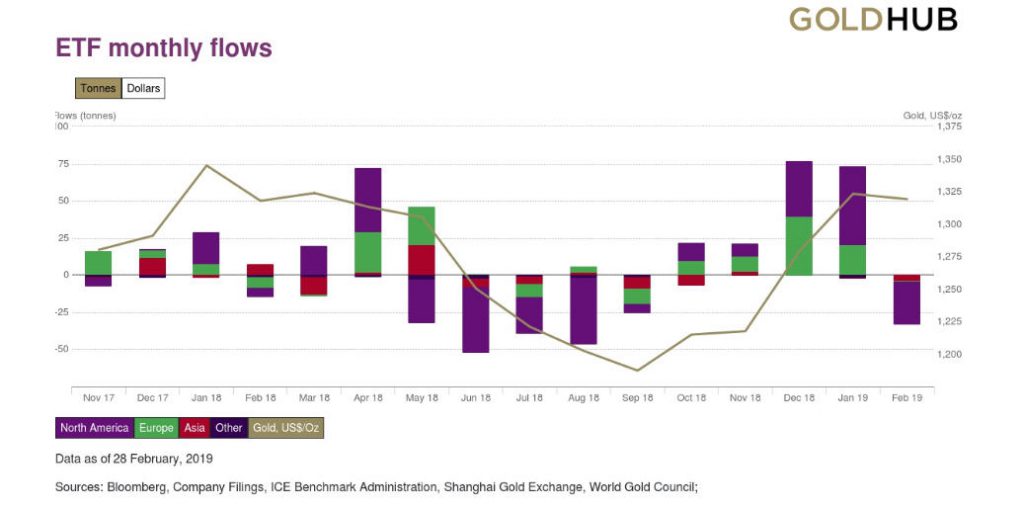

After four straight months of inflows, holdings in global gold-backed ETFs and similar products fell in February by 33 tonnes to 2,479t, equivalent to $1.3 billion in outflows, and gold trading volumes decreased 5% below the 2018 averages to $104 billion per day, according to data from the World Gold Council (WGC).

However, global gold-backed ETF flows remain positive on the year ($1.7 billion) on the back of strong inflows in January.

“Despite a recovery in the stock market during January, investors globally remained concerned about the December rout. By February, some investors, especially in the US, gained a greater sense of comfort and flows started coming into stock-based as well as broad-based funds, and out of gold,” Juan Carlo Artigas, Director of Investment Research, WGC, told MINING.com.

“By the end of the month, rates increased as bond markets re-adjusted their Fed expectations increasing the opportunity cost of maintaining large exposure to gold. Finally, in the US, where the outflows were concentrated, there was likely profit taking from more tactical gold positions. However, many low-cost gold-backed ETFs, which are often used by strategic investors, continued to see net positive flows,” Artigas added.

Institutional and retail investors have piled into gold in recent months. Holdings in global gold-backed ETFs rose 72 tonnes in January to reach 2,513 tonnes, hitting the highest levels in nearly six years.

“Gold-backed ETFs and similar products account for a significant part of the gold market, with institutional and individual investors using them to implement many of their investment strategies,” Artigas said.

There are more than 80 gold backed ETF’s around the world, accounting for about 2,440 tonnes of gold. Purchasing gold-backed ETF’s is an alternative to buying coins. In February, SPDR Gold Shares led global outflows, losing 40t ($1.7 billion), while iShares Gold Trust added 7t ($299 million) followed by SPDR Gold MiniShares adding 3t ($122 million).

“[While] investors can access gold in many ways, I think what we are seeing is that towards the end of last year, North American investors started to use gold-backed ETF’S to get exposure to gold as they saw certainty increase, but you have also seen a more consistent approach from European investors,” Artigas said. “Gold-backed ETFs have been an important part of the story of gold for the past decade. They have been contributing to new demand for gold and continue to be relevant.”

The post Gold-backed ETFs fell in February, following four months of inflows appeared first on MINING.com.