Here at U.S. Global Investors, we’re politically agnostic. We believe there’s money to be made no matter which party is calling the shots. That’s why we focus on government policy instead of partisan politics.

Having said that, I think most of you would agree that there’s lately been a change in some American voters’ appetite for socialist-leaning policies.

|

Need proof? A Gallup poll from August of last year found that, for the first time in modern memory, Americans aged 18 to 29 are more positive about socialism than they are about capitalism. Fifty-one percent preferred the former compared to 45 percent for the latter.

I don’t need to remind you that socialist policies are naturally anti-business and anti-private property, and they create all sorts of friction in the formation of new capital. A “threat to U.S. equity valuations is emerging in the form of left-wing populism in America,” writes Christopher Wood in his widely read GREED & fear newsletter.

Again, we believe extremism at either end can raise huge obstacles for business and investors. The difference, though, is that hard-left legislation seeks to punish wealth and prosperity through politics of envy. Amazon, one of the world’s most valuable companies, was driven out of New York as if it were the plague. The online retail company came under additional fire last week when Massachusetts senator Elizabeth Warren said she would break up giant tech firms if she were elected president.

At their worst, socialist policies can destroy entire economies. Just look at Venezuela. It’s hard to believe now that the beleaguered country was once the wealthiest in South America.

“There is the dark side of it,” Canadian psychologist Jordan Peterson once said of socialism, “which means everyone who has more than you got it by stealing it from you… ‘Everyone who has more than me got it in a manner that was corrupt, and that justifies not only my envy but my actions to level the field,’ so to speak… There is a tremendous philosophy of resentment that I think is driven now by a very pathological anti-human ethos.”

Still Strong Pushback Against Socialism in the U.S.

“America will never be a socialist country,” President Donald Trump proclaimed during last month’s State of the Union address. The remark appeared to have been directed squarely at the raft of newly elected lawmakers who seem to be cut from the same cloth as “democratic socialist” Bernie Sanders.

The 77-year-old Vermont senator, by the way, just announced that he would be seeking the White House for a second time—and raised a whopping $6 million within the first 24 hours.

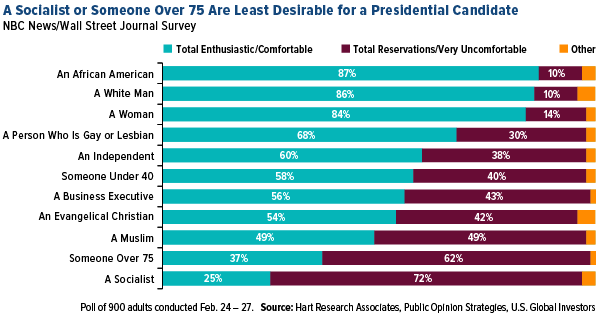

Despite his success in 2016, Sanders’ candidacy might be a hard sell for most Americans this year, as a recent NBC News/Wall Street Journal Survey showed that a majority of voters wouldn’t be too keen on having a socialist president or one who was over the age of 75. Close to three quarters of respondents either had “total reservations” or were “very uncomfortable” about the idea of voting for someone who self-identified as a socialist, as Sanders does.

At the same time, Sanders’ highly publicized bid for the White House during the last cycle appears to have galvanized some lawmakers and encouraged them to creep even further left. The Green New Deal (GND) is one such example.

The $93 Trillion Green New Deal

The GND resolution, if passed and signed into law, would radically transform day-to-day life here in the U.S. Reforms include “zero-emission” transportation, universal health care, guaranteed jobs and guaranteed “green” housing.

Photo: Dimitri Rodriguez /flickr | Creative Commons Attribution 2.0 Generic (CC by 2.0) |

These goodies might sound appealing to some, but they won’t come cheap. Universal health care alone would cost the U.S. government as much as $36 trillion between 2020 and 2029, according to calculations made by the American Action Forum (AAF). That amounts to $260,000 per household.

And the price tag for the entire package? An unfathomable, eye-watering $93 trillion.

Many of you are no doubt aware that the GND is co-sponsored by Alexandria Ocasio-Cortez, the 29-year-old freshman representative from New York’s 14th district who was among the most vocal critics of Amazon moving into her neighborhood.

Like Sanders, she identifies as a democratic socialist.

As some people have pointed out, “AOC,” as she’s often called, has no financial licenses or MBA. She’s not a fiduciary. And yet if she and other socialist-minded lawmakers get their way, the American taxpayer could be saddled with the single largest spending package the world has ever seen.

Further, did you know that AOC recently won a seat on the powerful House Financial Services Committee? The committee, chaired by Representative from California Maxine Waters, has oversight over all things Wall Street—from banks to insurance, from money to credit, from securities to exchanges.

Private Equity Has Grown Twice as Fast as Public Markets

According to the AAF, the regulatory cost of the GND would be at least $1 trillion. And that’s on top of the trillions that already-in-place rules and regulations sap from American companies every year.

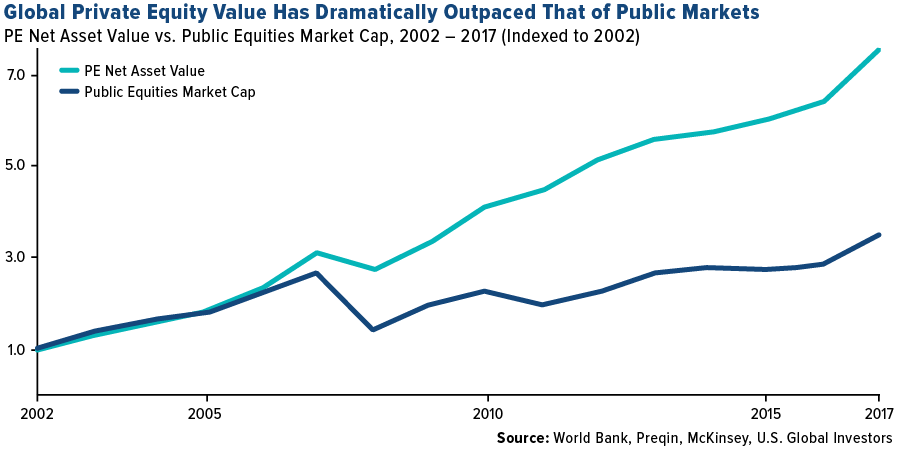

It’s little wonder, then, that more and more companies are choosing not to list on public markets. I’ve written about this a number of times before. Simply put, tougher and costlier regulations have largely contributed to the boom in private equity (PE)—not just in the U.S. but across the globe. According to a recent McKinsey report, private markets have grown 7.5 times so far this century, or twice as fast as public market capitalization.

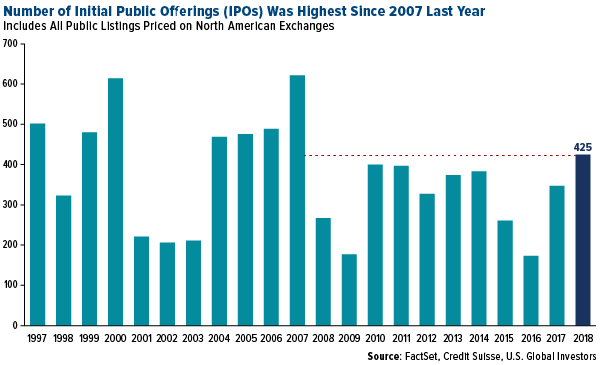

Here in the U.S. and Canada, the number of companies that publicly listed rose to an 11-year high in 2018, thanks to more business-friendly policies. The initial public offering (IPO) market looks as if it might do just as well this year, if not better, with huge tech unicorns such as Uber, Lyft, Airbnb and Pinterest expected to list.

But the overall trend has been down, and that’s really hurt small investors who don’t generally have access to private equity.

Is Gold the Solution?

|

All of this is ample reason to ensure that you have some gold in your portfolio. I always advocate the 10 percent Golden Rule. That means I think you should have half of that 10 percent in gold coins, bars and 24-karat jewelry. The other half should be in high-quality gold mining stocks and funds. Make sure you rebalance at least once a year.

One of the biggest proponents of gold is the Austrian school of economics, which emphasizes self-reliance and individualism. Because fiat currencies are solely based on the faith and credit of the economy, they have no intrinsic value and are prone to huge swings, according to Austrian economic thought.

Gold, on the other hand, is nobody’s liability. As destructive as socialist policies can be to business and capital, they can’t reduce the value of your gold. In fact, the inverse is true. Historically, the more debt that the government accrues, and the higher inflation gets, the more valuable the yellow metal has become.

Did you miss it? Last week I spoke with Small Cap Power’s Jim Gordan on a range of topics, from newcomer GoldSpot Discoveries to the U.S.-China trade war. Watch it now by clicking here!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 12/31/2018.

Frank Holmes was appointed chairman of the Board of Directors of GoldSpot Discoveries. Both Mr. Holmes and U.S. Global Investors own shares of GoldSpot.