Source: Peter Epstein for Streetwise Reports 02/05/2019

Peter Epstein of Epstein Research profiles this company with strategic energy metals properties in Canada.

Delrey Metals Corp.’s (DLRY:CSE; 1OZ:FSE) mandate is to create shareholder value by sourcing, financing and developing undervalued strategic energy metals properties and projects through staking ground or making accretive, prudently and creatively financed acquisitions and joint ventures/farm-ins. It’s off to a good start and has a clean balance sheet with just 34 million shares outstanding and cash of ~C$1.5 million. The market cap is about C$8 million = US$6.1 million. The company is aggressively pursuing additional strategic energy metals assets, and have homed in on two or three in particular.

Delrey Metals has acquired five highly prospective properties in Canada. Four are prospective for vanadium, for a total of 9,482 hectares, and one is a cobalt–copper-zinc opportunity that Cobalt 27 Capital Corp. acquired a 2% NSR on. All four vanadium assets will be receiving airborne magnetic surveys and geophysics in February. Subject to results, management will determine which properties to focus on. Both the Porcher and Blackie properties have unique features that if confirmed, will likely make them top priority targets for the next phase of exploration.

Early Days for the Canadian Vanadium Opportunity

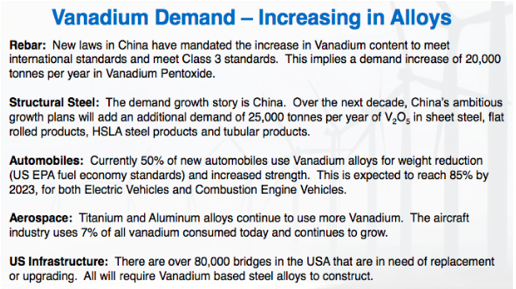

Interest in vanadium has grown along with the price. Demand from China continues to be the key driver. While the rest of the world grows at 2%–3% per year, a bad year for China is +6%, and it’s the second largest economy on the planet. Not only does China use a tremendous amount of steel, it uses huge quantities or rebar, which is used in construction and infrastructure building (and rebuilding).

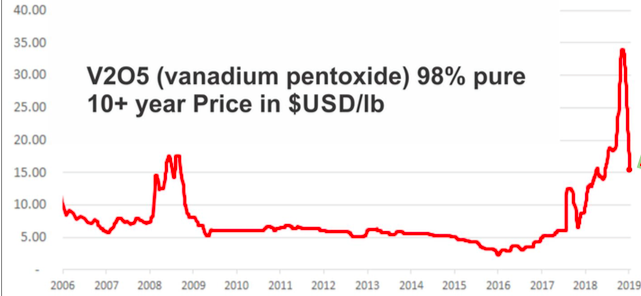

Regarding vanadium pentoxide pricing, there’s been a lot of angst over the recent dramatic decline, but Chinese prices seem to be settling in around US$17/lb. The chart above shows a price closer to US$15/lb, but the price was US$16.90/lb as of February 3rd. It topped out at nearly US$35/lb in November, so the price has been halved from a 13-year high. Importantly, US$17/lb is still a strong price, up from a low of US$2.35/lb on 12/31/15. From $2.35/lb, the Chinese vanadium pentoxide price has risen at a 3-year CAGR of ~93%. A price between US$15–US$25 is a sweet spot, too high a price and VRBs get priced out of the market.

Perfect Storm of Demand & Supply Fundamentals

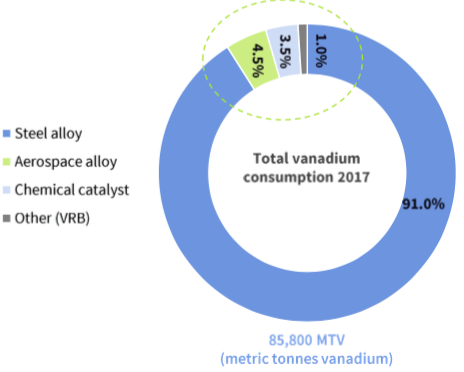

Vanadium is primarily used (91%) to strengthen steel rebar (two pounds of vanadium added to a tonne of steel doubles its strength); last year China came out with new regulations for Chinese rebar makers– use more vanadium! However, reportedly, 30%–40% of Chinese rebar producers did not follow the regulation implemented in November, which was likely a big factor in the vanadium price crash. The increased demand from this initiative alone is estimated at 10,000 tonnes per year. That’s on a global market of about 90,000 tonnes. 10,000 tonnes/year is what Largo Resources’ main mine in Brazil produces, one of the largest mines in the world.

Global demand for vanadium is also being enhanced by other internal moves in China, most notably a total ban on the import of slag and scrap (waste products) that contain vanadium. These waste streams had been used as feedstock for vanadium producers in China. The ban is expected to reduce domestic Chinese production by ~5,000 tonnes/yr.

Quickly on the supply side there have been mine closures dating back to 2015 that are impacting the market. In 2015 a major Brazilian company liquidated, closing the Evraz Highveld mine, representing 10%–15% of global vanadium production. However, at the time the inventory of vanadium was high, so there was a limited price reaction.

Fast forward two or three years, there have been other smaller mine closures in China and Brazil, and the above mentioned increase in demand, causing vanadium inventory to be drawn down substantially. Therefore, both sustained demand drivers and ongoing supply constraints help explain the price move from $2.35/lb at the end of 2015 to a peak of nearly US$35/lb in 4th quarter 2018.

Vanadium Reflux Flow Batteries Could use 31k tonnes of V2O5 by 2025

And then there’s Vanadium Reflux Flow Batteries (VRBs). They represent just ~1.5% of the global vanadium market, but some pundits have large, grid-scale energy storage growing at a CAGR of up to 40%. Roskill forecasts vanadium use in VRBs to be 31,000 tonnes by 2025. If true, VRBs would be a significant demand driver, easily overtaking the uses in aerospace and chemical catalysts combined.

2019 could be a sweet spot in vanadium pricing; several experts expect prices in the US$15/lb to US$25/lb range. That would sustain bullish sentiment for companies with properties outside of China, Russia and South Africa. Delrey Metals has exactly that, five early-stage prospects in Canada, all with decent infrastructure, all situated on past producing mining or logging sites, and most important, all having had historical work. Prior work included magnetic and other surveys, soil sampling, surface samples, concentrates were made from some samples, and a drill program (at the Star property).

Blackie Vanadium Property

The Blackie Vanadium property is in west-central British Columbia, ~96 km south-southwest from Prince Rupert. The property is on Banks Island and is accessible year-round. It is located on tidewater, accessible to the Prince Rupert deep water port, which allows for an eight-day trip to North American West Coast ports. There’s a network of logging roads (<500 meters away) allowing for low-cost exploration and development.

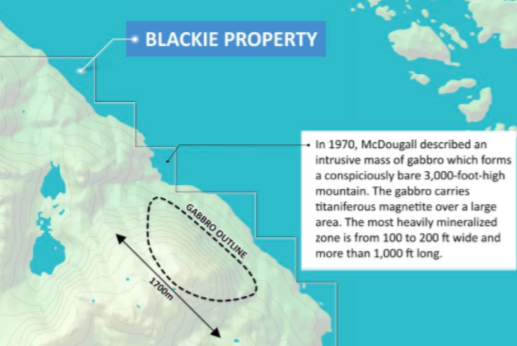

The property consists of five tenures covering 1,213 Hectares, open for expansion in multiple directions. Blackie is on a brownfield site; the Yellow Giant underground mine was operational as recently as 2015. Blackie is host to a gabbroic body 1.2 km by 0.4 km, with an estimated thickness of at least 500 m (McDougall, 1985).

Assays from samples collected by McDougall (1984) ranged from 20% to 25% iron, 1.1% to 1.9% titanium, and up to 0.33% V (0.59% V205). Concentrate results made from these samples returned 0.5% to 1% V (0.89% to 1.78% V205). Individual outcrop results from a previous operator returned up to 49% Iron, 7.0% Titanium and an extremely anomalous 1.2% V (2.14% V2O5). “Several million tons of Iron-titanium-vanadium bearing material are known at this locality” 1 (Rose and Mulligan, 1970).

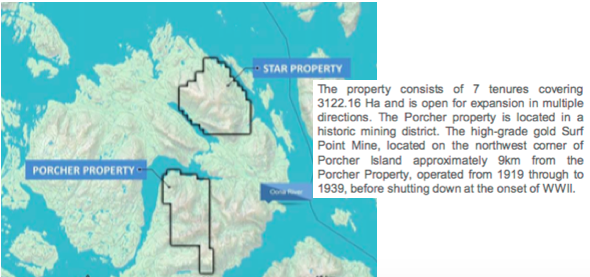

The Porcher property

The Porcher property is located in west-central BC, ~38 km south-southwest from Prince Rupert. The property is located on Porcher Island and is accessible year-round. There’s a network of nearby logging roads, allowing for cost-effective exploration and development.

Porcher consists of seven tenures covering 3,122 hectares, open for expansion in multiple directions. The property is located in a past-producing mining district. The Surf Point Mine, located ~9 km from the Porcher property, operated from 1919 through to 1939. As with the Blackie property, Porcher is located on tidewater, less than 39 km from Prince Rupert’s deep water port.

Porcher is host to two gabbroic dykes hosting iron-titanium-vanadium mineralization. These sizable dykes are 5.2 km x 1 km, and 4 km x 0.6 km. The dykes are coincident with a large magnetic anomaly identified in the Canada 200 m Residual Total Magnetic field dataset. Limited sampling by McDougall (1961) was completed, with concentrate results ranging from 0.3% to 1.5% titanium and 0.2% to 0.5% V (0.34% to 0.84% V205). V2O5 deposits globally range from about 0.3% to 0.7%.

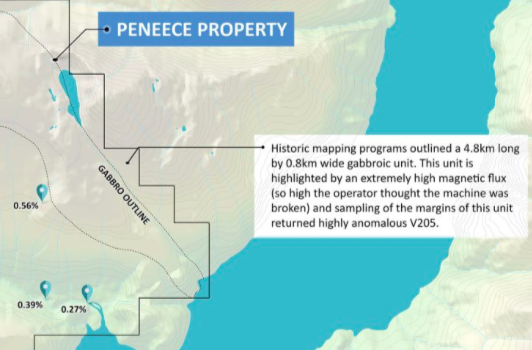

Peneece Vanadium Property

The Peneece Vanadium property is in southwest BC, a narrow coastal mainland fjord 85 km east of Vancouver Island. The property consists of five tenures covering 1,500 hectares, open for expansion in multiple directions. Peneece is located along tidewater and is accessible year-round. There’s a network of logging roads within the center of the project area.

The property is host to a >4.8 km long by 0.8 km wide (open to the northwest) pyritic gabbroic complex associated with a very large and intense magnetic anomaly which is believed to be caused by a large body of vanadium-bearing massive titaniferous magnetite.

Access problems prevented sampling of the highly magnetic core, and only marginal material samples were obtained. Concentrate results from these samples graded 0.16% to 0.33% V (0.29% to 0.59% V205 – AR 12204) and up to 6.5g/t Ag, a precious metal not typically found in these systems.

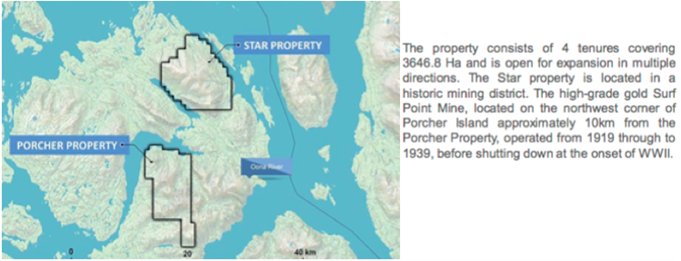

The Star Property

The Star property is located in west-central BC, ~ 27 km south-southwest from Prince Rupert. Like the Porcher property, Star is situated on Porcher Island and is accessible year-round. There’s a network of logging roads covering the majority of the property.

Star consists of four tenures covering 3,647 hectares, open for expansion in multiple directions. The Star property is in the same historical mining district as the Porcher property. A gold mine operated from 1919 to 1939. It is located 10 km from the Star property.

The eastern part of the property was explored and drilled in 1955 for Iron Ore by One Resources Canada Corp. Twelve short (<50 m) diamond drill holes were completed for a total of 696 m, targeting a small magnetic anomaly. Conclusions from this work program were that ‘at least several hundred thousand tonnes of magnetite-bearing rock with a grade of the order of 35% Iron exist within the drilling area’ (PF671671).

The One Resources Canada Corp. 200m Residual Total Magnetic field datasethighlights a large 5 km x 7 km magnetic high located in the center of the Star claim group. Historical drilling indicated a much larger resource potentially exists within the property area to the west. While the historical drill program did not analyze the magnetite for vanadium, a Regional Geochemical Survey (RGS) was completed by the British Columbia Geological Survey in 2000 over the Star claim group, which highlighted up to 148 ppm vanadium-in-silt (99th percentile) and 5.06% iron.

Management believes the Star property has the makings of a significant vanadium discovery including a large magnetic (5km x 7km) high, drained by extremely anomalous vanadium-in-stream results, with a several hundred-thousand-tonne magnetite resource on the margin.

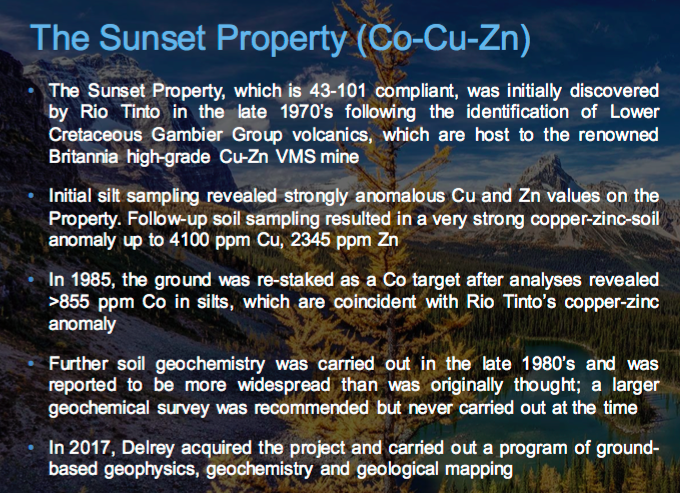

The Sunset Property

The Sunset Property consists of four mineral titles covering 785 hectares. The area had exploration work done in the 1970s–1980s. Several cobalt-copper-zinc soil geochemistry anomalies were discovered. In 1987, Decade International outlined a large cobalt‐copper‐zinc anomaly.

A recent exploration program consisting of mapping, grid preparation, geochemical soil sampling and magnetometer surveys has been done, validating the previous cobalt‐copper-zinc soil geochemical anomaly. Copper values in soil over 500 ppm, when plotted with historical values, indicate a cluster about 1,000 meters by 500 meters. Numerous anomalous cobalt values lie within this area and a smaller cluster of anomalous zinc in soil is also present.

The presence of elevated levels of cobalt is interesting, and a 2% NSR royalty on cobalt only has been sold to Cobalt 27 Capital Corp.

Delrey Metals recently finished a phase one exploration program at Sunset. In September 2018, the company collected 708 soil samples, 68 rock samples and 11 stream sediment samples. As a result of the sampling, management extended its cobalt-copper-zinc anomaly about a kilometer to the west, and discovered a new zone, called Roughrider, which graded up to 4.3% copper. Management believes the new zone may indicate a cobalt-copper-zinc VMS-style of mineralization.

With these five properties, investors have multiple opportunities to win if management advances any of the properties to a maiden resource or to a PEA. If one believes in the fundamentals of Vanadium, Canada is a great place to be looking for potentially economic deposits. In addition, management is actively looking at other attractive properties to acquire or option. 2019 is shaping up to be a busy and productive year for Delrey Metals (CSE:DLRY, FSE:1OZ).

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University’s Stern School of Business.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Delrey Metals, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Delrey Metals are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Delrey Metals was an advertiser on [ER]. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic. [ER] may buy or sell shares in Delrey Metals and other advertising companies at any time.

Streetwise Reports Disclosure:

1) Peter Epstein’s disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Graphics provided by author.

( Companies Mentioned: DLRY:CSE; 1OZ:FSE,

)