Source: Maurice Jackson for Streetwise Reports 03/10/2019

Judson Culter, CEO of Rover Metals, speaks with Maurice Jackson of Proven and Probable about historical exploration on his company’s properties, as well as current exploration plans.

Maurice Jackson: Welcome to Proven and Probable. I’m your host, Maurice Jackson, and joining us for our conversation is Judson Culter, the CEO and director of Rover Metals Corp. (ROVR:TSX.V; ROVMF:OTCQB). Mr. Culter, welcome to the show.

Judson Culter: Thanks for having me, Maurice.

Maurice Jackson: Glad to have you back on the program. We last spoke in January of 2018, and since then Rover Metals has completed its IPO and implemented a methodical process of building an exploration company that is positioning itself for success from land acquisitions, permit approval, OTC listing, option agreements and completed the first phase of the 2018 exploration program. But before we begin, Mr. Culter, for first time listeners, who is Rover Metals?

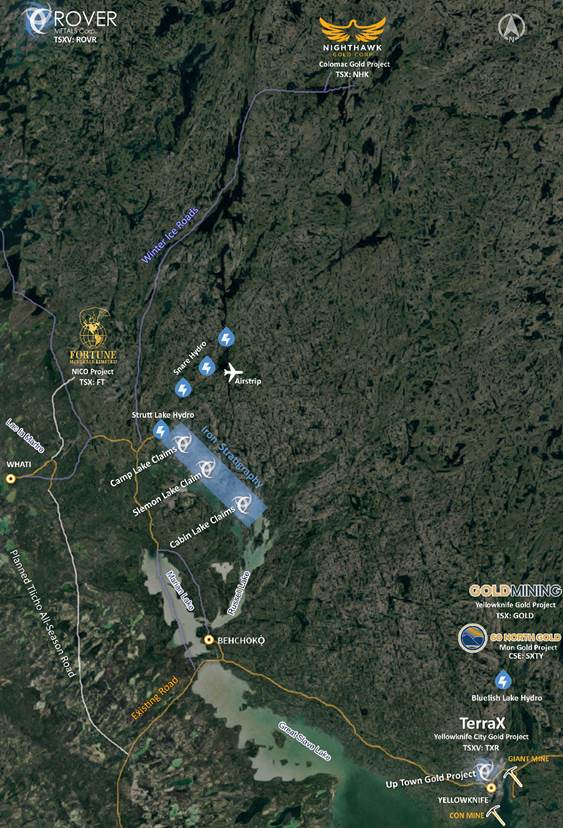

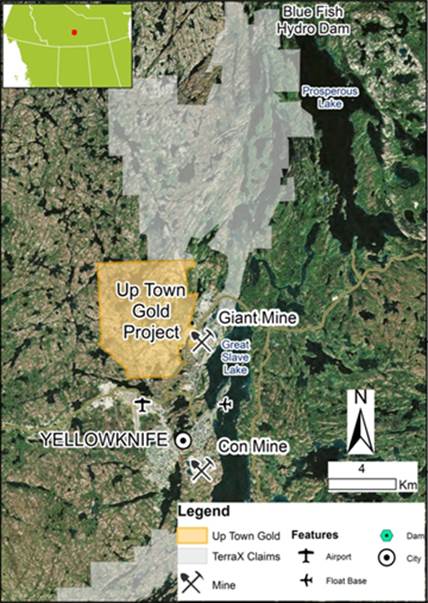

Judson Culter: Rover Metals, we are a precious metal exploration company, specifically gold is our focus currently. We’re co-listed in the United States OTCQB: ROVMF, as well as Canada on the TSX.V ROVR. Our project portfolio is concentrated in and around Yellowknife’s Northwest Territories, one of the most mining friendly jurisdictions in Canada and for North America for that matter. I say that just because that’s where our (Canada’s) diamond mines are. That’s historically where several of our gold mines have been. It’s really the primary employer in the Northwest Territories. Outside of government, mining is it.

Maurice Jackson: Why has Rover Metals received so much interest here of lately?

Judson Culter: I think that’s a two pronged answer. First is just credibility. Going back to 2017 on call with you, Maurice, if one listens to that interview, we talked about how we were going to go public, and how we were going to drill our resources, and how we were going to look to add new resources in the similar area code of Yellowknife.

We’ve successfully accomplished all those tasks. I believe we have strong foundational base in our existing shareholders. We’ve got a lot of credibility with them. We get a lot of word of mouth. I think that goes a long way in a market that can be a little bit over saturated in the junior mining space with which projects or which management teams do you back. I think really that we’ve gotten recognition for that now, which is really helping to drive our current success.

The second prong answer speaks to the projects themselves. Rover has the Cabin Lake Project, which is really what the market is asking for, and that’s why we bought it. When we receive the results from our drilling, we believe we will a high-grade gold historical resource that will contain super high grades that the market wants to see as confirmation that this really could be the next gold mine in the Yellowknife, Northwest Territories.

Not to mention this project itself has all the merits a speculator wants. We have solid infrastructure, the Blue Fish Hydro Dam, roads, all the accessibility and proven area of past producers. The market is beginning to recognize the credibility of the management team and the assets. Also, the awareness that we are near drilling in the not-too-distant future has investors’ attention as well.

Maurice Jackson: Justin, what is the driving thesis for Rover Metals in regards to the Kevin Lake gold project?

Judson Culter: The driving thesis has not changed. It’s the same thesis as in the late 1980s. There’s a project called the Lupin Gold Mine that produced from 1983 to 2003 in the north, which is an iron formation, super high-grade gold. The thought at the time was to go and find another one, and that’s what they thought they had here. This is when Cominco and Freeport McMoRan and then Aber Resources, that’s what they thought they had here. They drove 7,500 meters of at or near-surface iron hosted high-grade gold. The only reason they stopped is because somebody found kimberlites a few years after, and the diamond boom in the Territories began.

This project just kind of sat on the back burner as a result of that. Aber Resources, the owner of the time, of course, went on to find the kimberlites. That’s some historical context on this project and why it’s just now coming back to life.

Maurice Jackson: Talk to us about the business acumen here. When and how was Rover Metals able to acquire the Cabin Lake gold project in such a highly contested and sought out district?

Judson Culter: It wasn’t easy; when we looked at the business case, we figured that with a little bit of just rolling up our sleeves, and getting up there, and meeting the right stakeholders, and just recognizing that this is an area that needs new mines and new projects.

I didn’t think it would be like other areas in British Columbia, for example where BC, trying to get First Nation endorsement can be very difficult. There’s so many competing industries that people can really make a way of life in a jurisdiction like British Columbia, whereas knowing a little bit about the Northwest Territories, mining is a big deal up there. People want to see projects succeed.

When we went into the Cabin Lake project, we knew we had to get a couple of things there to get permits. We knew we had to get our neighbors, Tlicho First Nations, on board. We also did our homework and knew that the Tlicho First Nations had previously worked with Fortune Minerals, as well as Nighthawk Gold. When we got to it, there was a framework in place. There was a government that had been formed.

The Tlicho government and the land use formal plan to work within, for application permits, and applications. So, once we got to it, it ended up only being four months to get it permitted. I think it seemed to keep getting easier for us, and it ended up being a decision that looks like it was the right one to make.

Maurice Jackson: Regarding mineral rights in your project portfolio, are there any reversionary interests?

Judson Culter: There’s a 1.5% NSR that we’ve got viable down to a half percentage point for CA$250,000 per quarter percentage.

Maurice Jackson: And does Rover Metals own the mineral rights outright 100%?

Judson Culter: That’s correct. Yes, not just at Cabin Lake, but at the Cabin Lake group of projects. The claims themselves are 10 kilometers apart; so there’s three of them. For the entire group of projects, yes, we have 100% mineral right interest.

Maurice Jackson: Let’s fast forward to 2018 and discuss your exploration program. What were the results from that program and how has that improved the confidence in the gold project?

Judson Culter: It helped us to better track the iron information. So what we did was we spent the six months from March, when we acquired the project, into October, really to digitize all the historical records. At the time in the 1980s, that was meticulously kept, and it was handwritten. We digitize seven banker boxes of data, as well as three map boxes. Then, we put that in a GPS, and tag the colors and everything else.

Then what we wanted to do to follow on with that data was to run a current, modern-day geophysical program. There were a lot of options to us to do it, but in a really economical manner, but also to do it in a very detailed type formation using a drone. Because the mineralization occurs at or near surface, as well as the iron information itself being at or near surface, it really showed up well on the magnetic survey that we flew over the property. So by interlaying the drill results, as well as the mag survey, our geologist was able to get a better interpretation of the iron formation throughout the project. Really, that really set the stage for where we are going to put the drill when we get to drilling this year in 2019.

Beyond just the iron information, what we also realized about the project is the outcropping on either side is quartz. Historically, the quartz had never been tested for mineralization. So we also did a geochemistry program in October. What that showed us is that the PPM and PPB reading of gold from the quartz outcrop area suggest that it’s also very likely to be a host for gold on this project. It’s never been tested historically. That’s the excitement of 2018 and what’s led into the 2019 drill program, which was always trying to be between March and the end of April. We’re still trying to hold on to that deadline.

We’ve got the collars is ready to go. Right now, we believe what we need to do to start drilling is conduct a small financing that we’ll probably release in the coming week or two here.

Maurice Jackson: So to review the value proposition we had before. This is potentially an open-pitable, early-stage brownfield exploration gold project with historical high-grade resource next to a new cobalt-gold mine, is that correct?

Judson Culter: Yes, and that’s one thing I didn’t touch on is the actual historical resource itself. That’s 85,000 ounces unconfirmed in terms of what our current standards allow us to document as a historical resource. What we’re allowed to document in press releases and everything else is 50,000 ounces of roughly 10 to 12 grams gold per ton. The rest of that 35,000 ounces was never signed off by a Qualified Person, but it is in the NORMIN database in the Northwest Territories. It’s in the areas of the Andrew zone, which we’ve documented. Rover will do the work we need to do under 43-101 standards to take that other 35,000 ounces and get it compliant.

From our side internally, we see it as an 85,000 ounce of resource of 12 grams per ton gold on average. When we talk about it publicly, we have to say, 50,000 from a historical resource perspective, but you’re absolutely right that we’re 20 kilometers away from what’s looking to be Canada’s first cobalt mine. The reason I say that is this project’s been 20 years in the making; it’s at the feasibility stage. I believe they’re really just looking to raise the capital to get to work. It’s an open-pitable cobalt mine. The good news is it’s actually a cobalt gold bismuth. So there is a gold processor that’s going to be built 20 kilometers from us. What better news can you possibly have when you’re developing an at-surface resource?

Maurice Jackson: The location in of itself makes the opportunity quite interesting, but to have open pit to me is icing on the cake. Is the goal to sell the project or develop into a commercial scale mine?

Judson Culter: Definitely the goal is to sell it within the next three years, and so I want to put $10 million in the ground, and let’s get this wrapped up and sold. End of story.

Maurice Jackson: What can you share with us regarding the infrastructure?

Judson Culter: So what you see in Yellowknife right now is what’s going to be coming in the pipeline in the next two to three years in the Pine Point Zinc mine is going back into production and that’s Osisko. Part of that is twining the costs in Taltson Hydro Dam and bringing that into Yellowknife itself, as well as Hay River. There’s going to be federal funding allocated, as well as territorial, to do an environmental study that should be announced through fairly short order this year.

After there is a federally funded environmental study to evaluate the twinning of the Taltson Hydro Dam, a successful outcome will lead into a hydro power upgrade to Yellowknife. When Yellowknife is upgraded, that will free up excess hydro power at the Snare and Strutt Lake hydro dams, located approximately 5km away from Camp Lake, one of our claims that’s part of the Cabin Lake group. That power becomes excess power. All of a sudden that frees up for the future the viability of really selling the project because now you’ve got excess power sitting right there, five kilometers away. How good is that?

Maurice Jackson: Switching gears. Rover Metals’ board of directors and advisors consists of the following people:

Maurice Jackson: Bios for the management time are below:

Maurice Jackson: Let’s discuss some numbers. Please share your capital structure.

Judson Culter: We’ve got 47 million shares out today. That’s our issued and outstanding common shares. There are warrants out there. We have 10 million warrants at $0.20 cents, and 10 million warrants at $0.25 cents.

Maurice Jackson: How much cash and cash equivalents do you have?

Judson Culter: Treasury is sitting today around CA$450,000. Then, there’s been some prepayments for upcoming work commitments regarding our exploration plans for this year, as well as I mentioned, we’re doing a lot of our growth in terms of our marketing and our shareholder base in the United States. I think our prepaid balance, if you were to look at that today, should be around CA$200,000, just in terms of for events, as well as I mentioned, exploration planning. If you add that back to our cash position, we’re around CA$650,000 in current assets.

Maurice Jackson: What is your burn rate?

Judson Culter: Our burn rate’s about CA$30,000 a month, and that just includes all in. We purposely don’t carry an office in this market. We’re a bootstrap company. We have home offices, and then we’re on the road a lot. We’ve got an exploration office that is free from our exploration partner, Aurora Geosciences. That’s really where a lot of the hard work gets done. Then, there’s just no corporate office. I don’t feel the need for that, so that helps.

Maurice Jackson: How much debt do you have?

Judson Culter: We have some trade payables of, I think it’s roughly CA$40,000 that we’re going to settle in shares. Outside of that, we’ve got CA$25,000 in payables on top of that, that we’re going to pay in cash. That’s just some exploration legacy from last year.

Maurice Jackson: Who is financing the project, and what is their level of commitment?

Judson Culter: Just sophisticated mining investors. It’s been high net worth, accredited investors to this point. That will continue until we become a $10 million market cap company plus, because we’re just still not able to access institutional funds, and that’s fine. If Rover does everything that we hope to accomplish in the next drilling phase, which we hope is in the next 60 to 90 day window here, we should be a $10 million market cap plus company; and well on our way to institutional money.

Maurice Jackson: Who are the major shareholders?

Judson Culter: I’m a major shareholder. I’ve been seeding Rover not just with time, but my own money; since really inception in 2014. Tookie Angus, who is an advisor, is currently our third largest shareholder. Then, it really starts to break down to smaller tranches, but there is a notable name on the list: Ashwath Mehra, the chairman of GT Gold; he’s a relatively large shareholder.

Management, including Ron Woo. Ron’s also seeded this company. I think Ron’s probably fourth largest shareholder. Keith Minty’s a large shareholder; 38% of our outstanding shares are owned by insiders, management, board. That’s a good thing because that means our shares are tied up for three years.

Maurice Jackson: Judson, based on the data available, what type of value proposition do we have in comparing?

Judson Culter: Well, the market price, let’s just say, I think it should be $8.5 million, just on what we set out today. That’s my personal opinion. I think later value that, that’s just the reality of reserve stocks in North America. We’re going to do what we need to do to take that historical resource and bring it up to current standards, as well as to just extend where they stopped drilling, and just show them this really is a multimillion ounce potential asset.

I think we can get there with the drill program that we’re planning. We’re planning roughly a thousand meter program. I think the value proposition is we’re in a $3.5 million market cap today. I think we’re going to take it to $10 to 15 million in the next six months. Hold me to that.

Maurice Jackson: I certainly will, sir. Multi-layered question here: what is the next unanswered question for Rover Metals? When can we expect the response? How much will the response cost? What determines success?

Judson Culter: That’s going to be our Q1 or Q2 exploration drill campaign. I was going to caveat that, that is subject to the future success of our financing effort (click here), which we hope to announce in roughly two weeks’ time.

That will lead into confirmation of the historical high-grade gold results, such as the open-pit economics, expand upon the known mineralization in the iron formation, as well as to prove up a larger area play and this is more Q2/Q3 work, for the Slemon Lake, and Camp Lake claims, which are located 10 kilometers northwest from Cabin Lake, and we’ll fly that with an aerial B10 survey. What that will show is that the drilling we’ve done at Cabin Lake in the iron formation really just, those other two claims, or districts, an extension of the same geology, which everything that we’ve read historically shows us it is.

Maurice Jackson: Mr. Culter, please share the contact details for Rover Metals.

Judson Culter: Please visit our website www.RoverMetals.com. On there, you’ll find our social media links, which are LinkedIn, Twitter, our Facebook page and CEO.ca.

Our social media channels really have daily content. We’re press releasing every couple of weeks, but a lot of our investors like really the daily updates on what’s going on in the Northwest Territory. That’s the best place to stay tuned.

You can also submit to our mailing list. We typically will do an email update every two weeks as well. If you go to the bottom of the homepage on the website, and just submit your email, that subscribes you to our email mailing list.

Maurice Jackson: And last but not least, please visit our website, provenandprobable.com, for mining insights and bullion sales. You may reach us at contact@provenandprobable.com.

Judson Culter of Rover Metals, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Rover Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.

( Companies Mentioned: ROVR:TSX.V; ROVMF:OTCQB,

)