at 3 out of 5 and 4 out of 6 customers.

It’s entirely possible that Pareteum has some premium customers making up the majority of the backlog from these two press releases and across the rest of the backlog.

The problem for me is I can’t validate that. Which makes the stock tough to buy.

iPass

Apart from questions about revenue conversion and questions about backlog, the other questions I have revolve are about the acquisitions. Particularly iPass.

iPass has a fairly straightforward business: they provide Wi-Fi access in hotels, airports, convention centers, trains and cafes.

Venues pay iPass for access to the Wi-Fi network. Payment options are either fixed unlimited or pay-as-you-go. The venue embeds the cost to customers as part of their pricing or charges directly based on usage.

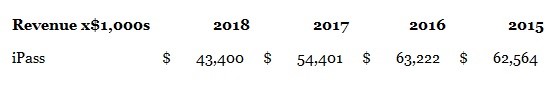

Here is iPass revenue since 2015:

The business appears to be in significant decline.

It is not surprising. Customers are getting less fees from their Wi-Fi platforms. Pay as you go Wi-Fi is being replaced by complimentary Wi-Fi. Data charges from carriers are low enough that users balk at expensive Wi-Fi.

In their disclosures iPass notes that partners and customers are lowering their minimum commitment fees on renewels and even requesting a re-evaluation of these commitments on existing contracts.

Because iPass generates fees by turning wholesale bandwith into retail Wi-Fi, this is a low margin business.

Gross margins were only 26% in the first nine months of 2018. They’ve been in decline since 2012, when they were as high as 50%.

One way iPass has stemmed its revenue decline is by signing customers up to unlimited, flat-rate plans. Yet they pay network providers based on usage. This sets up the potential for further margin decline if usage shrinks, and makes it difficult to see how the company ever turns to profitability.

The decline in business has weighed on the stock. iPass fell from being a $13 stock in July 2017 to trading at less than $2 late last year before being acquired by Pareteum.

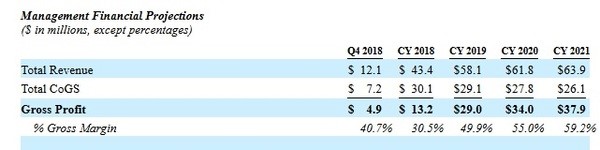

Yet Pareteum is expecting a remarkable turnaround in the business. This is from the SEC projections. Revenue is expected to increase more than 30% in 2019 and gross margins are expected to rise to 50%.

Yet Pareteum doesn’t appear to be investing in the business. In fact, just the opposite.

On the Q4 call one of the analysts asked management whether with all the new backlog business they would have to hire more development resources. Not so, Turner said. They can use the iPass employees. Speaking of using the iPass employees, Turner said:

“And this is an extremely important point. We gained 75 developers and network cloud personnel to help deploy and what was at the end of the year was $650 million and growing 36-month contractual revenue backlog is extremely important.”

So Pareteum can allocate iPass employees to their own backlog while at the same time growing the iPass business… is hard for me to comprehend.

CONCLUSIONS

The upside here is substantial – if management meets their “extraordinary aspirational guidance“. I don’t doubt that. If Pareteum is successful with the following, the stock is a screaming buy:

- Converting backlog to revenue

- Meeting their revenue and EBITDA growth forecast

- Meeting their Artilium and iPass growth forecast

- Realizing anticipated synergies for these companies

The problem I have is believing they can do this. There are so many oddities with this company that I just don’t know. I didn’t even touch on their failed blockchain idea of December 2017 (which took the stock from 60 cents to over $3 in a couple weeks).

The one real thing that Pareteum can hang its hat on is that they did grow revenue in 2018. Revenue was $4 million in the first quarter and up to $8 million in the third quarter.

But even that has questions. Revenue rose again in the fourth quarter to $14.3 million. But $5 million of that came from Artilium.

Look, I can point to 5 brokerages that all believe Pareteum is going to continue to grow and that 2019 will be a break out year.

That may be the case. They certainly have the backlog to do it.

But given the information I have, I have to pass.

DISCLOSURE: I am NOT long or short Pareteum, but I DID have more fun trying to figure out this company’s story than studying oil stocks.

Keith Schaefer

Publisher, Oil and Gas Investments Bulletin

Copyright © 2011

This feed is for personal, non-commercial use only.

The use of this feed on other websites breaches copyright unless you have written permission from Keith Schaefer of Oil and Gas bulletin to republish. If this content is not in your news reader, it makes the page you are viewing an infringement of the copyright. (Digital Fingerprint:

3r5723475234957asdgvaisduthadsfg)