Source: Michael J. Ballanger for Streetwise Reports 02/06/2019

Sector expert Michael Ballanger discusses the Federal Reserve and precious metals.

Upon reflection back to kinder, gentler times before interventions and the emergence of central bankers as modern-day messiahs, it is noteworthy that every January dawning back to 2001, the precious metals “guru” community makes their usual bombastic pronouncements claiming that “(INSERT YEAR) WILL BE THE YEAR THAT GOLD AND SILVER EXPLODE TO ALL-TIME HIGHS!!!” followed by an array of pretty little charts and breathless podcasts all the while forgetting that with the exception of more facial hair and the odd streak of grey, it is the same speech they gave last January and every January before that. Then they trot out six of the twenty-seven “buy signals” generated by “the charts” and claim visionary status for a 22.2% win ratio while asking you to sign up for a mere 99¢ per day to their “proprietary service” that is “informational only” and not intended to be construed as “investment advice.”

The reason I am mentioning this is that due to the recent rally in gold and silver, services that were nowhere to be found in late August with gold just off the lows at $1,167 (as in when I wrote “Back Up The Truck”) have suddenly determined that gold at $1,300 is a better reason to pull the trigger NOW rather than five months ago at $1,167. Buying an RSI at 73 is “WAY BETTER!” than accumulating at < 30 so get out your cheque books and/or credit cards and sign up immediately before you miss out on that Friday night podcast. As you all know, I have been 100% long gold and silver since the summer and have only last Thursday issued a tweeted directive imploring my readers to “Use tight stops on all gold and silver positions” going into the Friday morning NFP (“phony jobs report”) and sure enough, I was stopped out of my GLD and SLV calls for a 570% return for the GLD April $120s purchased in September and a 215% return for the SLV April $13 calls purchased at $1.00 in November. Celebrate? Not a chance. Five minutes after I received the fill, I was already nervous. OUT, and nervous.

Adding to gold (and silver) with RSI in the 70s is a clarion call for masochism.

I have a five-wave pattern completed last week with the spike to $1,331 for gold and $16.20 for silver with RSI figures knifing up through 70 for both of the metals Wednesday and Thursday before pulling back sharply on Friday. I am not looking for a crash in gold or silver just yet because the USD Index is now extremely vulnerable to a breakdown under 90 as the Powell/Fed cave-in undermines the global love affair with “all things U.S.”

When is the world going to finally recognize that central bankers are not statesmen like Churchill or Ghandi or Roosevelt? They are “BANKERS” that are far removed from the plight of humanity; they deal in the world of “MONEY.” Their concerns are those of profit and power, not social justice or liberty. As we have seen from the emerging Vancouver/Chinese money laundering scandal, bankers will break the law for profit at the turn of a hat. The recent capitulation by Jerome Powell was not in the slightest “data driven” unless, of course, 97% of the data was the closing level of the S&P 500 on Christmas Eve. The double-tap of leaving rates unchanged and ceasing the balance sheet roll-offs has now sent a message to the world that the U.S. cares not a whit about the purchasing power of its currency nor does it care about the potential harm to U.S. consumers of a weakening currency.

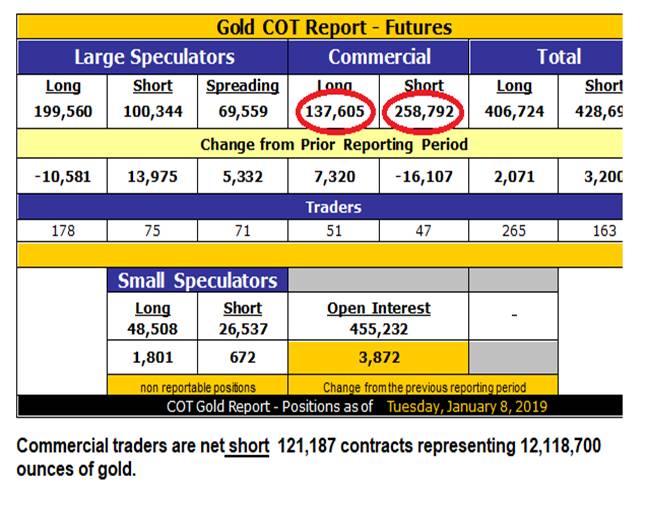

However, the gold and silver markets no longer represent a “Back up the truck” opportunity as they did in the waning days of August 2018 below $1,200; they instead have the far-too-familiar feel of a raid-waiting-to-happen. With the first COT report since the U.S. government shut-down released on Friday and for the week ended December 24th, the Large Speculators let crashing stock markets panic themselves into 35,000 new contracts only to have 95% of them filled by the Commercials. It was truly an ELP moment where “Welcome back my friends to the show that never ends; we’re so glad you could attend, come inside, come inside.”

Open interest has exploded during the month of January such that by March 1 when they have finally caught up with the data delayed by the shutdown, the Dec. 24th 128,000-contract aggregate short position held by the Commercials will have easily doubled by then, which begs the question, from what level will they be unwinding those shorts? Will it be 200,000-plus shorts reversing from under $1,200? If you use history as a guidepost, probabilities favor declining gold and silver markets right through the month of February, and while the Fed policy shift and the declining dollar and the record central bank buying and the global slowdown might all be good cover stories with which to sell newsletters, the bullion banks control price and that just simply will not change. To be clear, I am a bull and that will not change but as for futures and options, I am sidelined. Physical bullion both gold and silver will remain in place as well as selected miners and explorcos because they don’t have expiry dates and they are fully paid-for. On these points, I want to be clear.

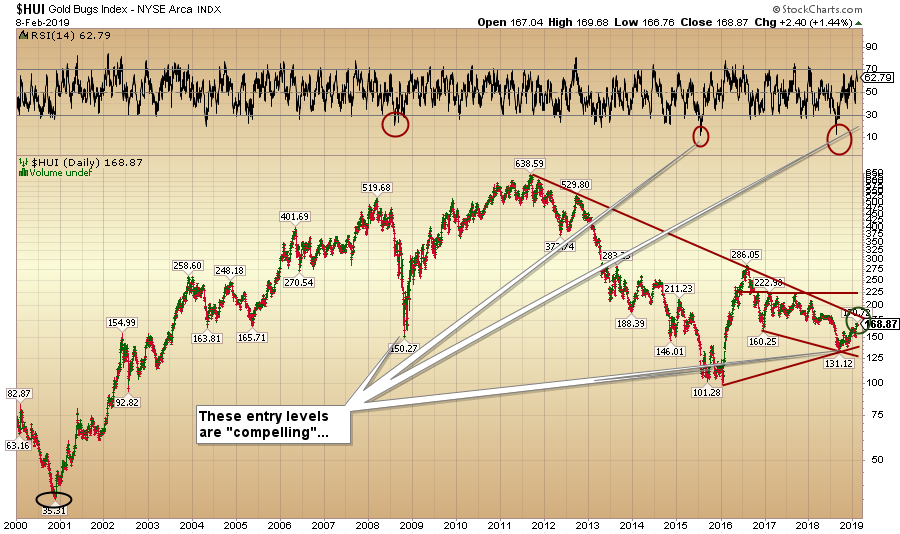

As we close out the barometric month of January, it would appear that a particularly lethal bullet has been dodged, thanks largely to the mystical machinations of the financial media, the President’s Working Group on Capital Markets and the Global Banking Cartel fronted and championed by the Fed’s Jerome Powell. However, since there is nothing strikingly new to this author about interventions, bailouts and stock market rescue schemes, it should be noted that one of the best periods EVER for gold and silver came immediately after the 2009 bailout and successive liquidity injections of immense proportion and frequency. The two charts shown above offer unadulterated proof of the Fed-induced advance from $700 in late 2008 to over $1,900 by August 2011, and while that was then and this is now, the events of the past thirty-nine days have proven once again that while history may not repeat, it most certainly rhymes.

The Powell “about face” in tone and texture was never more obvious than Wednesday’s FOMC discussion where he used the word “patience” no fewer than two dozen times. I was astounded by the number of times Jerome alluded to the “need for patience” and the “use of patience” and the “application of patience,” but what was really curious was the number of upticks in the S&P 500 that occurred with each utterance of that word. The about-face that we have witnessed in the past eight weeks has been nothing short of mercurial, but what leaps off that page containing the Fed “mandate” is the addition of the phrase “rising stock markets” to the other two former top priorities “maximum full employment” and “price stability.”

Since that fateful first Friday after Christmas 2018, Powell has been a blazing symbol of dovishness, complete with smiles and chuckles and the usual “Wink, wink, nudge, nudge” type of banter back and forth with the financial media, which is a stark contrast to the dour taskmaster referring to balance sheet shrinkage as being “on auto-pilot” and rate hikes “continuing on schedule” as recently as early December. All I can say it that “How quickly they forget!” and “Amazing what a few billion dollars in margin calls can do to a Fed Chairman’s thought processes.”

The danger right now for the gold and silver markets is that since the Fed shift in policy was become so blatantly and embarrassingly transparent (almost to the point of vulgarity), they are going to go all-out to defend the U.S. dollar and, more importantly, bludgeon any and all enthusiasm for precious metals. The obvious victim of such a one-eighty in policy is the greenback, so it stands to reason that the masters of behavioral finance at the NY Fed will be vigilant in keeping sentiment focused on rising stocks, the “stable” currency and mitigated vigor for the PM’s. Monday’s predictable raid looked fairly ominous at 6:30 a.m. as I climbed onto the elliptical machine but what was a $10 drop for gold and a $0.25 hiccup for silver was nearly erased with some bargain-hunting just before lunchtime. I now await the inevitable descent of the RSIs for gold and silver back into the sub-30 range where they resided in mid-August when all of the podcasters were calling for $1075 gold.

Since the Fed’s dual mandate is purportedly “maximum full employment and price stability”, I am proposing that they contact Google and Wikipedia and order the revisions to the posted mandate with the addition of “rising stock markets.” It didn’t seem to matter that up until Christmas Eve, most global stock markets were in either full correction mode or full-blown bear markets.

Only when the S&P 500 officially closed in bear market territory at 2,351 on Christmas Eve did the Fed and the U.S. Treasury go into full panic mode despite the lowest unemployment numbers in decades and with an inflation rate of only 1.7%. Based upon employment and inflation, there was actually NO REASON for the Fed to change course but since it did, stocks are ahead 15.6% and are now soundly away from not only bear market territory but also well clear of “correction” territory.

I can only conclude that the third and possibly premier component of the NEW Fed Mandate is ensuring that stocks remain elevated and that any time Donald Trump, Jim Cramer or Bob Pisani complain about the weak stock market, I will determine that it is only a matter of time before we get a course correction in Fed Policy resulting in higher stock prices.

I was engaged with a close friend of mine last weekend with whom I used to work back in the 1990s, and we were reminiscing about the “good ol’ days” when the buying and selling of securities was executed by carbon-based life forms that you could actually speak to on a land-line telephone. In the modern world of high-speed supercomputers and microwave transmission, it is difficult to speak with a computer programmed by (and for the expressed benefit of) the politico-banker cartel that needs order flow against which they can chip away at fractions of a penny but on millions of trades a day around the world. We were lamenting the days when traders would honor “pit rules” where many times an errant order improperly entered would be cancelled because the offending trader knew the broker and agreed to have the trade “busted” as long as he bought the trader on the “other side” (of the error) a beer after work at the Lock and Key Bistro. They were kinder, gentler times when the admission of error was not seen as a grave human frailty in need of counselling or psychiatric care.

It was also a period in which there were only two real drivers in financial markets: there was greed and the thrill of making a big score on a well-thought-out trade, and, of course, there was fear and the abject terror of losing both money and clients by being on the wrong side of a badly constructed trade. However, as difficult as it was to beat the market in the 1990s, you had only the two main drivers with which to contend.

The direction of stock prices has recently become a gargantuan political football such that premiers and prime ministers and presidents consider stock index levels as part of their legacies. This is the primary reason why stock the markets are no longer fulfilling their original purpose, which was (and should be) to facilitate the financing of new ideas, businesses and industries. A healthy economy is one that boasts not about the level of the market averages but rather the amount of money raised by the industry for new and/or existing businesses in need of capital to launch, grow or expand. In today’s system of elitism, the really great ideas are usually financed by the monstrous venture capital funds and to participate in the early rounds of an Apple or Netflix or Facebook is “By Invitation Only” leaving the average investor on the outside looking in while the big profits are the intended domain of the elite crowd and their 1%-er social set.

This is why I fly off the handle when I witness this malodorous macrocosm of central bank intervention into financial markets. I try to remind everyone with whom I speak that whether it is Ben Bernanke or Marc Carney or Mario Draghi or Jerome Powell, these individuals are, purely and quite simply, BANKERS. There are no Benjamin Disraelis or Benjamin Franklins to honor and obey; we have Benjamin Bernanke and his legacy of bailing out the criminals that allowed a frenzy of greed to sabotage the world financial system.

As the great Disraeli once wrote: “When men are pure, laws are useless; when men are corrupt, laws are broken.” That is how I view the global financial markets these days where at the mere mention of the term “bear market,” everyone immediately jumps to the ready in anticipation of the next Great Depression. I see it as a symptom of the financialization of the Western economic system where bear markets are to a financial economy in 2019 what drought or locusts were to agrarian economy pre-Industrial Revolution. The financial media uses stock price declines as fodder for the news-cycle cannons whipping up imaginary storms upon which the unsuspecting public are supposed to fret. People forget that in the worst decade in recent history, the 1930s, new inventions included frozen food, Scotch tape and the jet engine. There were two bear markets in the 1970s (’69-’70 and ’73-’74) and yet the decade delivered the Home VCR, the floppy disk, the first artificial heart and the cellular phone.

Now, I am not one of those nostalgia-obsessed sexagenarians constantly cursing out the younger generation and ridiculing technological change. However, I do see serious problems arising from the rise of corporate and governmental amorality, the likes of which are found manifested in nearsighted social programs and ill-planned policies, such as the current levels of politico-banker DEBT and the attendant rot that accompanies it. The moral hazard associated with government-assisted stock market recoveries is substantial because it indoctrinates the public with expectations that are unrealistic and unhealthy. The last chart of the session is a repeat of one I posted on December 24th with the S&P 500 at 2,351 having just entered bear market territory amidst wailing and screaming and moaning from every corner of the financial world because Jerome Powell was taking away the punch bowl.

And take away the punch bowl he did with two years of rate hikes and billions of dollars drained from the Fed’s toxic waste balance sheet. The only problem was that by Christmas Eve, it was painfully evident that the credit explosion of 2009–2017 constituted all of the air keeping the bubble afloat and removing it was going to take the S&P back to pre-explosion levels. Alas, as we are all now finally discovering, stock market advances are like toothpaste; once out of the tube it is impossible to get it back in. In other words, the Millennials and the Gen-X-ers who have never seen a real bear market that has the usual 12–18 month duration, having got a tiny whiff of what could happen in the last quarter of 2018, screamed so vociferously when the Fed-fueled 330% advance off the 2009 lows suddenly morphed into a 230% advance that they forced the politico-banker elitist cartel to gulp, blink, recant and finally reverse in order to save the precious stock market.

The asymmetrical wealth effect governing consumer behavior in a financialized economy has now been righted and purchasing patterns are once again in line with the “global growth” and “MAGA” goals to the chagrin of those that believe in the sound money policies that Powell attempted with his long-overdue quantitative tightening campaign. To put this all into perspective, stocks are now up 291.32% from the lows of 2009 with the lowest unemployment rate in decades so the Powell about-face was about as “data driven” as the Guess Your Weight booth at the Ex.

So in closing, we are flat our leveraged gold and silver trades with handsome profits from the summer yet still very committed to physical bullion and selected miners and explorcos. Watch for a big retracement in the RSI figures before taking a plunge into anything in the leveraged arena (such as NUGT and JNUG or the call options and futures); if I am wrong and gold and silver do an about-face in the next few days, I will still be amply exposed to the space but simply without the octane and stress of the high-risk positions.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and images provided by the author.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.