This post Warren Buffett Bets Big as Canada Abandons Capitalism appeared first on Daily Reckoning.

In a shocking turn of events, the Canadian Province of Alberta abandoned free market capitalism in December of 2018.

This was a story we were on top of as events unfolded.

Following the lead of dictators and oppressive regimes around the world, Alberta announced the enactment of mandatory production cuts for large oil producers operating in the province.

Keep in mind that Alberta is the Canadian equivalent to Texas. Cowboy hats and pickup trucks are everywhere. And Albertans don’t like the government sticking its nose in their business.

The most conservative of all people can be found in the Alberta oil patch. These folks are true entrepreneurs and detest government intervention.

As you might expect, the response to these government mandated production cuts in the Alberta oil patch were overwhelmingly… positive.

Wait, what?

Desperate Times Call for Desperate Measures

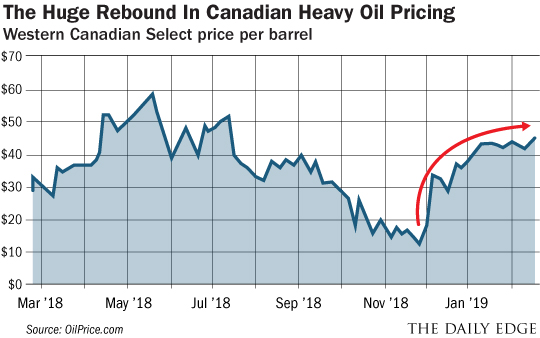

Prior to the Alberta Government’s oil patch intervention, Canadian Heavy Oil was selling for $50 per barrel less than West Texas Intermediate, the benchmark American oil blend.

Canadian producers were getting not much more than $10 per barrel for their crude. The industry was losing billions and billions of dollars and the Alberta Government was too because of lower royalty fees that were assessed on production revenue.

The reason for the pricing difference was simple:

Alberta’s oil is landlocked. Being landlocked means that the province needs to ship its oil through pipelines that run through other provinces and American states.

As you are likely aware, these days getting major pipelines built has been virtually impossible. The political left and environmental groups keep putting up roadblock after roadblock.

With all pipelines out of Alberta already full and the resulting glut of oil only forecasted to get worse, prices in the region plummeted.

That’s when the Alberta Government took action to deal with the problem.

With the benefit of hindsight, it looks like a great decision.

Immediately after the production cuts were announced, Canadian Heavy Oil prices went on a tear, now having tripled since December.

It has truly been a spectacular reaction by the market.

As I said, we were on top of this story back in early December, the moment after the production cuts were announced. I pegged Alberta producer Canadian Natural Resources (CNQ) as a way to profit from the opportunity we saw in improving Canadian heavy oil pricing.

I still like Canadian Natural shares today.

Interestingly, it turns out that I wasn’t the only one who saw a rebound in Canadian oil pricing as an opportunity in December.

Last week a certain “Oracle of Omaha” revealed that he had opened up a big new position in another Alberta oil producer during the fourth quarter of 2018…

Warren Buffett Bought Suncor and You Can Too!

During the fourth quarter of 2018, Warren Buffett’s conglomerate Berkshire Hathaway purchased more than $300 million in shares of integrated Canadian oil producer Suncor Energy Inc. (SU).

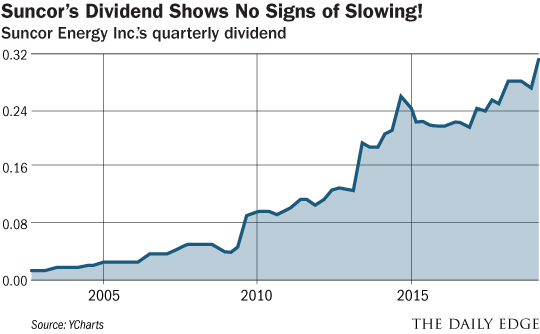

You don’t have to look any further than the chart below to understand what the appeal of Suncor is for Buffett.

Today, an investor can lock in a 3.9 percent yield by buying shares of Suncor. That yield is nice, but think of what that yield might turn into five years from now.

That’s because Suncor does an incredible job of growing that dividend.

In 2002, Suncor’s quarterly dividend was $0.01 per share. Today that quarterly dividend is $0.316 per share — a 31.6 times increase!

Just from 2010 until now, Suncor’s dividend has quadrupled. And guess what folks… oil prices are lower today than they were in 2010!

That kind of dividend growth with oil prices falling is amazing and speaks to the quality of Suncor’s assets.

This company is a cash flowing monster. Exactly the kind of free cash flow machine that Warren Buffett loves to own.

The big reason Suncor is able to return so much money to investors lies in the fact that Suncor’s existing base of oil reserves is already large enough to last for the next 36 years. That means that this company already has all of the oil it needs so it doesn’t need spend money and resources on finding more.

Complimenting Suncor’s massive reserve base is the fact that the company’s production has a miniscule decline rate of just 1 percent per year.1 That means that not only does the company not need to spend money finding oil, it also doesn’t need to spend much money offsetting year on year production declines.

For context, consider that a typical shale oil producer battles annual decline rates of more than 30 percent. That means that a shale producer must drill enough wells to replace 30 percent of production every year just to keep production flat!

These are expenses that Suncor — with its 1 percent decline rate — doesn’t have. So instead of spending that cash, Suncor can return that cash to shareholders.

With a rapidly growing 3.9% dividend yield, a 36-year reserve life and a 1 percent production decline rate, I believe Suncor is perfect addition to any diversified portfolio.

Just like Mr. Buffett!

Here’s to looking through the windshield,

Jody Chudley

Financial Analyst, The Daily Edge

EdgeFeedback@AgoraFinancial.com

1 Suncor Energy Inc. Investor Relations

The post Warren Buffett Bets Big as Canada Abandons Capitalism appeared first on Daily Reckoning.