Source: The Critical Investor for Streetwise Reports 02/03/2019

The Critical Investor looks at MineHub, the blockchain initiative started by Kutcho Copper’s CEO Vince Sorace, that has just announced major consortium partners.

1. Introduction

After a year of preparations, Kutcho Copper Corp.’s (KC:TSX.V) CEO Vince Sorace was finally ready to finalize the paperwork and disclose the names of the consortium partners for the MineHub blockchain initiative, of which he is also the CEO and founder. A quick look at the names reveals immediately that there was no exaggeration at all in the general description last year: “a senior mining company, one of the world’s largest streaming companies, an international base and precious metals and concentrates trading company that specializes in providing trading and financing solutions for miners and smelters, and a global financial institution offering banking services in the metals and mining industry.”

The senior mining company appears to be Goldcorp Inc. (G:TSX; GG:NYSE) (in the process of being taken over by Newmont Mining Corp. (NEM:NYSE), creating the largest gold producer in the world), the streaming company is Wheaton Precious Metals Corp. (WPM:TSX; WPM:NYSE), the trading company turns out to be Ocean Partners, and the global financial institution is ING. Kutcho Copper isn’t a multi-billion dollar outfit of course, but earns its seat at the table as a founding father of the deal. On top of this, one of the largest providers of blockchain applications worldwide, IBM, will closely collaborate with MineHub to build the mining supply chain solution on top of the IBM Blockchain Platform. This is an impressive lineup and shows the seriousness of such an initiative. It is not set up as the umpteenth blockchain initiative in order to profit from the hype (of which the first wave has already subsided anyway), this certainly seems to be the real deal. This article will delve a bit further into the specifics of MineHub, and what it could mean for investors in Kutcho Copper.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in U.S. dollars, unless stated otherwise.

Please note: the views, opinions, estimates or forecasts regarding Kutcho’s performance are those of the author alone and do not represent opinions, forecasts or predictions of Kutcho or Kutcho’s management. Kutcho has not in any way endorsed the information, conclusions or recommendations provided by the author.

2. Quick General Update

Before I will discuss MineHub, a quick overview of the current state of affairs seems appropriate. As I described in my last update, Kutcho’s 2018 drill program has been completed successfully, as was the data collection, which serves as necessary information for the upcoming Feasibility Study (FS). Metallurgical results are up first and are expected this month.

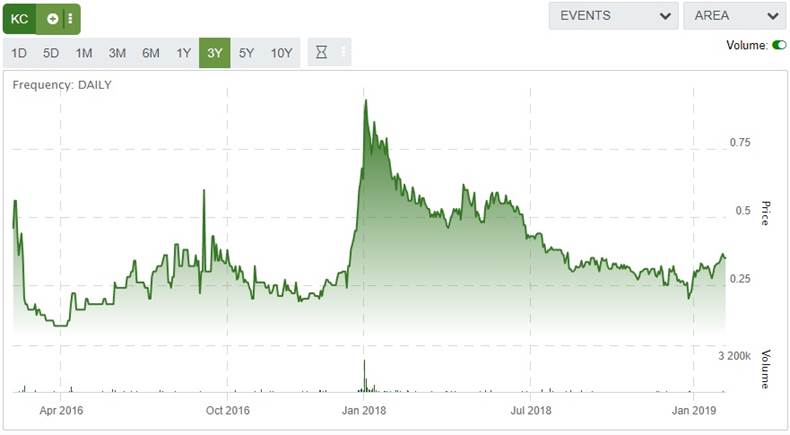

The current cash position hovers around C$1.4 million at the moment. The latest share price was quoted at C$0.35, and the corresponding market capitalization is C$20.0 million, at 57.15 million shares outstanding and 78.4 million shares fully diluted. The three year chart looks like this:

Share price over 3 year period

After side ranging around C$0.30 for quite a while last year, tax loss selling took it down to C$0.20 mid-December, which provided a nice buying opportunity in itself. Since then, the stock has been recovering on improving general sentiment, driven by a weaker U.S. dollar and higher metal prices. In my view the stock is still very undervalued, as the economics are already excellent (post-tax IRR of 28% @$2.75/lb copper, @$1.10/lb zinc, post-tax 2017 PFS NPV8 of C$265 million), and this is only based on a 10Mt reserve scenario, which I expect to grow meaningfully when the next resource update comes out (probably right before PDAC). The Feasibility Study, which then will incorporate this larger resource (and most likely even further improved economics), is scheduled to be completed at the end of Q2 or early Q3, 2019.

3. MineHub

Kutcho Copper news has almost completely been about the Kutcho Copper project story so far, which has been impressive all around in my view, from financing to project economics, but this is about to change. MineHub Technologies, initiated and founded by Kutcho CEO Vince Sorace, who has many years of tech-oriented experience, has finally finalized negotiations with arguably the most important partner of the consortium, IBM, meaning that the consortium is finally able to move forward, also in public. As a reminder, MineHub Technologies is one of the first, if not the first, serious application attempts of blockchain in mining.

Blockchain in short is a system that allows information to be coded in a decentralized way. Besides the numerous initiatives around nowadays with bogus stories on blockchain just to ride the hype, there really is nothing blockchain related working at the moment in the mining industry. Notwithstanding this, other, related sectors are already developing applications, and one example is VAKT, which is a new blockchain energy trading platform, set up by MineHub consortium partner ING, other banks and giants in the oil & gas industry like Shell, BP and large trading houses. Cost savings through smart contracts is estimated in this case up to 40%. Time spent on processing documents and data reportedly was reduced fivefold in a pilot involving a cargo of soybeans from the U.S. to China. Another pilot involving shipping oil generated similar figures, both with excellent user experiences.

An even larger initiative for the efficient financing of energy and commodities trading is Komgo SA, and is being launched by BNP Paribas, ING, Citi, Société Générale, Macquarie, Shell, SGS and many other large parties. So all the big players seem to be very determined to make blockchain work, and MineHub could be the answer for the mining industry itself.

First, let’s start with some basics. Kutcho Copper, as a consortium member, is a shareholder in MineHub, as is MineHub management itself. At the moment, the consortium members hold 35%, founders and management 35%, and associates 30%. All current shareholders are restricted from selling for the next two to three years. MineHub, which is a private company at the moment, will self-finance and will not need Kutcho Copper money. At the moment management is privately raising C$2.5 million @ 25c through a brokered private placement, with underwriters Haywood and PI Financial. The plan is to list MineHub as an RTO in late spring or early fall on the Venture exchange. MineHub is a separate company, it will not be a spin-out, and Kutcho is a big shareholder. MineHub plans to expand the collaboration to additional consortium members across the mining industry.

The consortium members will provide knowledge/experience, which needs to be baked into the future applications. MineHub fully owns the platform and trademarks, and will own all the generated resulting intellectual property (IP), and the central idea is to license out the applications to parties outside the consortium. The members are shareholders of MineHub, but they will have to pay for using the platform as well; they will be the first customers. In this case, consortium member Goldcorp’s Peñasquito Mine will be the first operating mine of which its concentrate production will find its way through the supply chain with the help of MineHub, starting in June this year.

Peñasquito Mine; source: Goldcorp

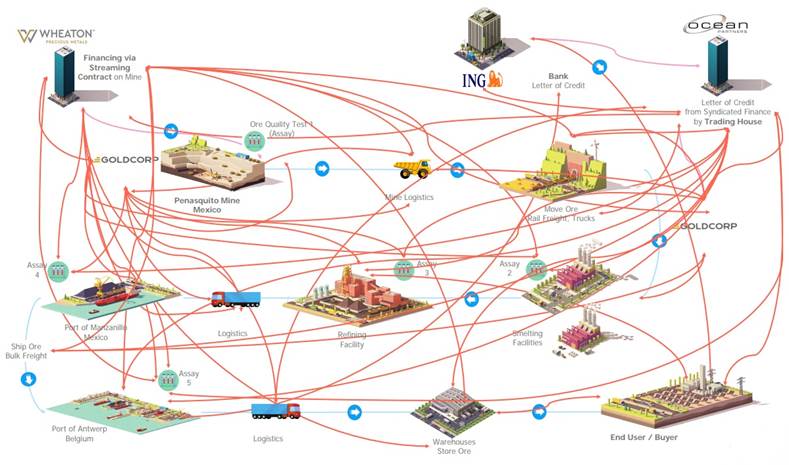

The current system in the mining industry is almost antiquated, and the industry could certainly use improvements on costs and efficiencies. The amount of communication is one of the relevant subjects. The numerous points of communication are conceptually visualized in this diagram, and give a solid indication of what is going on, besides all the paperwork:

A lot of time- and cost savings can be realized, besides visibility and speed through the supply chain, by using smart contracts for transactional requirements and compliance with regulations across multiple jurisdictions and reducing in house personnel responsible for back office processes and data security. For example, one shipment of concentrate has a binder full of documents that has to be handled; there is no uniform system as well, as almost every company has its own system. Loads of emails go back and forth, spreadsheets need to be compared, etc., etc. This all can be automated through smart contracts on one platform. MineHub is collaborating with IBM in order to develop, deliver, deploy and market the MineHub platform globally. They are also working together on new ways to scale and expand the platform, identify new use cases and incorporate innovative technologies in the future.

Such an integrated platform will provide four main characteristics:

- Transparency:

- Real-time visibility from mine to market

- Real-time data sharing

- Cash flow management

- Automation:

- Smart contracts for settlements, invoicing and payments

- Real-time reporting and reconciliations

- Auditability:

- Provenance across the entire supply chain

- Commodity trade finance

- Consolidated records

- Fraud reduction

- Security:

- Secure and trusted movement of information between multiple parties

The timeline of the entire MineHub venture looks like this so far, with the Peñasquito pilot starting in June, and the product rollout being scheduled for September:

The relevant market potential for MineHub is huge. According to a PWC report from 2018 and a World Economic Forum Whitepaper, digital transformation is estimated to generate more than $320 billion of value in the mining and metals industry over the next decade, including $77 billion through an integrated ecosystem (linking operations, IT layers and systems). If MineHub would only end up with a 2% market share, it would still generate $150 million in annual revenues, and a large part of this is operational cash flow as costs seem to be very modest in my view.

The revenues are based on recurring annual subscription fees. MineHub estimates charging between $300,000 and $1 million per customer per year dependent on customer requirements. Outside MineHub, the consortium members don’t receive any revenues, they are just in it for the technology to help them reduce costs, and if all goes well there will also be increased value of MineHub shares for them. They are willing to pay license fees for the technology; it is the solution they are ultimately after and they are basically happy that someone (MineHub) is taking the lead to develop a solution.

The customer base includes miners, smelters, surveyors, insurance providers, ports and warehouses, shipping and banks. MineHub expects to have five customers this year, increasing to 50 in 2023. I believe this to be very conservative if the platform can in fact generate substantial savings. MineHub has done estimates on cost savings, and it turned out that for the concentrate market the estimated savings at 50% digitization were up to 25%, and for the refined metals market up to 39%.

Assuming an average contract price of $500,000, 50 customers would generate $25 million in revenues in 2023, and, say, $15 million in operational cash flow. At a tech multiplier for a strong growth venture of say 20 (usually these multipliers are far higher, even ranging from 30 to over 100), the market cap could be a hypothetical $300 million in 2023. Assuming the $150 million in revenues in 2028, with $100 million in operational cash flow, the market cap could easily exceed $1.5 billion if blockchain and MineHub keep developing in the right direction, the markets behave, etc., etc. This is all very far out, of course, and I don’t have a crystal ball, but the consortium members are large and powerful, and IBM and ING are known to be frontrunners in developing blockchain applications, so they are determined to make this work.

As it will take time before MineHub can generate meaningful revenues and will see an increase in market cap, it will take at least as much time before Kutcho Copper as a MineHub shareholder will see the benefits of this increase. For potential near-term catalysts, we have to turn toward the Kutcho Copper project. This enjoys an after-tax NPV8 of C$265 million from the 2017 PFS, which is already no less than 13 times the current Kutcho market cap, and is awaiting an updated resource and the FS, which will likely see further improved economics based on a larger reserve base.

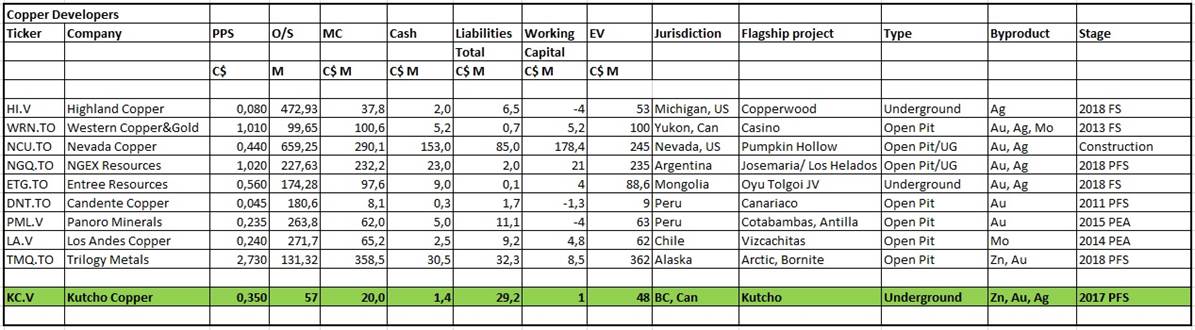

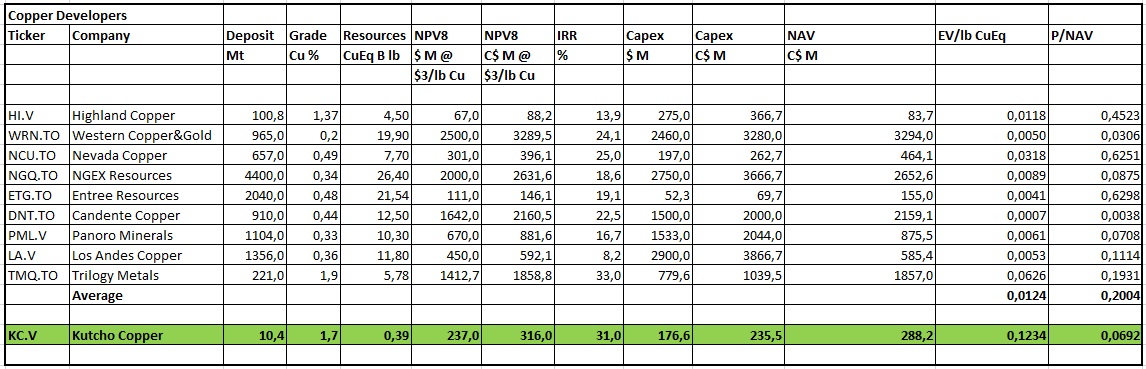

I updated and expanded the peer comparison again, and although there are no real peers for Kutcho because of its small size, high grade and good jurisdiction, one can get an idea of size, profitability and metrics of copper developers in general:

And:

As always, every company has its own story with very specific details, keep this in mind with every peer comparison. At first I included Copper Fox and Polymet, but these companies generated such extreme metrics because of their economics that the averages became unrealistic because of these outliers, so I left them out. However, two things caught my attention immediately, and these were the EV/lb and P/NAV metrics. It appears that Kutcho because of its limited size deposit but very profitable metal already has a high EV/lb, despite the tiny market cap. Trilogy as the only other comes relatively close, again with a relatively small deposit and high-grade/profitable metal. Nevada Copper has a high EV/lb because it is already under construction, as indicates its very high P/NAV.

In my view, the EV/lb metric is best used for explorers with a resource but without an economic study, as this metric doesn’t include economics and therefore is very incomplete/flawed. But for an explorer with a resource it is all they have and therefore for them it is the only useful metric for a peer comparison. Long story short, EV/lb isn’t the best metric to indicate under/overvaluation for developers. On the other hand, P/NAV isn’t clear cut either, as, for example, a project with a low NPV/IRR would generate a high P/NAV number, just as a good project close to production would. However, with a high NPV/IRR one can be more certain that a low P/NAV indicates undervaluation, as is the case with Kutcho Copper, as the project doesn’t seem to be flawed so far. A P/NAV of 0.06 for such a profitable project (only Trilogy is better with Arctic) almost at FS stage is ridiculous in my opinion.

With the current base case NPV8 of C$265 million @US$2.75/lb Cu, and the expanded scenario coming out with the FS at the end of Q2 or the beginning of Q3, 2019, I expect the share price to re-rate as even confirming PFS economics should be reflected more than the current market cap of C$20.0 million in my view, as the project is more derisked.

Keep in mind that at some point, the market cap has to make up for the difference between the current market cap and 0.8-1 times NPV8 when commencing commercial production as a rule of thumb. A feasibility study showing the market that Kutcho Copper can not only back up the PFS economics on reduced risk, but increase economics potentially a great deal as well, which should be possible on the back of a larger resource, combined with the MineHub venture in some shape or form, should be able to convince a new set of investors, in my view.

5. Conclusion

After a year of drilling and gathering information, Kutcho Copper has now come into the phase of catalysts, as an updated resource is expected anywhere between now and PDAC, followed by the FS at the end of Q2 or the beginning of Q3. The results of met work are expected in February as well. I expect the economics to improve further, and I am looking forward to a significantly increased NPV. Besides all this, Kutcho Copper is an important shareholder in the MineHub Technologies platform, and it seems time to start things up now after all agreements have been finalized. This development will take time, but the future potential regarding value is possibly much larger than the Kutcho Copper project itself. For the short term, the latter one represents two solid catalysts that could put things firmly on the radar for people unaware of this (at least in my view) undervalued base metal play.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website http://www.criticalinvestor.eu to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

The Critical Investor Disclaimer:

The author is not a registered investment advisor, currently has a long position in this stock, and Kutcho Copper is a sponsoring company. All facts are to be checked by the reader. For more information go to www.kutcho.ca and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor’s disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: Wheaton Precious Metals. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Wheaton Precious Metals, a company mentioned in this article.

Charts and graphics provided by the author.

( Companies Mentioned: G:TSX; GG:NYSE,

KC:TSX.V,

WPM:TSX; WPM:NYSE,

)