Happy Year of the Pig! This week marks the start of China’s Spring Festival, during which an estimated 3 billion trips will be made using the country’s massive transportation network of roads and rail. That figure is a slight rise from the same period last year, despite slowing economic growth prompted by trade tensions with the U.S. and a strengthening dollar.

Ctrip, China’s largest online travel agency, forecasts that more than 400 million people will travel across the country for family reunions, while some 7 million will go abroad.

To prepare for the additional travel demand, China built as many as 10 new railways at the end of last year and expanded the length of its high-speed rail system to 29,000 kilometers, or around 18,000 miles. Meanwhile, the Civil Aviation Administration of China (CAAC) expects more than 532,000 flights to be scheduled during the week-long travel rush, a 12 percent increase from last year, according to China Daily.

Since the start of 2018, the National Development and Reform Commission (NDRC), China’s top economic planner, has approved 27 large-scale infrastructure projects, totaling nearly $220 billion. Among the largest is the expansion of the Shanghai Metro, already the world’s largest transit system by route length. The $44 billion project, to be completed by 2023, will add six new subway lines and three intercity railways.

Looking for a Resolution to the Trade Dispute

If you’ve been paying attention, you might have noticed that much of the news involving China right now is negative. Its manufacturing sector is slowing, and economic growth in 2018 was at a nearly-30-year low.

I believe this is only a temporary lull as we await a resolution to the U.S.-China trade war and a fall in the U.S. dollar, which has made American goods more expensive to its trade partners. So I remain bullish on China and the surrounding region, and I believe now might be an advantageous time to gain exposure.

The U.S. and China reportedly made “tremendous progress” during last week’s high-stakes talks between President Donald Trump and China’s Vice Premier Liu He. Although technology and intellectual property rights remain sticking points, China is slated to “substantially” increase its purchases of U.S. crops, energy and services.

Case in point: Just two days after the January 31 talks, Chinese state-run agricultural conglomerate COFCO Group and Sinograin reported purchasing at least 1 million tons each of American soybeans. This marked the Asian country’s first order of soybeans from the U.S. since summer of last year, when purchases were halted as a result of escalating trade tariffs.

The good news here is that the U.S. and China appear to be working toward a resolution. Official Chinese outlets called the talks candid, specific and fruitful. President Trump affirmed that, although “much work remains to be done,” progress is being made.

Looking ahead, Treasury Secretary Steven Mnuchin and U.S. Trade Representative Robert Lighthizer will meet at least once with Chinese President Xi Jinping sometime later this month. And Trump is reportedly considering planning a meeting with Chinese President Xi Jinping, possibly near the time of the summit with North Korea’s Kim Jong Un.

Ongoing U.S.-China Tension Expected to Divert Trade to the European Union

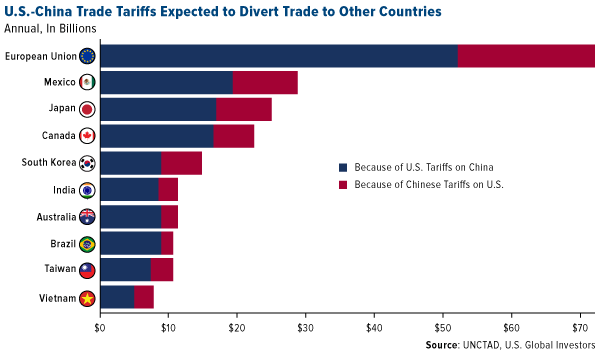

I’m confident that a resolution will come sooner rather than later, as neither side has anything to gain from continued trade hostility. In fact, they have much to lose. This week, the United Nations Conference on Trade and Development (UNCTD) estimated that the tariffs imposed by Washington and Beijing will do very little to protect the respective economies, and that a majority of the bilateral trade will instead be diverted to firms in other countries, most of them European. Those in Mexico, Japan and Canada would also stand to benefit.

“Overall, European Union exports are those likely to increase the most, capturing about $70 billion of the United States-China bilateral trade—$50 billion of Chinese exports to the U.S., and $20 billion of U.S. exports to China,” the report reads.

I think it’s safe to say that neither China nor the U.S. wants this, which drives me to believe that we’ll see a satisfactory resolution in the coming weeks. Hopefully then China’s manufacturing sector and gross domestic product (GDP) growth can recover.

How to Gain Exposure to China and the Surrounding Region

An excellent way to participate, I believe, is with our China Region Fund (USCOX), which provides investors access to one of the world’s fastest growing regions.

China and the surrounding region has experienced many changes since USCOX opened in 1994, but we believe the region continues to hold further investment opportunities. Many Asian countries possess characteristics similar to the U.S. prior to the industrial revolution: a thriving, young workforce; migration from rural to urban areas; and shifting sentiment toward consumption.

Curious to learn more? Explore and discover the China Region Fund (USCOX) today by clicking here!

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, a regional fund’s returns and share price may be more volatile than those of a less concentrated portfolio.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the China Region Fund as a percentage of net assets as of 12/31/2018: Ctrip.com International Ltd. 0.00%, COFCO Group 0.00%, Sinograin Oils Corp. 0.00%.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.