Plus Products Inc. (PLUS:CSE / PLPRF:OTC) is the cannabis business backed by the same high powered hedge fund that took as E-cigarette manufacturer JUUL – which went from being nothing more than an idea to a business valued at $38 billion in a span of just 40 months.

I don’t need to speculate whether that elite hedge fund can do the same thing with Plus Products – because I can already see it happening.

The hedge fund is Tiger Global Management – the PLUS prospectus shows they own over 6 million shares or 15% of the company – and it has an incredible track record of helping turn small companies in rapidly growing industries into multi-billion dollar businesses.

JUUL was the most recent homerun for Tiger Global. In December, tobacco giant Altria paid $12.8 billion for a 35% interest – valuing JUUL at $38 billion.

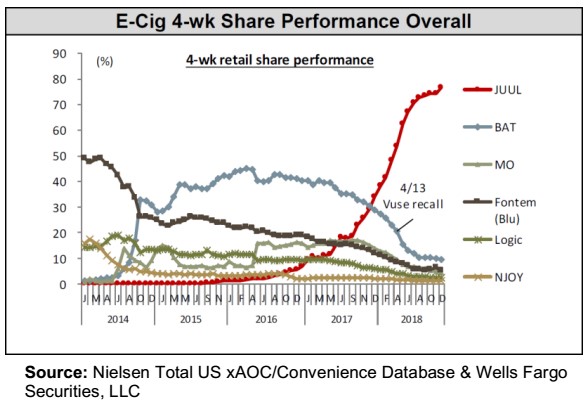

Take a look below at what Tiger Global and JUUL were able to achieve in terms of E-Cigarette market domination. In 40 months JUUL went from no market share to controlling more than 75% of the E-Cigarette market.

Tiger Global’s homerun with JUUL was not a one-off occurrence. Tiger Global also built Indian based e-commerce juggernaut Flipkart which was recently sold to Walmart for $16 billion. Tiger were also early investors in Spotify and Glassdoor – Tiger can spot HUGE winners very early.

Just Like JUUL –

Plus Products Inc. Is Steamrolling Competition

Like many investors, Tiger Global has rightfully identified cannabis as its next big homerun opportunity – and they’ve made Plus Products Inc. one of their biggest investments.

Plus Products Inc. is a cannabis company that is already dominating the market the way that JUUL did.

Plus Products is just starting to tell its incredible growth story, of becoming the #1 edibles brand in California. But its main stock listing is in Canada… not the United States; very much offer the radar.

The OTC listing for Plus Products Inc. only took place on January 24, 2019 – so it was more difficult for a huge group of US investors to look at the company until just last week.

What you are reading today is the “coming out party” for Plus Products Inc. in terms of market awareness.

And it’s perfect timing, as business performance is rocking.

Plus Products Inc. has been knocking it out of the park… in exactly the same manner that JUUL did on its way to become a $38 billion company. Plus Products Inc. has been taking cannabis edibles market share at a staggering rate.

This is not my opinion. These are verifiable facts by the top two cannabis market research firms – BDC Analytics and Headset.

California is – far and away – the largest and most important market for cannabis at this point. Everyone knows that cannabis will be legalized everywhere eventually, but for now California is the most important market by a mile.

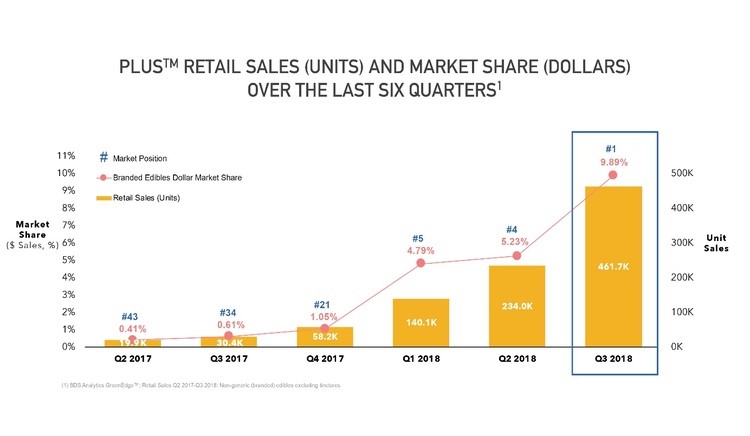

In Q2 17, Plus Products was ranked #43 in California and had less than one-half of one percent share of the edible cannabis product market.

Barely 12 months later – by Q3 18 – Plus Products became ranked #1 in California and has increased its market share by 24 times now with 9.89 percent of the crucial California market. Revenue is at a $10 million run rate now and growing every month. And The Big News is – they’re about to go into more states.

It’s important to me – how and why that happened: It happened organically, with almost NO marketing–to become #1 in the #1 Market in the world right now! It’s all about the quality and consistency of the product, and the logistics behind making sure it’s on every shelf on every store possible. Their edible products have an incredibly consistent dosage, much tighter than what the law says is necessary. Good product, good business execution.

Take a look at the chart above which shows what Tiger Global-backed Plus Products has done in just over a year in California… then look back at the chart that I showed you earlier with the incredible growth in market share that Tiger Global backed JUUL was able to achieve.

Growth that took JUUL from no market share to being worth $38 billion in 40 months.

This is no coincidence and I can assure you of one thing… Tiger Global didn’t put invest Big Money into Plus Products without feeling very confident that it could be built into another multi-billion dollar, dominant business.

Plus Products is now getting ready to expand outside California. I think this will be the biggest growth story in the sector in the next 18 months. And one of their largest backers has done it all before – grown something from zero to a $38 billion dollar company in just 40 months.

This stock has only 40 million shares out… meaning this could be a HUGE winner if management executes like Tiger Global thinks they can.

One Or Two Brands Will Control

The Entire Cannabis Opportunity

There is no better investment than a dominant consumer brand.

Just ask Warren Buffett who built his $90 billion fortune by owning the dominant consumer brands of Coca-Cola, American Express and Gillette.

A brand name is the most valuable asset a retailer has because it lends credibility to product quality… consumers know what they can expect when they buy that brand name product.

As consumers we buy Coke or Pepsi because we know that we like it; the same thing for McDonalds or Wendy’s. Every retail market ends up being dominated by a few powerful brands.

As I’m sure you can imagine… for a product like an E-Cigarette or edible cannabis – being able to trust the quality and safety of the product you are buying is even more important.

That is a big reason why JUUL was able to lock down a 75%market share. That is why the opportunity for Plus Products to do the same in cannabis is so very real… and in fact is already happening.

The truth is that it is going to be easier for Plus Products to dominate cannabis than it was for JUUL to dominate E-Cigarettes. Everything that Tiger Global built and learned with JUUL in E-Cigarettes is directly transferable to Plus Products and cannabis.

This gives Plus Products a huge advantage with marketing, distribution, manufacturing, talent, financing… you name it, Plus Products has the edge. Having a multi-billion dollar hedge fund titan behind Plus Products is an incredible advantage.

You can see that advantage in how fast the Plus Products brands are taking market share.

Plus Products has almost US$20 million cash and has zero dollars of debt. Sales and revenue are increasing every month. They’re about to start expanding into several new states. Insiders are aligned and own a boatload full of shares… and so do I.

Tiger Global isn’t invested in Plus Products to build a nice little business. Tiger Global is invested here to build another multi-billion dollar business. And there’s only 40 million shares out.

I think my timing is excellent – right on the cusp of a major expansion, after already being #1 in the biggest market in the world right now. Whoever wins the California cannabis market could win the world… and Plus Products is already #1 and increasing that market share at an incredible clip.

With a big expansion plan on the immediate horizon, I expect this company to do very very well in 2019 and 2020.

DISCLOSURE—I am very long Plus Products Inc.

Keith Schaefer

Copyright © 2011

This feed is for personal, non-commercial use only.

The use of this feed on other websites breaches copyright unless you have written permission from Keith Schaefer of Oil and Gas bulletin to republish. If this content is not in your news reader, it makes the page you are viewing an infringement of the copyright. (Digital Fingerprint:

3r5723475234957asdgvaisduthadsfg)