Source: Jay Taylor for Streetwise Reports 03/06/2019

Jay Taylor of J. Taylor’s Gold, Energy & Tech Stocks discusses a royalty generator company with a large number of projects in Nevada.

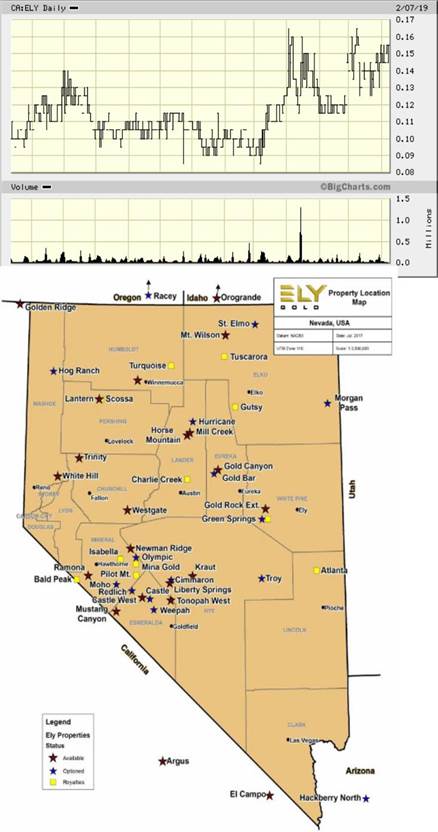

This is a very easy and straightforward story to tell. Not only does Ely Gold Royalties Inc. (ELY:TSX.V; ELYGF:OTCQB) have 77 Nevada properties in play but it is already enjoying one royalty and expects a second royalty to start kicking in by June of this year. Without any other revenues, these two properties are expected to generate $1.25 million this year, which will cover all corporate overhead and SG&A. But that’s chump change compared to what I expect this company will earn, as it has royalties on several advanced-stage projects in the hands of solid companies.

Of the 74 properties in play, here is a breakdown of their various stages:

- 27 deeded royalties

- 21 projects optioned to third parties

- 26 available properties

- Anticipated royalty revenues in 2019: $1.25 million from a 1% royalty from the Fenelon Project in northern Quebec and a 0.75% royalty on the Isabella Claims in Nevada.

The company also has a strong database, which is the key to property transactions, and the database continues to generate new properties and district consolidations. Also impressive to me are some of the well-known mining company partners that working on various projects in Ely’s portfolio, such as Barrick, Coeur Mining (two projects), Hochschild Mining (four projects) and Gold Resource Corp. (four projects).

Ely has also been able to consolidate properties and, as a result, gain royalties on a number of Nevada properties, including the following: Mina Gold, Isabella, County Line, Weepah, Tonapah and Gold Bar. The Isabella Project is being developed by NYSE-traded Gold Resource Corp. and the first royalties are expected to start flowing toward Ely by June of this year. The Gold Bar Project is being developed by one of our current recommendations, namely, Fremont Gold.

With the very large portfolio of companies owned by Ely, it is of course impossible to begin to talk about all of them. But let me point out some of the more advanced projects, beginning with two that are expected to start generating cash flow to Ely this year.

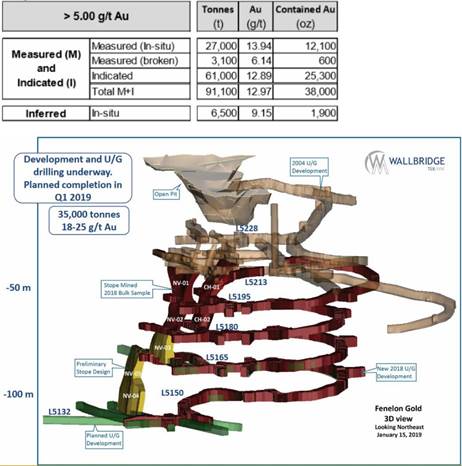

Fenelon Gold Mine, Northern Quebec—While most all of the company’s focus is on Nevada, last year management purchased a 1% royalty from Balmoral Resources for $500,000 in cash plus 1 million common shares issued at a deemed value of $0.10 per share. The underground mine currently has a small high-grade resource but with mineralization open at depth, exploration will be ongoing as mining proceeds. At present, commercial operating permits are being applied for but the company does have permission for bulk mining of some 35,000 tonnes grading between 18 and 25 g/t gold. Expectations are that some 26,000 ounces of gold will be produced from this bulk mining. A 1% royalty would amount to 260 ounces of gold, which at $1,300 would be worth approximately US$338,000. At current exchange rates, that mounts to around C$450,000, thus returning most of the initial cash investment to acquire this royalty.

Admittedly, a small-scale mining operation like this may not excite many investors, but as a starter asset, with a high probability of high-grade mineralization extending to depth, this project could provide long-term cash flows that repay the initial investment many times over.

The Fenelon Gold Mine Project is being advanced by Wallbridge Mining, another company that Eric Sprott has a position in. It trades in the U.S. under the symbol WLBMF. It is headed by Marz Kord, a mining engineer with over 30 years of experience in the mining industry, spanning a career over which Mr. Kord has held progressively more responsible roles in both operations and management. During the early part of his career with Falconbridge, Mr. Kord was involved in mining operations in both Sudbury and Timmins.

In 2017 and since acquisition, Wallbridge has completed 33 drill holes totalling 6,348 meters in three surface exploration drilling campaigns at Fenelon (see Wallbridge Press Release dated December 13, 2017). Results from this initial year’s exploration drilling program exceeded expectations and resulted in an expanded exploration target for the area near existing infrastructure and above 150 meters depth. In 2017, some of the high-grade intersections were:

- 141.16 g/t over 7.06 meters

- 311.08 g/t over 3.06 meters

- 260.44 g/t over 7.02 meters

- 80.42 g/t over 4.73 meters

In 2018 with 18,000 meters drilled, 10,000 of which was from surface and 8,000 from underground, the following high-grade intersections were reported.

- 144.96 g/t over 1.77 meters

- 262.18 g/t over 0.97 meters

- 137.63 g/t over 4.1 meters

- 611.00 g/t over 0.4 meters

Very little drilling has been carried out below 150 meters and the mineralization remains open to depth and along strike. In addition, drill intersections along the 4-kilometer strike length of the mineralized structure demonstrate potential for new discoveries on the broader property. Wallbridge is immediately targeting 250,000 to 400,000 high-grade ounces at depth. It looks to me as if Ely Gold could receive a very quick payback of its capital and then enjoy a long life of royalties for its shareholders.

Isabella Pearl 0.75% NSR—The Isabella Pearl Gold Project is located in south-central Nevada’s Walker Lane Mineral Belt in Mineral County, Nevada. The property covers 494 mining claims comprising 3,642 hectares (9,000 acres), of which 58 claims encompass the Isabella Pearl deposit and planned mine area.

On June 19, 2018, the company commenced construction at Isabella Pearl and targets the first gold pour by June 19, 2019. The Isabella Pearl project contains Proven and Probable reserves estimated at 2,694,500 tonnes grading 2.22 grams per tonne, which equates to 192,600 gold ounces based on a feasibility reported dated December 31, 2017. Future production development anticipates two adjacent open pits with the Isabella pit averaging approximately 1 gram per tonne gold with mineral outcropping at the surface, and the Pearl pit averaging approximately 3.7 grams per tonne gold with a higher-grade core averaging nearly 5 grams per tonne gold. The project estimates an average 5:1 strip ratio with metallurgical tests estimating gold recoveries for crushed oxide rock of 81% and run of mine ore (ROM) of 60% using conventional heap leaching. Small amounts of silver are expected in recoveries, which would be treated as by-product credits against gold production costs.

The Isabella Pearl is being developed by NYSE-traded Gold Resource Corporation (NYSE-GORO). The acquisition cost for Ely was US$300,000 cash. In year one it is expected to produce 20,000 to 30,000 ounces and in years 2 and 3 between 30,000 and 40,000 ounces. There are 10 Isabella Pearl claims, all of which are subject to Ely’s 0.75% royalty.

Advanced Exploration Projects

Following is a list of the company’s royalty holdings:

Here are a couple of the more advanced royalty holdings that are being worked on now:

Castle/Blackrock Lease 2% NSR—The Castle/Blackrock Lease was acquired for US$500,000 for a large package of properties and royalties, including Castle/Blackrock. It also included the Eastside Project, which is the flagship of Allegiant Gold, within its 17-project portfolio. The Eastside Project has a historical resource of 272,000 oz. of gold.

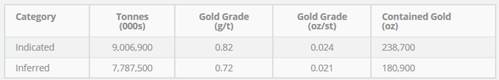

Gold Rock Resource—Ely has a 0.50% NSR on this project that is being developed by Fiore Gold. The project consists of a large 20,300-hectare contiguous land package on the Battle Mountain-Eureka Trend, anchored by the former Easy Junior Mine, which reportedly produced approximately 2.6 million tonnes at a grade of 0.89 grams per tonne for 74,945 gold ounces in the early 1990s. The area in and around the former Easy Junior Mine hosts a recently released mineral resource as follows:

Management believes there is an excellent chance to grow the project along strike, both north and south of the former Easy Junior open-pit mine. This is a 200-sq.-kilometer contiguous land package on the Battle Mountain-Eureka Trend.

As noted above, the company has some 21 properties that are optioned to third parties. The options are for 100% and are purchased from Ely for cash payments and/or ongoing option requirements during the time the options are held. Following is a schedule of options held with the schedule of payments coming to the company in 2019 from the current portfolio.

These are options only. Ely has no interest in holding a JV interest. However, they are subject to future royalties payable to Ely and the projects are scalable, meaning that royalty payments in the future can grow as the project and production grow.

A typical option contract lasts for four years with escalating and balloon payments over that time frame. There are no work commitments and data is held open to the public on all properties.

As noted previously, the company has an additional 26 optionable properties available for options.

MANAGEMENT

Trey Wasser, President, CEO and Director

- President and Director of Research for Pilot Point Partners LLC

- Over 33 years of brokerage and venture capital experience, with 20 years as a corporate finance specialist with Merrill Lynch, Kidder Peabody and Paine Webber

- Specialized in equity/debt re-structuring and cash management.

- Founded Due Diligence Tours organizing analyst tours to hundreds of mining properties in North America.

Jerry W. Baughman, Director BSc, PGeo, President

- Certified Professional Geologist (CPG) with the American Institute of Professional Geologists (since 1997), a graduate of University of Nevada with degrees in geology and economic geology

- Over thirty years of experience in mineral exploration in the United States, Mexico and South America

- Based in the Reno area, has extensive experience as an independent geologist evaluating gold and silver properties.

- Former geologist and management positions with Southwestern Gold, Cambior (USA), Gryphon Gold, Fronteer Gold

- A member of the Geological Society of Nevada (GSN), a member of the Nevada Petroleum Society (NPS), a member of the Society of Economic Geologist (SEG), a member of the British Columbia & Yukon Chamber of

Mines, and a member of the Prospectors and Developers Association of Canada (PDAC). - A Qualified Person as defined by National Instrument 43-101

Scott Kelly, CFO & Corporate Secretary

- Over 12 years of senior management experience in the global mining sector

- Current CFO of Ethos Gold Corp, Sonoro Metals Corp and Marlin Gold Mining Ltd.

- Held the office of VP Finance for Pediment Gold Corp until its acquisition by Argonaut Gold Inc.

- Bachelor of Commerce degree from Royal Roads University (2001).

Stephen Kenwood, BSc, PGeo, Director & Qualified Person

- B.Sc. (geology) from the University of British Columbia. Over 25 years world-wide experience in mining sector and 15 years experience managing junior exploration companies

- Former geologist with Cominco on the Snip gold mine, project geologist at Eskay Creek, and project geologist at the Petaquilla copper-gold porphyry deposit

- Currently President and a director of Majestic Gold Corp., President and a director of Remo Resource Corp., and director of two other TSX.V listed companies

Tom Wharton, Independent Director

- Over 30 years experience with start-up, development and financing of early stage mining companies

- Currently on the board of Angel Gold, DV Resources and Dolly Varden Silver

Ron K. Husband, MBA, Independent Director

- Currently Director of Sonoro Metals Corp.

- 15 years of world-wide experience

- MBA from the University of Calgary

- Chairman of the Audit & Compensation Committees

William M. Sheriff, Independent Director

- Entrepreneur and visionary with over 30 years’ experience in the minerals and securities industries.

- Founder and Executive Chairman of Golden Predator Corp. Prior to founding Golden Predator Corp.

- Currently serves as Chairman of enCore Energy Corp.

- Previously served as Chairman of EMC Metals Corp., and as a Director of Western Lithium USA Inc., Uranium One Inc., Midway Gold Corp., Eurasian Minerals Inc. and Starcore International Mines Ltd.

- Holds a B.Sc degree (Geology) from Fort Lewis College, Colorado and an MSc in Mining Geology from the University of Texas-El Paso.

THE BOTTOM LINE

This company has a large number of projects, most of which are in Nevada. Its business model generates cash now through its sale of options, and its large database allows it to generate new prospects. The one negative at the present time is that there are no really large-scale deposits yet outlined. However, with such a large number of prospective projects hosted in various area of Nevada where elephant-size deposits are known to exist, the potential for one of Ely’s partners to outline something large that could allow this company to develop into something that is meaningfully large would seem to be considerable.

For the time being, as noted above, the company is set to receive at least $1.25 million in 2019, which will cover all overhead while work continues on several exploration targets. Compared to its peers, this company carries a very low valuation. I see very little downside compared to upside at a time when growth should really start to accelerate first from developing projects and longer term from the pipeline. If you find this story of interest, you may wish to view the presentation here, made on behalf of Ely Gold at the January 2019 Metals Investor forum.

To Subscribe to J Taylor’s Gold, Energy & Tech Stocks click here.

As he followed the demolition of the U.S. gold standard and the rapid rise in the national debt, Jay Taylor’s interest in U.S. monetary and fiscal policy grew, particularly as it related to gold. He began publishing North American Gold Mining Stocks in 1981. In 1997, he decided to pursue his avocation as a new full-time career—including publication of his weekly J. Taylor’s Gold, Energy & Tech Stocks newsletter. He also has a radio program, “Turning Hard Times Into Good Times.”

Read what other experts are saying about:

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Jay Taylor’s disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Ely Gold Royalties and Allegiant Gold. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Allegiant Gold, a company mentioned in this article.

Charts and graphics provided by the author.

J Taylor’s Gold, Energy & Tech Stocks (JTGETS), is published monthly as a copyright publication of Taylor Hard Money Advisors, Inc. (THMA), Tel.: (718) 457-1426. Website: www.miningstocks.com. THMA provides investment ideas solely on a paid subscription basis. Companies are selected for presentation in JTGETS strictly on their merits as perceived by THMA. No fee is charged to the company for inclusion. The currency used in this publication is the U.S. dollar unless otherwise noted. The material contained herein is solely for information purposes. Readers are encouraged to conduct their own research and due diligence, and/or obtain professional advice. The information contained herein is based on sources, which the publisher believes to be reliable, but is not guaranteed to be accurate, and does not purport to be a complete statement or summary of the available information. Any opinions expressed are subject to change without notice. The editor, his family and associates and THMA are not responsible for errors or omissions. They may from time to time have a position in the securities of the companies mentioned herein. No statement or expression of any opinions contained in this report constitutes an offer to buy or sell the shares of the company mentioned above. Under copyright law, and upon their request companies mentioned in JTGETS, from time to time pay THMA a fee of $250 to $500 per page for the right to reprint articles that are otherwise restricted solely for the benefit of paid subscribers to JTGETS.

( Companies Mentioned: ELY:TSX.V; ELYGF:OTCQB,

)