Gold mining is one of the very oldest human occupations. The earliest known underground gold mine, in what is now the country of Georgia, dates back at least 5,000 years, when people were just starting to develop written language.

Over the centuries, a number of innovations have emerged that disrupted and forever changed how we explore and mine for gold and other metals. Think dynamite, or the steam engine.

Lately, however, innovation has slowed. Mining companies are in cost-cutting mode, and many producers have favored generating short-term cash flow, often to the detriment of longer-term value. In last year’s “Tracking the Trends” report, Deloitte analysts observed that “miners from 50 years ago would find little has changed if they entered today’s mines, a situation that certainly doesn’t hold true in other industries.”

Consider the earth-shattering change that’s taken place in oil and gas over the past two decades. Fracking and horizontal drilling have completely revolutionized how we extract resources from the ground, making hard-to-reach oil and natural gas accessible for the first time.

No equivalent technology exists in precious metals. Some companies are now using cutting-edge technology like blockchain to improve supply chain efficiency and transparency, but to date there’s no “gold fracking” method. As a result, metal ore grades are decreasing, and large-scale gold discoveries are becoming fewer and farther between.

One company thinks it has the formula to reverse this trend. I think it could be sitting on a gold mine, pun fully intended.

Meet Goldspot Discoveries

“Some people call it ‘peak gold,’ but I tend to think of it more as ‘peak discovery,’” says Denis Laviolette, the brains behind Goldspot Discoveries, a first-of-its-kind quant shop that aims to use artificial intelligence (AI) and machine learning to revolutionize the mineral exploration business.

A geologist by trade, Denis conceived of Goldspot while serving as a mining analyst with investment banking firm Pinetree Capital. His vision, as he described it to me last week, was to disrupt mineral exploration as profoundly as Amazon disrupted retail and Uber the taxi business.

“We have more data at our fingertips than ever before, yet new discoveries have been on the decline despite ever increasing exploration spending on data collection,” Denis continues. “We believe Goldpsot can change that. Harnessing a mountain’s worth of historic and current global mining data, AI can identify patterns necessary to fingerprint geophysical, geochemical, lithological and structural traits that correlate to mineralization. Advances in AI, cloud computing, open source algorithms, machine learning and other technologies have made it possible for us to aggregate all this data and accurately target where the best spots to explore are.”

Hence the name Goldspot—though I should point out that Denis considers the Montreal-based company “commodity agnostic,” meaning it collects and aggregates data for all metals, including base metals, not just gold.

Moneyball for Mining

Denis has the record to back up his extraordinary claims. In 2016, Goldspot took second place in the Integra Gold Rush Challenge, a competition with as many as 4,600 worldwide applicants. After consolidating more than 30 years of historical mining and exploration data into a 3D geological model, the company was able to identify several target zones with the highest potential for gold mineralization in Nevada’s Jerritt Canyon district, among several others.

|

Goldspot’s targeting approach was a complete success. New zones were discovered by AI, validating the company’s models of finding patterns in the data that humans alone couldn’t have seen.

The exercise stands as an example of what can be unlocked when machine learning is applied to geoscience.

“When I first entered the field, geologists were still using pen and paper, and I’m not even that old,” Denis says. “We were paying for all this data, but no one was really doing anything with it.”

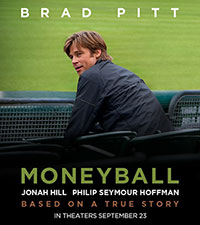

Denis’ quant approach to discovery reminds me a lot of Billy Beane, the former general manager of the Oakland A’s and subject of the 2003 bestseller and 2011 film Moneyball. Beane was among the first in sports to pick players, many of them overlooked and undervalued, based on quantitative analysis. His strategy worked better than anyone anticipated.

Although the A’s had one of the lowest combined salaries in Major League Baseball—only the Washington Nationals and Tampa Bay Rays had lower salaries—the team finished the 2002 season first in the American League West.

Similarly, Goldspot seeks to help mining companies cut some of the costs and risks associated with discovering high-quality deposits—something it’s managed to do for a number of its clients and partners, including Hochschild Mining, McEwen Mining and Yamana Gold.

And speaking of teams, Denis has assembled an impressive roster of PhDs and experts in geology, physics, data science and other fields.

But Wait, There’s More…

The company, not yet three years old, does more than assist in exploration. It also invests in and acquires royalties from exploration companies, similar to the business model practiced by successful firms such as Franco-Nevada, Wheaton Precious Minerals, Royal Gold and others.>

The difference, though, is that Goldspot has developed an AI-powered screening platform to identify the very best and potentially most profitable investment opportunities.

For this, Goldspot has also received accolades. It was one of only five finalists in Goldcorp’s 2017 #DisruptMining challenge, for “revolutionizing the investment decision model by using the Goldspot Algorithm to stake acreage, acquire projects and royalties, and invest in public vehicles to create a portfolio of assets with the greatest reward to risk ratio.”

I’ll certainly have more to say about Goldspot in the coming weeks. For now, I’m excited to share with you that the company is scheduled to begin trading on the TSX Venture Exchange early this week. The future belongs to those that can mine data and harness the power of AI, and I’m convinced that what Denis and his partners have created fits that bill. Congratulations, and the best of luck to Denis Laviolette and Goldspot Discoveries!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/31/2018): Integra Resources Corp., Hochschild Mining PLC, McEwen Mining Inc., Yamana Gold Inc., Franco-Nevada Corp., Wheaton Precious Metals Corp., Royal Gold Inc.