Miner and commodities trader Glencore (LON:GLEN), one of the world’s top coal exporters, has yielded to investor pressure to embrace a “low-carbon economy” by announcing it will cap production of the fossil fuel to align its business strategy with the goals of the Paris climate agreement.

The unexpected move will also see the Swiss miner setting new targets for cutting emissions from both its activities and products.

“As one of the world’s largest diversified mining companies, we have a key role in enabling transition to a low carbon economy,” Glencore said in a statement.

The company, which acquired Rio Tinto’s thermal coal business only last year, said it would cap its global thermal and coking coal production at about 150 million tonnes per year, close to its planned output level for 2019, after holding talks with the Climate Action 100+ initiative.

Glencore will continue to operate its coal mines, which are largely based in Australia, for at least another 15 years — or around the time analysts expect demand for the fuel to peak.

The group, whose global members collectively manage more than $32 trillion in assets, has as mission to improve climate governance, curb emissions of carbon dioxide and strengthen climate-related financial disclosures.

The 100 refers to a list of the companies that the organisation rates as “systemically important emitters”. The + refers to another 60 companies that are assessed as owning “significant opportunity to drive the clean energy transition”.

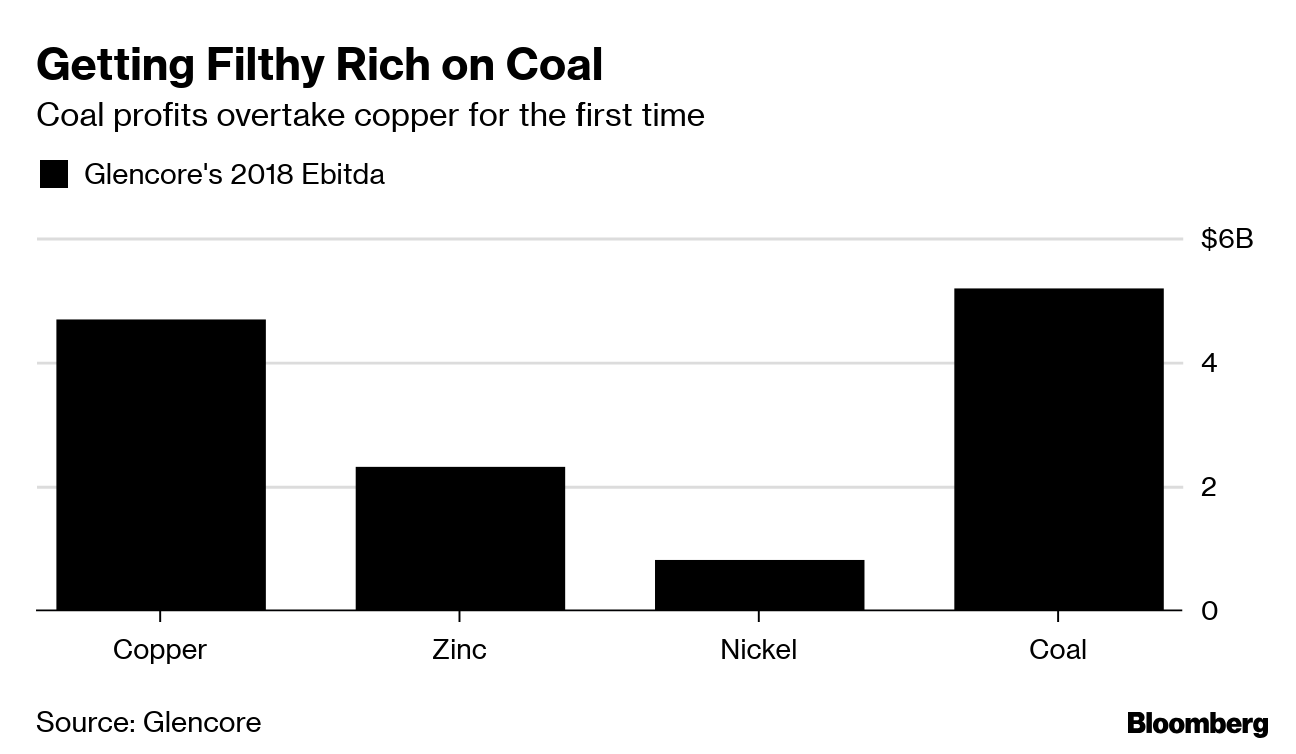

Glencore, however, is not giving up on coal. The commodity, in fact, remains the company’s chief money maker among its industrial assets.

Coal made up the biggest slice of Glencore’s profits in 2018 annual results, published Wednesday, and the company has even said the fuel is a viable part of global emissions-reduction plans.

Glencore also said it would continue to operate its coal mines, mostly based in Australia, for at least another 15 years, which is around the time leading forecasters expect demand for the fuel to peak.

Chasing “value over volume”

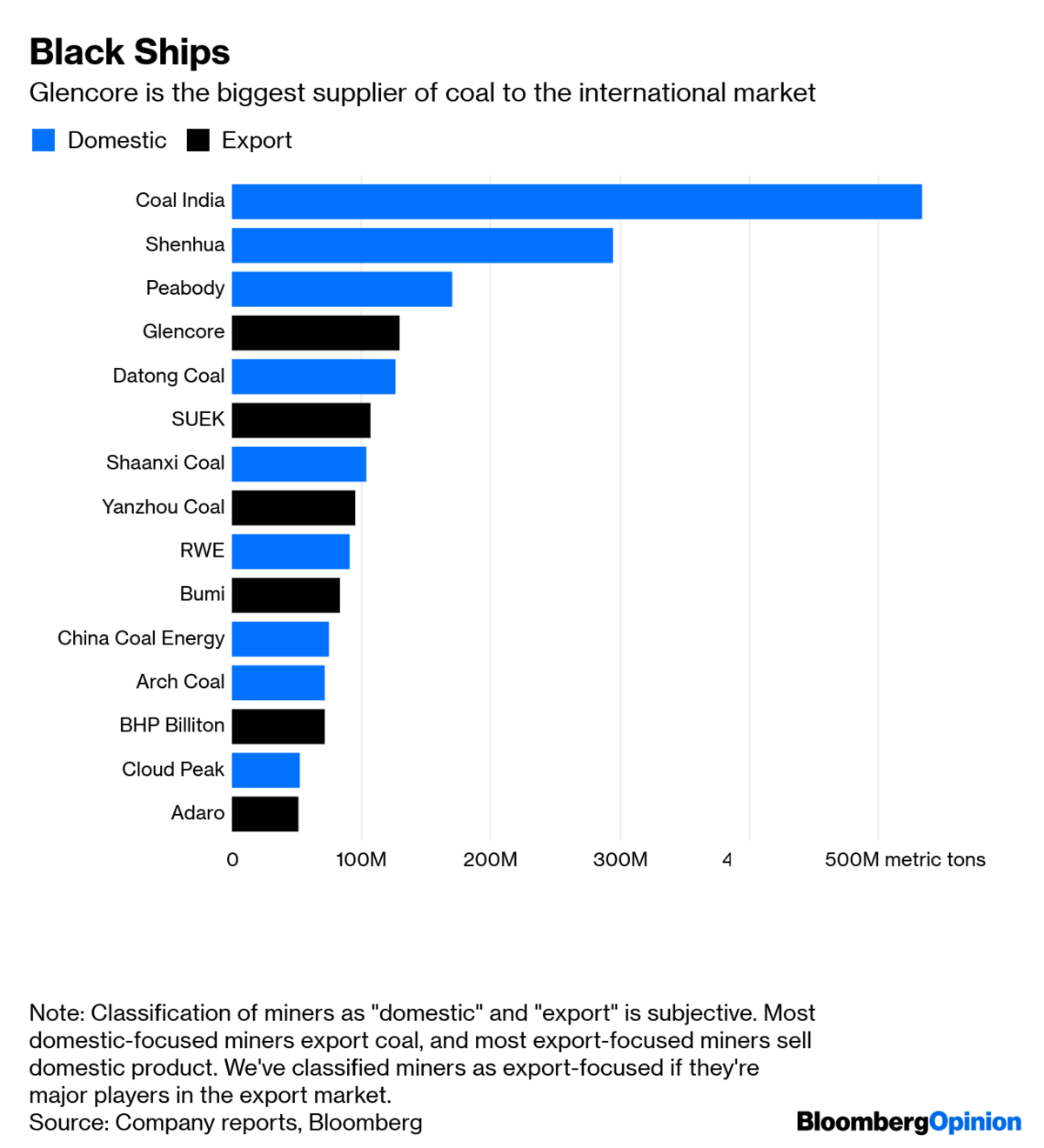

Wood Mackenzie’s research director Prakash Sharma said the move will have an impact in prices. “We estimate that Glencore had a market share of nearly 25% in the seaborne trade last year. It also has a dominant position in the premium thermal coal segment,” he said in an emailed statement.

“In that regard, capping coal production is significant because prices could remain high amid tighter supplies. Glencore is chasing value over volume,” Sharma said.

“In a 2-degree scenario, premium thermal coal demand is expected to be resilient compared to other coal types. That means companies holding on to high energy thermal coal assets stand to gain and will realise higher prices,” he added.

Coal producers have been raking in profit as the price of the fuel soars. Those gains have been underpinned by rising Chinese demand for high-quality imported coal, while many in the mining industry are reluctant to build new capacity as banks and investors are turning their backs on the commodity.

The Baar, Switzerland-based company plans to invest cash generated by its coal operations in metals likely to benefit from increased demand coming from the electric vehicles sector, battery storage and renewable energy. These include copper, cobalt and nickel, metals in which the company already has a marked footprint.

Glencore on Wednesday reported weaker than expected profits for 2018, and it announced a $2 billion share buyback program.

“Glencore remains in a strong financial position, but the sell-off in its shares relative to peers clearly leaves it feeling a little defensive,” BMO Capital Markets analyst Edward Sterck said in a note. “The share buyback reinforces this perspective and does seem like the most sensible option.”

The firm lowered its 2019 forecast for copper output to about 1.50 million tonnes from an earlier target of 1.54 million tonnes and said output from its Mutanda mine in Congo would drop to 100,000 tonnes per year.

The post Glencore yields to investor pressure, caps coal production appeared first on MINING.com.