European miners will maintain their position at the forefront of integrating technology, particularly in more developed markets, due to a highly skilled workforce and high levels of connectivity among the more developed economies, a regional overview published by Fitch Solutions reports.

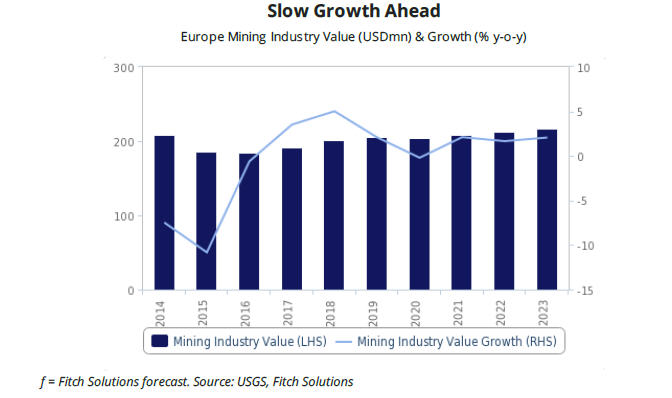

On a more sombre note, analysts predict high costs, a weak project pipeline and conservative company strategies will drag on mining investment levels in Europe over the coming months, despite an improved commodity price environment.

Growth opportunities stand to be further impeded by a continued lack of investment in the European mining industry, and the outlook for Poland and Ukraine specifically will be hindered by EU environmental regulations and an ongoing armed conflict, Fitch forecasts.

In Q2 2019, analysts expect investment levels across the European mining sector will be sluggish as miners continue to pursue balance sheet improvements over expenditure, while macroeconomic risks increase.

Tightening environmental regulations will pose headwinds to mining sector growth prospects of coal-producing countries in the EU, particularly in the west. Fitch forecasts, while Ukraine’s steel outlook will remain bleak in the coming quarters, as disruptions from the Donbas blockade remain in place, as tensions with Russia continue to run high.

According to Bloomberg, mining mergers and acquisitions in the reg ion over the first three quarters of 2018 totalled 9.47 billion, compared with 17.9 billion over the same period in 2017, reflecting European miners ‘ ongoing restraint. Europe only counts with 149 new mining projects in the pipeline according to Fitch’s Global Mines Database, tailing behind North America, Latin America, Africa and Asia.

Read the full report here.

The post Slow growth for Europe’s mining sector — report appeared first on MINING.com.