This post [INSIDE] A Stock that Goes Up During Good Times and Bad appeared first on Daily Reckoning.

Today my objective is simple…

I want to show you why packing up your portfolio and getting out of the stock market during scary stretches is a really, really bad idea.

As you’ll see, time in the market is the key, not timing the market.

However… I realize this is easier said than done.

Therefore, in addition I’ll also be giving you a top quality stock that will position your portfolio to profit in both a rising AND falling stock market.

This will make following through on today’s objective a whole lot easier.

So let’s get to it!

Over Time the Stock Market Does One Thing… Goes Up

The last quarter of 2018 was nothing short of a horror show.

In just the last three months of the year, the S&P 500 dropped a whopping 14%. For comparison, out of the 370 quarters since 1926, there have been only 20 that were worse than Q4 2018.

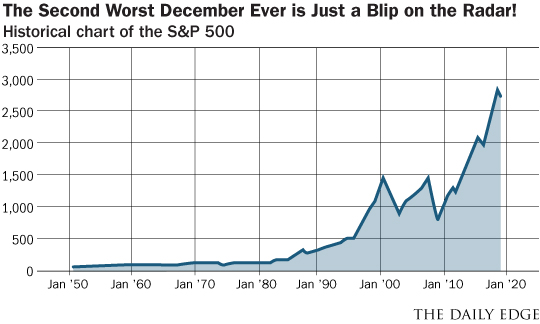

Even more shocking was the 9.2% decline posted in just the month of December. That ranks as the second worst December on record.1

Without a doubt this was an uneasy time to be in the market.

But just look at how the carnage that was Q4 2018 stands out in a broader view of the S&P 500:

There is no question that the fourth quarter of 2018 was terrible, but on that long-term chart it looks like a blip on the radar, a drop in the bucket, a speck on the screen!

Over time the stock market does one thing. It goes up and up and up.

Don’t ever forget that.

Being invested in stocks over the long term is a tremendous way to generate wealth. Even the worst stock market crashes in history are just a temporary annoyance on the stock market’s long-term journey higher.

The single biggest mistake an investor can make is panicking and getting out. So don’t do it.

Sticking to Your Guns During a Market Panic is Hard… But This Will Help

A quick look at that long-term S&P 500 chart is all it takes to convince an investor that staying in the market is the way to go.

But having been through a few really scary market collapses myself, I can tell you that sticking to that long-term plan during a true market panic is much easier said than done.

It is terrifying to watch your net worth melt away on a daily basis.

The “flight or fight” response that is hardwired into our DNA is virtually impossible to fight during such times.

That is why having companies in your portfolio that actually benefit from financial market distress can be so helpful. Holding these securities allows you to remain calm because you know that you own businesses that are profiting specifically because the market is plunging or the economy is reeling.

Oaktree Capital Group (OAK) is one of such companies.

Founded in 1995, Oaktree Capital Group is a widely respected investment firm with nearly unparalleled expertise in the credit market. Under the leadership of legendary investor Howard Marks, the firm is viewed as being perhaps the best distressed asset investment shop in the business.

With $119 billion in assets under management, the Oaktree investment approach is simple: the firm waits until the market is in distress and then swoops in to pick up incredible bargains.

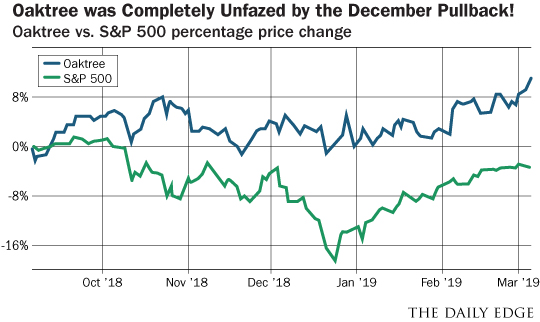

It is no surprise then that when the overall stock market tanks, Oaktree’s share price outperforms. The late 2018 market swoon was a perfect example of this when Oaktree’s trading price didn’t move at all while the S&P 500 fell by a double digits percentage.

During tough times investors know to look to Oaktree’s stability. The worse the financial markets get, the better it is for Oaktree’s distressed investing approach.

Structured as a partnership, Oaktree pays out almost all of its profits as a dividend each quarter, which as of most recently amounts to a juicy 6.78% yield.

Just this dividend yield alone makes Oaktree a terrific addition to a diversified portfolio. And the comfort that an investment like this provides during market turmoil makes it even better.

As you can see, the stock market rewards investors who stick around for the long-term. And reducing portfolio volatility with companies like Oaktree can help make sure you’re one of the investors who does exactly that.

Here’s to looking through the windshield,

Jody Chudley

Financial Analyst, The Daily Edge

EdgeFeedback@AgoraFinancial.com

1 The 2nd Worst December Is Only Half The Story

The post [INSIDE] A Stock that Goes Up During Good Times and Bad appeared first on Daily Reckoning.