Zinc prices climbed to $2,845 a tonne on Wednesday after data showed LME warehouses now hold little over 58,000 tonnes of the metal; less than two days’ worth of global consumption.

Inventories are down 55% this year and is on course to reach levels last seen in 1990. Zinc stocks peaked in 2012 at the height of the commodities boom reaching 1.2 million tonnes.

Inventories held by the Shanghai Futures Exchange are more plentiful, but low inventories of many metals in LME-registered warehouses are helping to bolster prices despite weak economic data from top metals consumer China, Reuters reports:

“The exchange stocks being at very low levels are understandably keeping many market participants on edge about the outlook when there has been speculation that a (US-China) trade deal is near,” Ross Strachan, senior commodities economist at Capital Economics in London told Reuters.

Last year China imported 713,000 tonnes of zinc – the second consecutive year of record imports.

Today’s price for zinc, used mainly to galvanize steel, compares to an all-time high of $4,580 struck in November 2006. During the depth of the global financial crisis zinc came close to falling into triple digits.

Source: Reuters

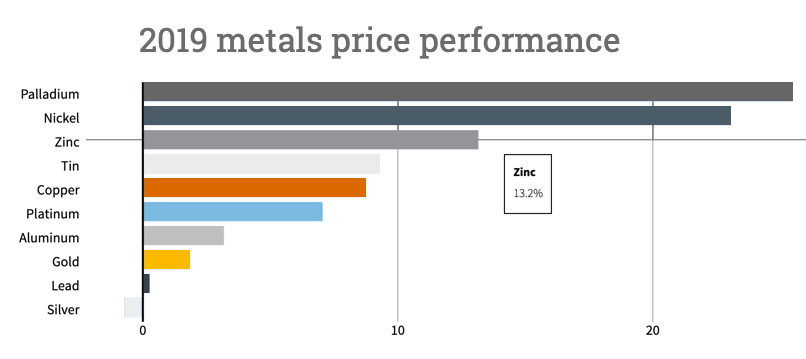

The post Zinc price builds on 2019 rally as stocks reach just 2 days consumption appeared first on MINING.com.