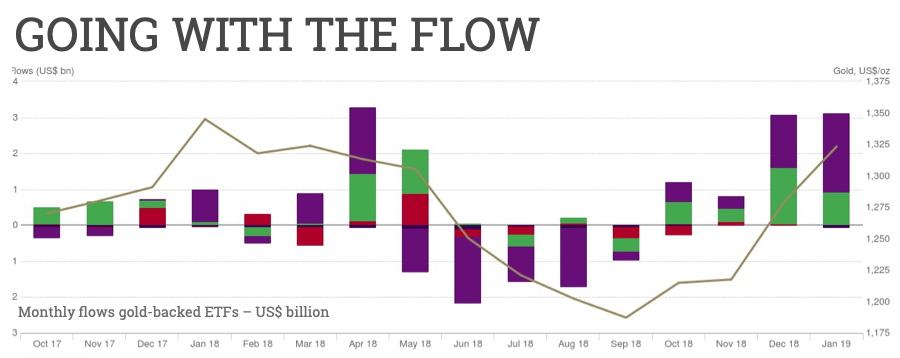

According to the latest report by the World Gold Council holdings in global gold-backed ETFs and similar products rose 72 tonnes in January, hitting the highest levels since to 2,513 tonnes (80.8m troy ounces), the highest in nearly six years.

In dollar terms net inflows in January equaled $3.1B with the value of gold held in ETF vaults reaching just shy of $107B by the end of the month, a 6% rise.

Last month was the fourth consecutive month of net inflows according to WGC data and thanks to a blockbuster December, 185 tonnes or $8B was injected into the scores of funds of listed around the world over the past four months.

More than $112.5B of gold was traded on average each day in 2018

The industry body says the inflows were driven by market uncertainty and a shift in sentiment that drove the price of gold 3.5% higher in January.

Fund flows strongly reversed the Q3 2018 declines with total inflows of or 9% over the past four months.

North American gold investors led the buying with funds in the region enjoying 53 tonnes or $2.2B of net inflows.

Low-cost ETFs, defined by the WGC as funds that charge less than 2% management fees, are becoming particularly popular adding 16 tonnes (worth roughly $700m) over the past six months, representing growth of 53%.

As at 31 January 2019 Graphic World Gold Council. Data sources: Bloomberg, Company Filings, ICE Benchmark Administration, Shanghai Gold Exchange, World Gold Council

WGC notes that global gold trading volumes increased in January on par with 2018 averages. More than $112.5B of gold was traded on average each day in 2018 in over-the-counter transactions, futures exchanges and ETFs.

That compares to trading volumes of $23B in Dow Jones stocks and not far behind all the shares traded as part of the S&P 500 index ($124.7B).

Sentiment and positioning in Comex futures in New York is unclear as there has not been an update to positioning by large-scale speculators such hedge funds since mid-December; a consequence of the US government shutdown.

The WGC says it believes “net longs increased yet remain below historical averages.“

A recent study by the WGC showed bearish positioning in futures historically precedes strong rallies in the price of gold.

Gold closed at $1,314.40 an ounce on the Comex market in New York on Wednesday, down on the day but up more than $130 an ounce from its summer lows.

The post Gold price: ETF inflows reach $100m a day appeared first on MINING.com.